I got this from a blog which is referenced at the end of the post.

Getting beyond the “bubble” really changes things around. The question becomes an individual one rather than a macroeconomic one. Is the price someone is willing to pay for my practice high enough now that I am willing to accept future risk to my practice? What are the opportunity costs of not selling now?

What are the future practice risks? This is somewhat nebulous. Let’s look at one scenario. The large entity you sell to may be better at managing expenses and risk in an era of health reform. For some time, you may benefit from practice efficiency, technology and income stability/repair that the new entity provides (see previous articles for more details). Is there a point at which they maximize efficiency? What point will growth cease to impress the capital markets and multiples (price above earnings the market will pay) start to come down? What affect will that have on operations? When companies leave the rapid growth cycle, it creates pressure to decrease costs. Salaries and staff are reduced.

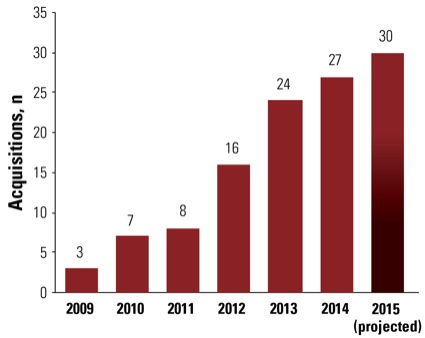

In our past articles, we argued that corporations are buying practices at earnings multiples of 3-9 and “reselling” them to the capital markets at multiples of 15-30. They use the money raised to purchase more practices. As corporate valuations go up, they can easily fund more practice acquisitions (of note, they also use the free cash flow of the practices to fund acquisitions as well). This means that practice valuations can be subject to the whims of Wall Street. Here is the 52-week chart of Envision Healthcare (EVHC), Team Health Holdings (TMH) and Mednax (MD). Notice the volatility. If their access to capital is decreased due to a declining valuation, that could mean decreased prices for practice acquisitions in the future.

The recent buyout offer by Amsurg for TeamHealth underscores that this is a dynamic marketplace. Consolidation will reduce the number of potential acquirers.

We must also consider macroeconomic pressures. Eventually, rising interest rates will make acquisitions more costly and reduce prices. The lending market is still tight because of the financial crisis of 2008.

The uncertainty raised in the previous paragraphs explains the dilemma but also points to the solution for

those worried about a bubble. Our best guess is that most providers/owners are better off now with the investment and efficiency of a large entity. If the underlying business of anesthesia deteriorates, the smaller groups will be hurt more than the bigger ones. Even if the business falls apart, you will likely have fared better in a large company than on your own during a downturn (“popped bubble”).

In the end, I cannot say with certainty that we are in a practice valuation bubble. Bubbles tend to be impossible to predict. Are we saying you should sell now? Not necessarily. Just that you should think about it systematically and not run away because of fear. Start with a practice and risk assessment. Then you can choose among several options, which may or may not involve a sale of your practice.

http://www.anesthesiastat.com/2015/12/24/medical-practice-buyouts-are-we-in-a-bubble/