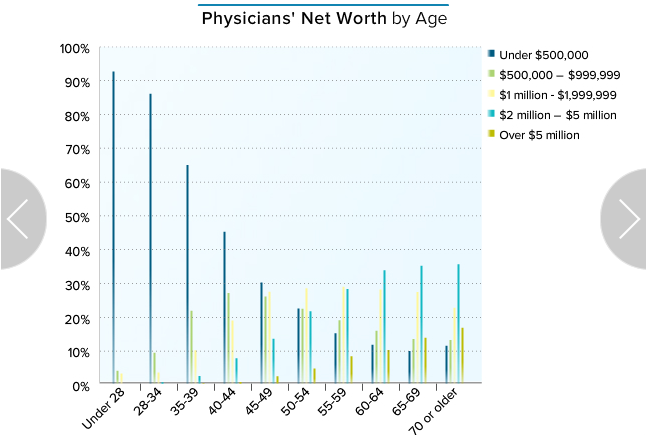

I also found it depressing to see that only 50% of docs over 50 are millionaires. Remember this is net worth- home equity, savings account, checking account, retirement accounts, other investments etc. That’s terrible. While I don’t expect every doc to be a millionaire at 40, I don’t think 50 is a particularly high hurdle. I think $2 Million is a reasonable number for a doc to retire on (that’s an income of $80K a year plus Social Security), but when you look at docs at retirement type ages (60+) you see a quarter of doctors still don’t have that, and that includes their home equity! Take away the home equity, and that number would be even higher! I was, however, surprised by just how many 70+ docs had more than $5 Million-about 18%. I don’t know if that is a reflection of “The Golden Age of Medicine,” or simply due to the fact that they were able to invest throughout the 80s and 90s. But clearly, there are still some docs out there who became very wealthy.

http://whitecoatinvestor.com/starting-at-zero/