ten year return for Vanguard Energy is 5.60% as of June 30 2015

ten year return for Vanguard Index 500 is 7.7%

I would add that S & P 500 (cap weighting) is not the most efficient way to capture the equity premium of large cap stocks.

dividend stocks which you have repeatedly touted are one strategy of capturing the value premium. Also not the most efficient way.

“

Dividend Investing: A Value Tilt in Disguise?” appeared in the April 2013 edition of the Journal of Financial Planning.

Fisher’s study covered the 33-year period from August 1979 through July 2012. His objective was to determine which factors best explained stock returns. Using Barra’s performance-attribution methodology, various risk factors such as value, growth, momentum and company size were separated out to determine the contribution of each to the portfolio’s returns.

For the high-dividend strategy, he used the highest-yielding 10 percent of the Russell 3000 Index. The Russell 3000 was used to represent the market portfolio. The following is a summary of his findings:

The high-dividend-yield portfolio’s annualized return was 1.27 percentage points greater than that of the total market portfolio (12.42 percent versus 11.15 percent).

The high-dividend strategy had, as should be expected, a high loading on yield: 1.60. Other loadings of note were leverage (0.42), momentum (-0.22), growth (-0.41), value (0.53), volatility (-0.37) and earnings yield (-0.47).

By tilting the portfolio to high-dividend-paying stocks, investors were—perhaps unknowingly—tilting their portfolios to value stocks.

The factors with the largest contributions to the excess return of the high-dividend strategy were: earnings yield (2.28 percent), volatility (1.22 percent), value (0.41 percent) and growth (0.40 percent).

Fisher drew this conclusion: “If it is long-term outperformance over the broader market that investors are seeking, findings from this study suggest a more direct approach would be to employ a portfolio tilt toward value and high-earnings-yield stocks.”

Value is defined as a high book to market stock. One of Graham's criteria. Earnings yield is not the same as dividend yield.

Graham's "intrinsic value" often involved subjective judgements that reasonable people could disagree about. In short it was a from of fundamental analysis and not passive management.

Single company risk is not rewarded for the overwhelming majority of investors. Perhaps you are the minority. If so congratulations.

“The Capitalism Distribution.” The study, which covered the period from 1983 through 2007 and the top 3,000 stocks, found the following:

- 39 percent of stocks lost money during the period.

- 19 percent of stocks lost at least 75 percent of their value.

- 64 percent of stocks underperformed the Russell 3000 Index.

- Just 25 percent of stocks were responsible for all of the market’s gains.

Investors picking individual stocks had an almost two-in-five chance of losing money, even before considering inflation, and an almost one-in-five chance of losing at least 75 percent of their investment, again before considering inflation. And the odds of picking a stock that outperformed the index were just more than one-in-three.

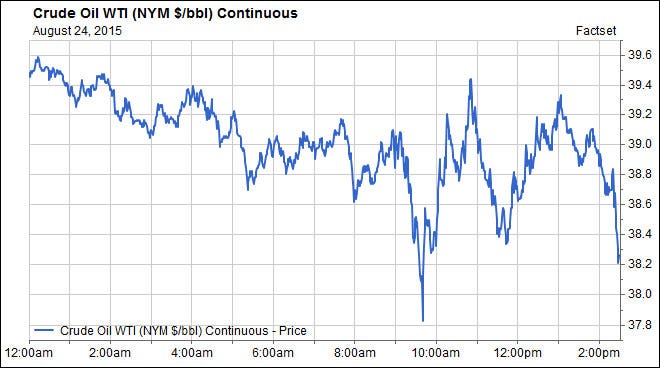

To be sure, oil has fallen quickly and sharply – conditions which could lead to an “oversold” bounce on short-covering from short term scalpers. The fundamentals will ultimately drive the price of oil into the $30’s. I made that call when oil first dropped below $50 in February and I’ve maintained that call since then.

To be sure, oil has fallen quickly and sharply – conditions which could lead to an “oversold” bounce on short-covering from short term scalpers. The fundamentals will ultimately drive the price of oil into the $30’s. I made that call when oil first dropped below $50 in February and I’ve maintained that call since then.