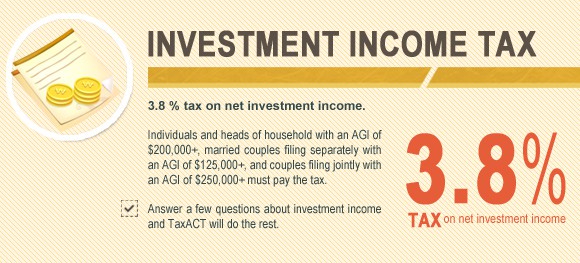

Additional 3.8% Medicare tax on investment income collected by “rich” folks

Before Obamacare, investment income was not subject to any sort of Medicare tax.

After Obamacare, all or part of your net investment income, including long-term capital gains and dividends, can get socked with a 3.8% Medicare surtax (the so-called net investment income tax). Therefore, the maximum federal rate on long-term gains and qualified dividends is actually 23.8% (20% for the “regular” capital gains tax plus 3.8% for the net investment income tax) versus the advertised 20% maximum rate.

Fortunately, the 3.8% surtax will not hit you unless your adjusted gross income (AGI) exceeds: (1) $200,000 if you’re unmarried, (2) $250,000 if you’re a married joint-filer, or (3) $125,000 if you use married filing separate status.