- Joined

- Apr 22, 2007

- Messages

- 22,315

- Reaction score

- 8,963

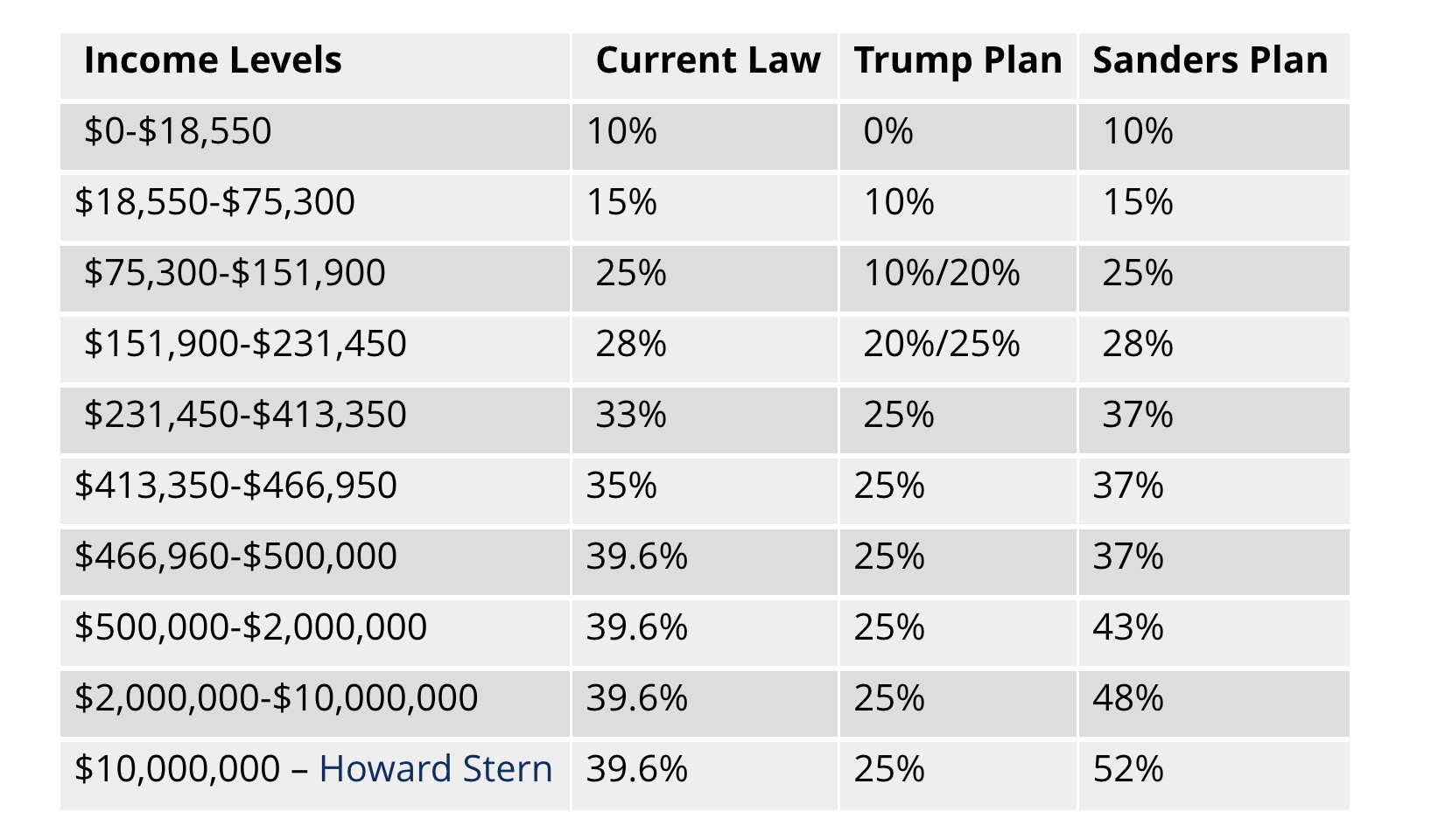

I know many of you on SDN are liberal-leaning Closet Socialists but the Clinton Tax plan will be raising taxes on Physicians yet again. Clinton will be forced to raise taxes on all those earning more than $120K per year in order to pay for the expanding Federal debt and the ever-increasing Federal budget.

http://money.cnn.com/2016/03/03/pf/taxes/hillary-clinton-taxes/

http://taxfoundation.org/article/details-and-analysis-hillary-clinton-s-tax-proposals

http://money.cnn.com/2016/03/03/pf/taxes/hillary-clinton-taxes/

http://taxfoundation.org/article/details-and-analysis-hillary-clinton-s-tax-proposals