- Joined

- Oct 1, 2011

- Messages

- 84

- Reaction score

- 0

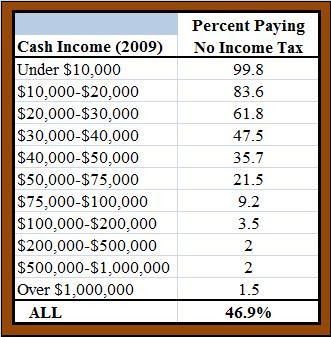

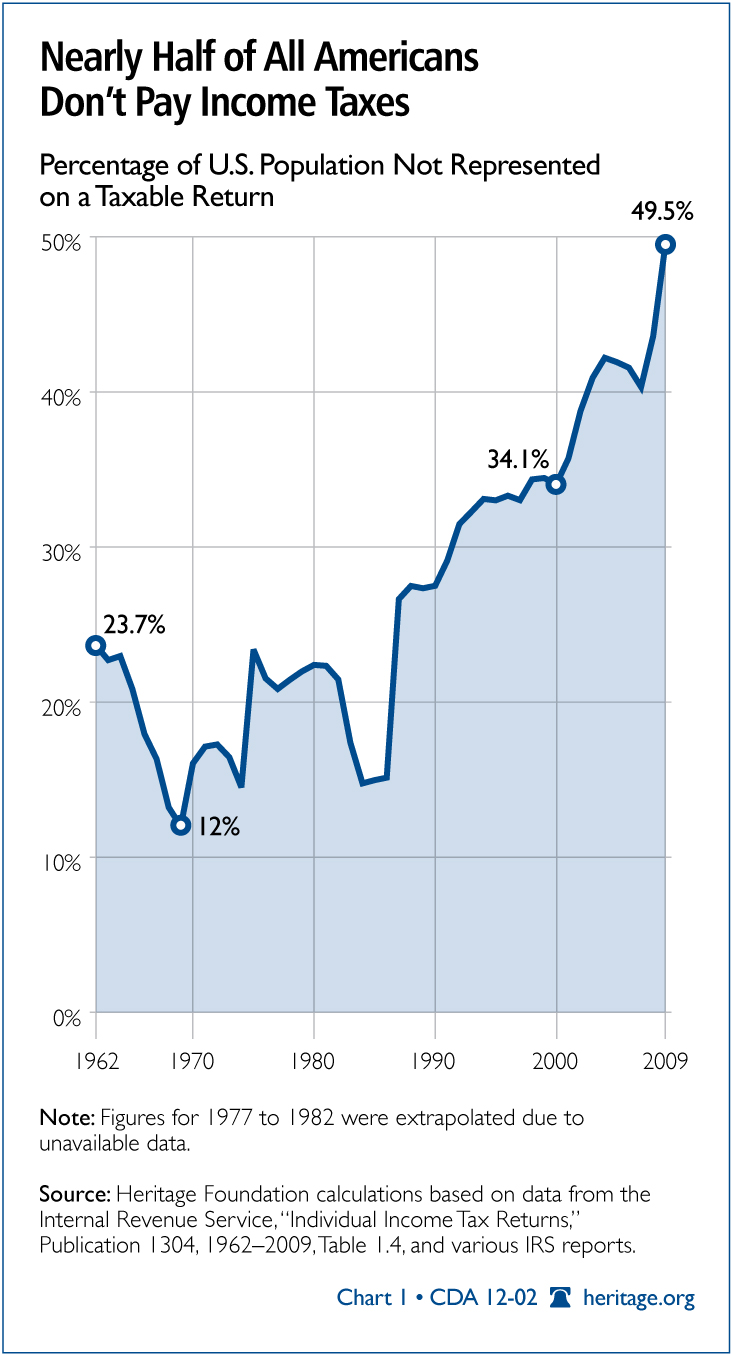

Believe me I explored this option with my tax attorney and accountant and we would have paid more in that scenario. I am not being deceptive. I make enough to put everything that she makes in the 35% bracket. By the way if you are married and file separately I don't think you can claim the child credit and lots of other credits. It's typical of progressives to take what is a real world scenario like this and say "well you know the effective tax rate that you really pay blah,blah,blah.....". By the way, combined our effective federal tax rate was around 31% Now you may say well there you go 31% isn't so bad. But then you look at FICA, and unemployment, and state taxes and the bill keeps going up and up. So yeah, thats about 37k lost in revenue because it wasn't worth it to us for her to work. I doubt that we are an isolated case. Raising taxes does not in the long run raise tax revenue. A system in which half of all Americans pay no taxes cannot last.

I wasn't doubting your sincerity. It must be a terrible burden to make enough that your wife has options. On this note, if you were offered a$ 75000 raise you would turn it down right. And you conservatives should stop spreading the half of americans pay no taxes distortion.

From http://www.cbpp.org/cms/?fa=view&id=3505#_ftn10

" The 51 percent figure is an anomaly that reflects the unique circumstances of 2009, when the recession greatly swelled the number of Americans with low incomes and when temporary tax cuts created by the 2009 Recovery Act including the Making Work Pay tax credit and an exclusion from tax of the first $2,400 in unemployment benefits were in effect. Together, these developments removed millions of Americans from the federal income tax rolls. Both of these temporary tax measures have since expired.

In a more typical year, 35 percent to 40 percent of households owe no federal income tax. In 2007, the figure was 37.9 percent. [2]

The 51 percent figure covers only the federal income tax and ignores the substantial amounts of other federal taxes especially the payroll tax that many of these households pay . As a result, it greatly overstates the share of households that do not pay any federal taxes. Data from the Urban Institute-Brookings Tax Policy Center show only about 14 percent of households paid neither federal income tax nor payroll tax in 2009, despite the high unemployment and temporary tax cuts that marked that year. "

.

.