- Joined

- Apr 25, 2008

- Messages

- 8,793

- Reaction score

- 9,019

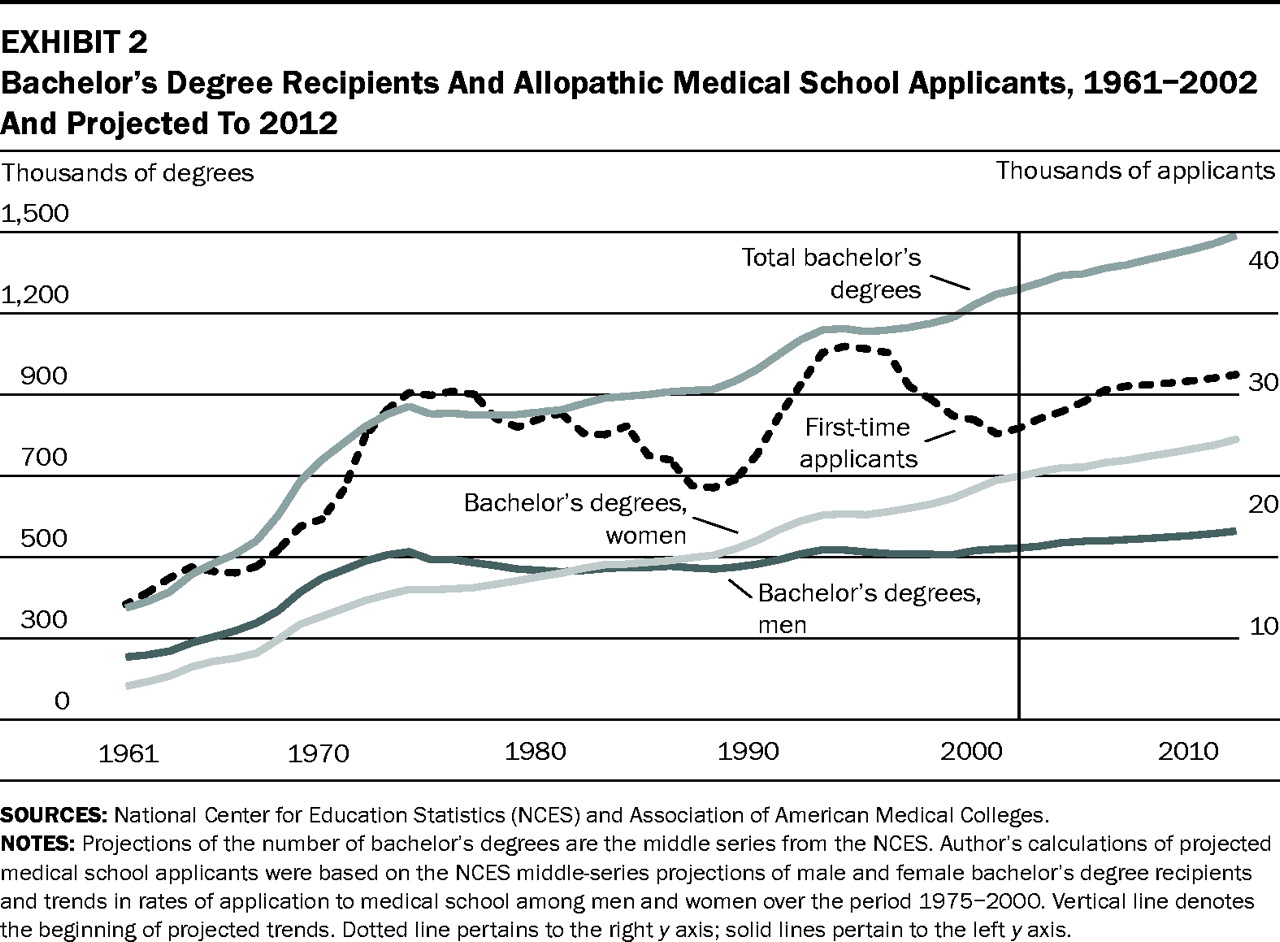

Not sure I believe that - the current overall acceptance rate to medical school (positions available / applicants) exceeds 40%. Individual schools may be far less than that, but taken as a whole nationwide, it's not bad, and certainly a far cry from the overall 10% rate when I was applying in the late 70's.

You've stated that point over and over again but I'd like to see a citation for it. Yes, it's true that there is approximately a 40% selection rate right now, but if you look at the data going back, that's approximately as low as it has been. At least since 1982. Review https://www.aamc.org/download/153708/data/ and compare "all matriculants" to "all applicants" in chart 3. In 1982, not so far off from the late 70s, there was still approximately a 45% selection rate. In 1988, eyeballing the numbers because the raw data is only available on the website back to 2004, it looks like it was 65%! Only in ~1994-6 was it lower than it is now, and even then it looks like the acceptance rate bottomed out at ~35%. Now, it's possible that it was a bit lower in the 70s, but 10%? I call bull****.

Also, you're completely ignoring self-selection. 91% of US graduates who apply dermatology match dermatology. But most likely 80% of US medical students would fail to match dermatology if it wasn't for self-selection, not 9%. People who apply to medical school (and certainly people who apply to residency) are smart enough that they will often cut their losses before they even submit the application.