- Joined

- Apr 30, 2009

- Messages

- 339

- Reaction score

- 350

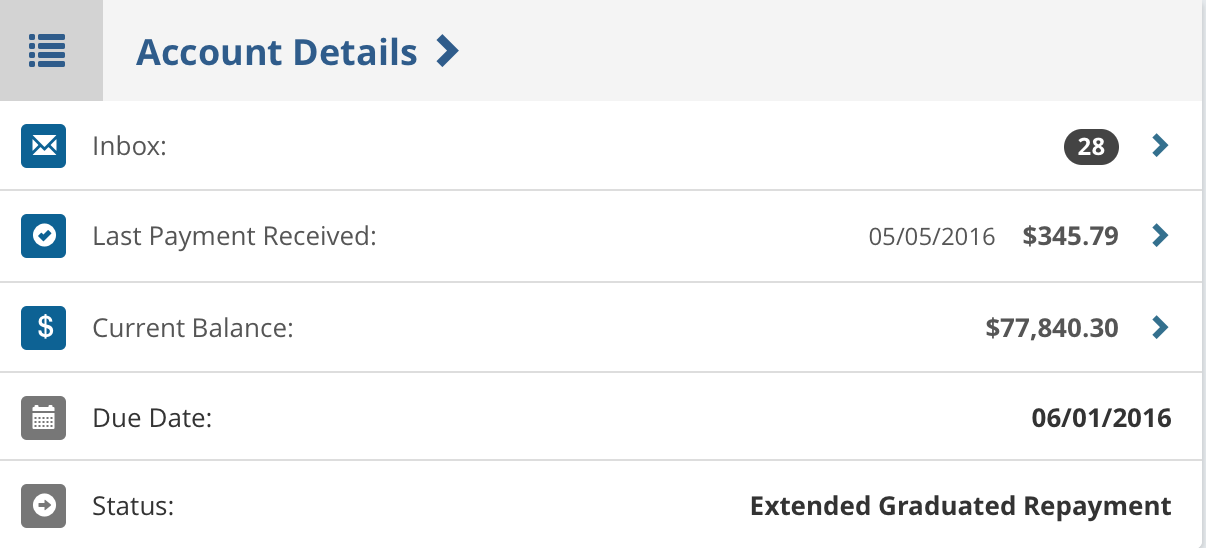

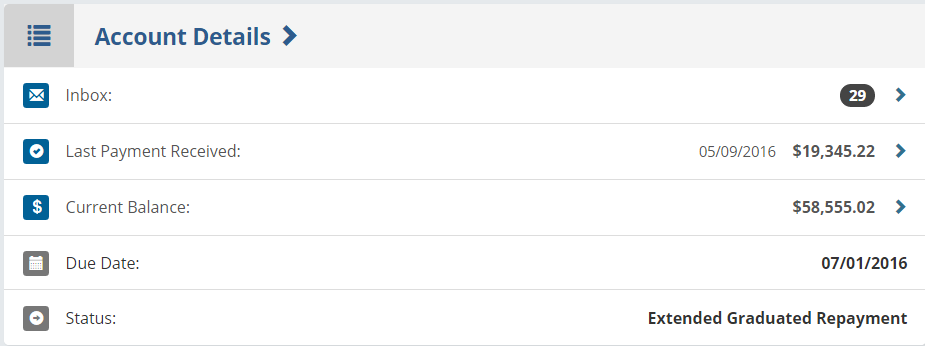

Just wanted to share. I come from immigrant parents and came here at a young age. I just graduated from psychiatry residency, yeah! My loan burden is now at 190k down from 340k. I started paying them off approximately 14 months ago when I started moonlighting in residency. I am engaged to a non-medical student and have no kids, I receive no financial assistance from anyone else and live in an expensive city. With the contract jobs I am about to start, I expect to pay the remaining balance in 7-8 months and be completely debt free. I am working in psychiatry M-F 8-5 and two full weekends a month of call at another facility. This is 400k a year. All are contract jobs through my corporation I used for moonlighting that allow me to maximize my tax savings. I continue to rent and have no mortgage. I have a nice BMW I bought for 12k cash from a government auction when I first started moonlighting and before I started paying the loans off. I sold my old car for 7k. I worked on cars myself in residency.

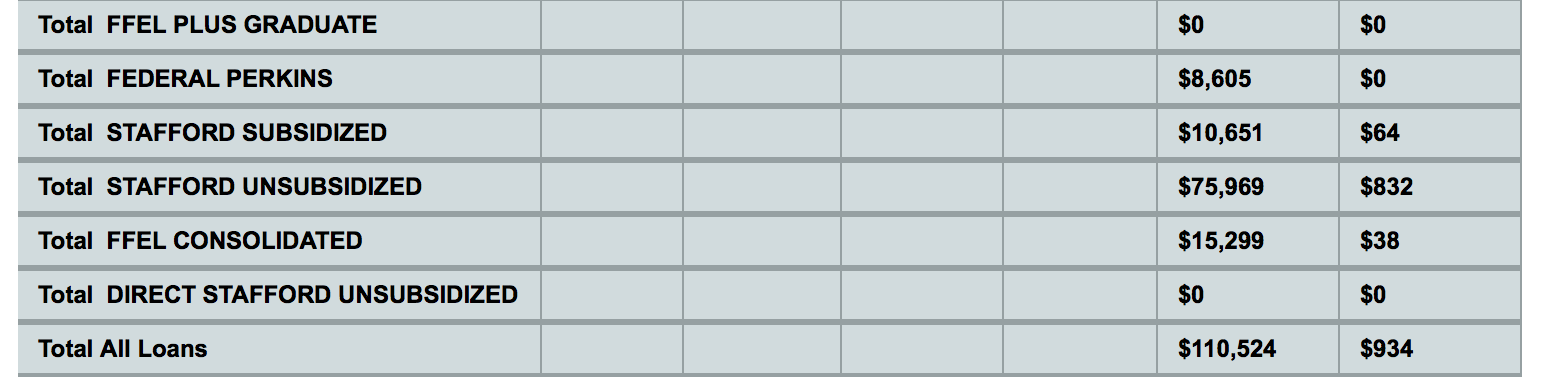

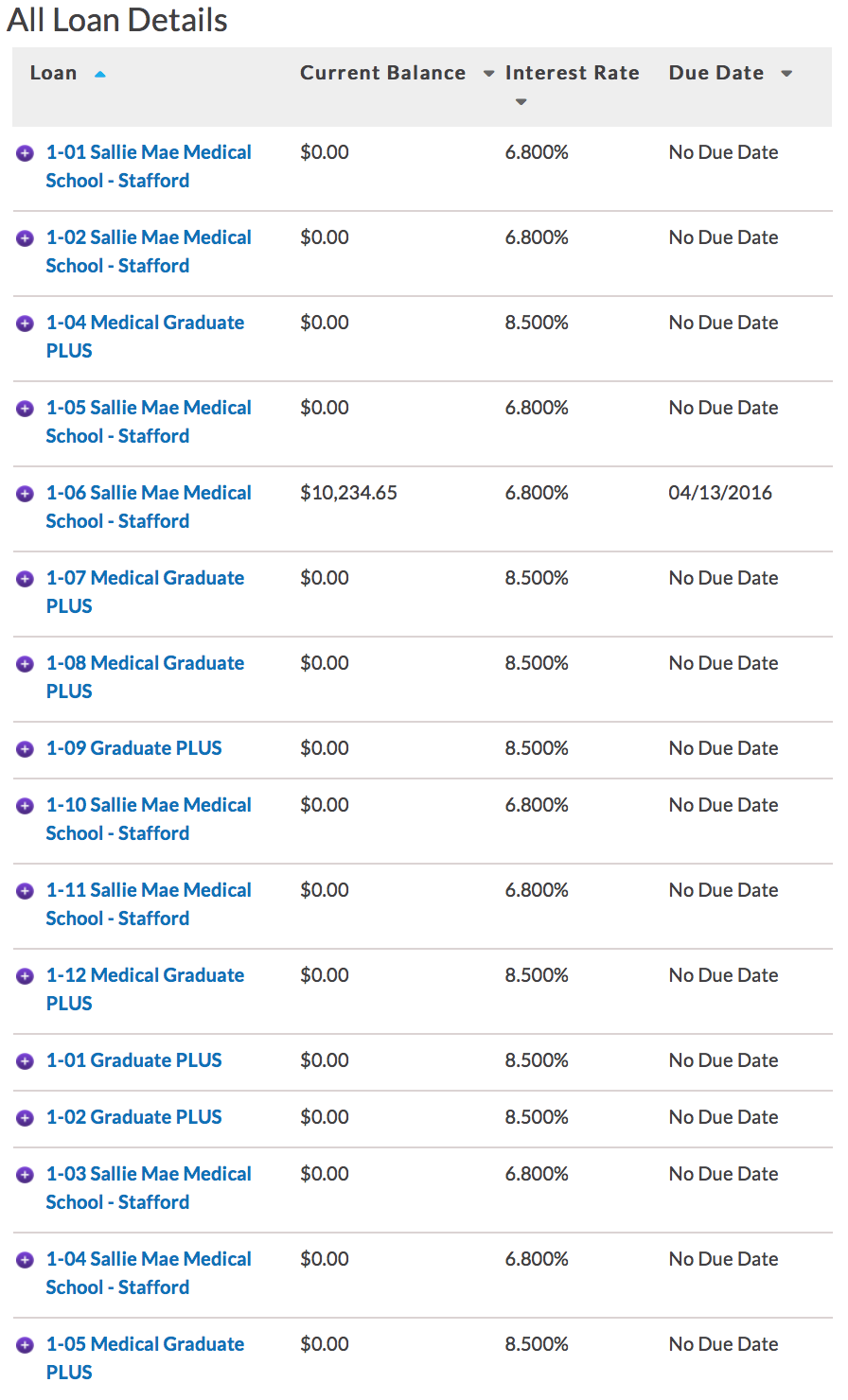

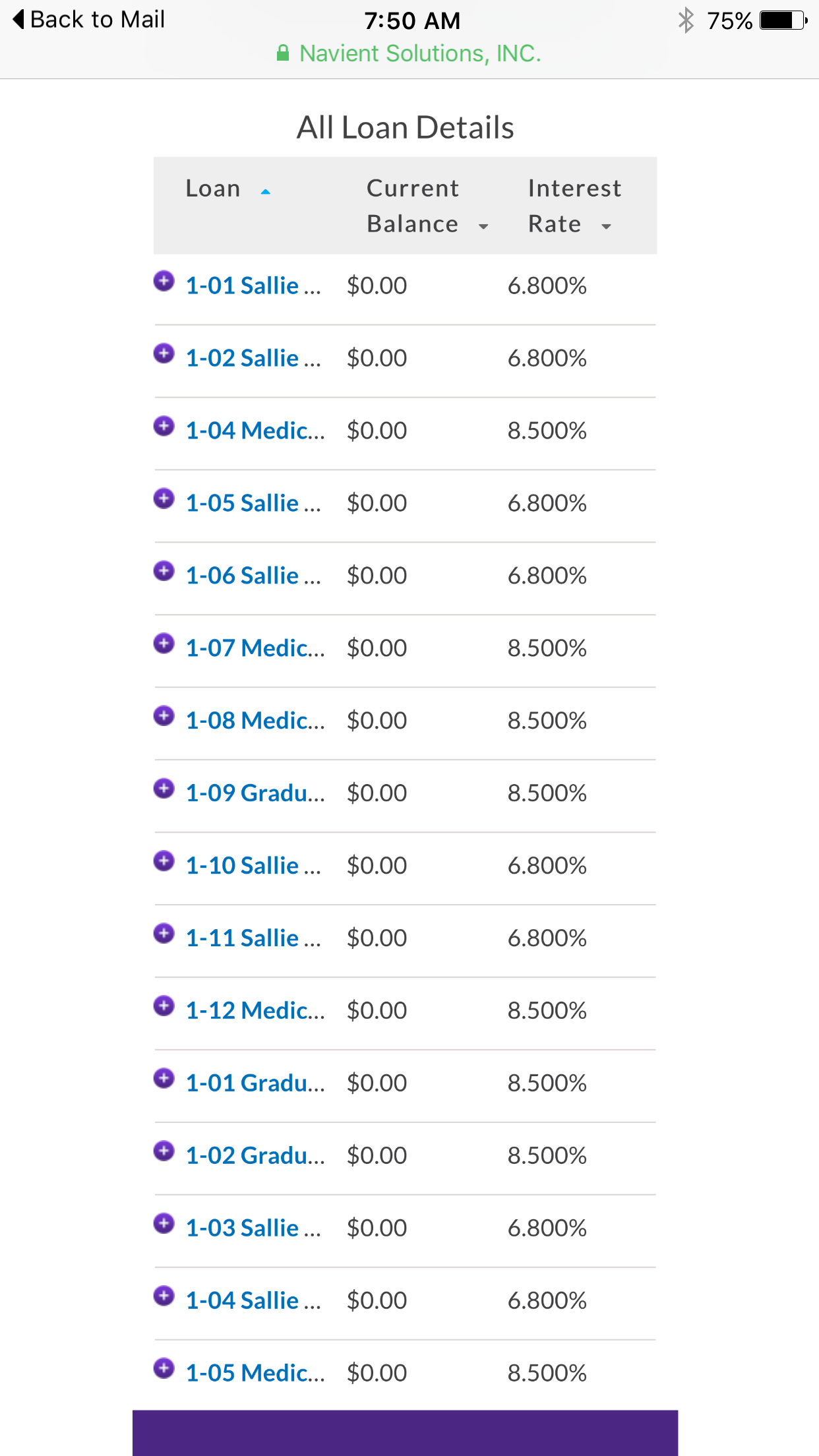

But I digress. What got me motivated was listening to Dave Ramsey and being sick of debt. At 340k and growing, with majority 6.8% and and sizable portion at 8.5% graduate plus it would have been 25k in interest every year. My payment on the standard repayment plan would have been 4k a month for 10 years. That made me sick. I graduated from a US med school with about 225k in loans. I lost a year to not matching and residency was four years, so the loans grew in deferment from 225k to 340k. Before moonlighting I decided to not make loans while in residency. Salary was especially low here and expenses high in this metropolis. Any payment would have been a token payment but degraded whatever quality of life I had during the first 3 years to terrible.

After becoming debt free, I have to work for a couple months to catch up with taxes due in April. Anyway, I will not be interested in more debt, no, I don't want that "doctor's mortgage" with a crappy APR or some kind of "practice loan." No more debt. I will continue to live modestly, invest my money in various businesses/funds/real estate. I refuse to ever get a mortgage even though I continue to live in said expensive city. Save money over time, then buy a house cash at a great deal from a foreclosure or an auction at some point.

I am sharing today to keep myself on track with my plan to pay off debt and to possibly inspire others that it is possible to shake off the shackles of debt slavery. If you get angry about it, you can do it and make a plan.

end rant

But I digress. What got me motivated was listening to Dave Ramsey and being sick of debt. At 340k and growing, with majority 6.8% and and sizable portion at 8.5% graduate plus it would have been 25k in interest every year. My payment on the standard repayment plan would have been 4k a month for 10 years. That made me sick. I graduated from a US med school with about 225k in loans. I lost a year to not matching and residency was four years, so the loans grew in deferment from 225k to 340k. Before moonlighting I decided to not make loans while in residency. Salary was especially low here and expenses high in this metropolis. Any payment would have been a token payment but degraded whatever quality of life I had during the first 3 years to terrible.

After becoming debt free, I have to work for a couple months to catch up with taxes due in April. Anyway, I will not be interested in more debt, no, I don't want that "doctor's mortgage" with a crappy APR or some kind of "practice loan." No more debt. I will continue to live modestly, invest my money in various businesses/funds/real estate. I refuse to ever get a mortgage even though I continue to live in said expensive city. Save money over time, then buy a house cash at a great deal from a foreclosure or an auction at some point.

I am sharing today to keep myself on track with my plan to pay off debt and to possibly inspire others that it is possible to shake off the shackles of debt slavery. If you get angry about it, you can do it and make a plan.

end rant

Last edited: