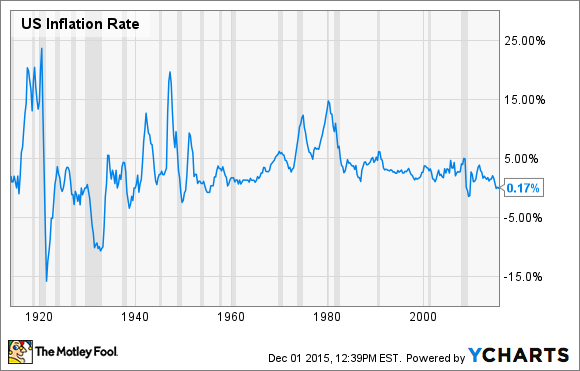

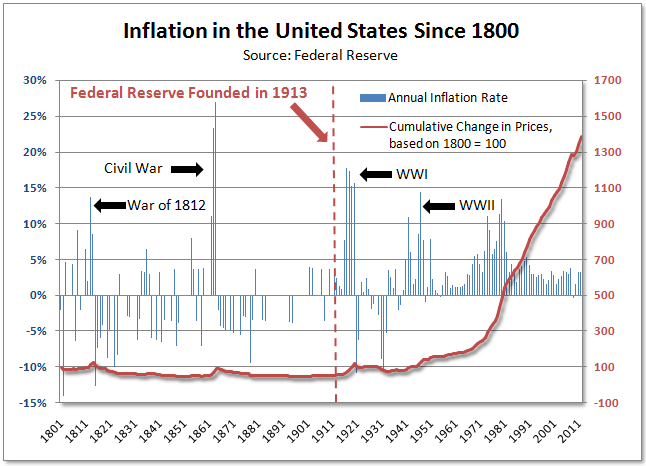

No, it wouldn't. In the 20th century inflation was much more volatile before Nixon depegged. The period since the late 70s and early 80s has been the least volatile for inflation either up or down in history.

It's silly trying to analogize national and world economies with the image of a household sitting around the dinner table looking at their credit card statement. A government is not a family of four, nor should a government be restricted to the financial ingenuity of an individual when having to deal with myriad macroeconomic problems.

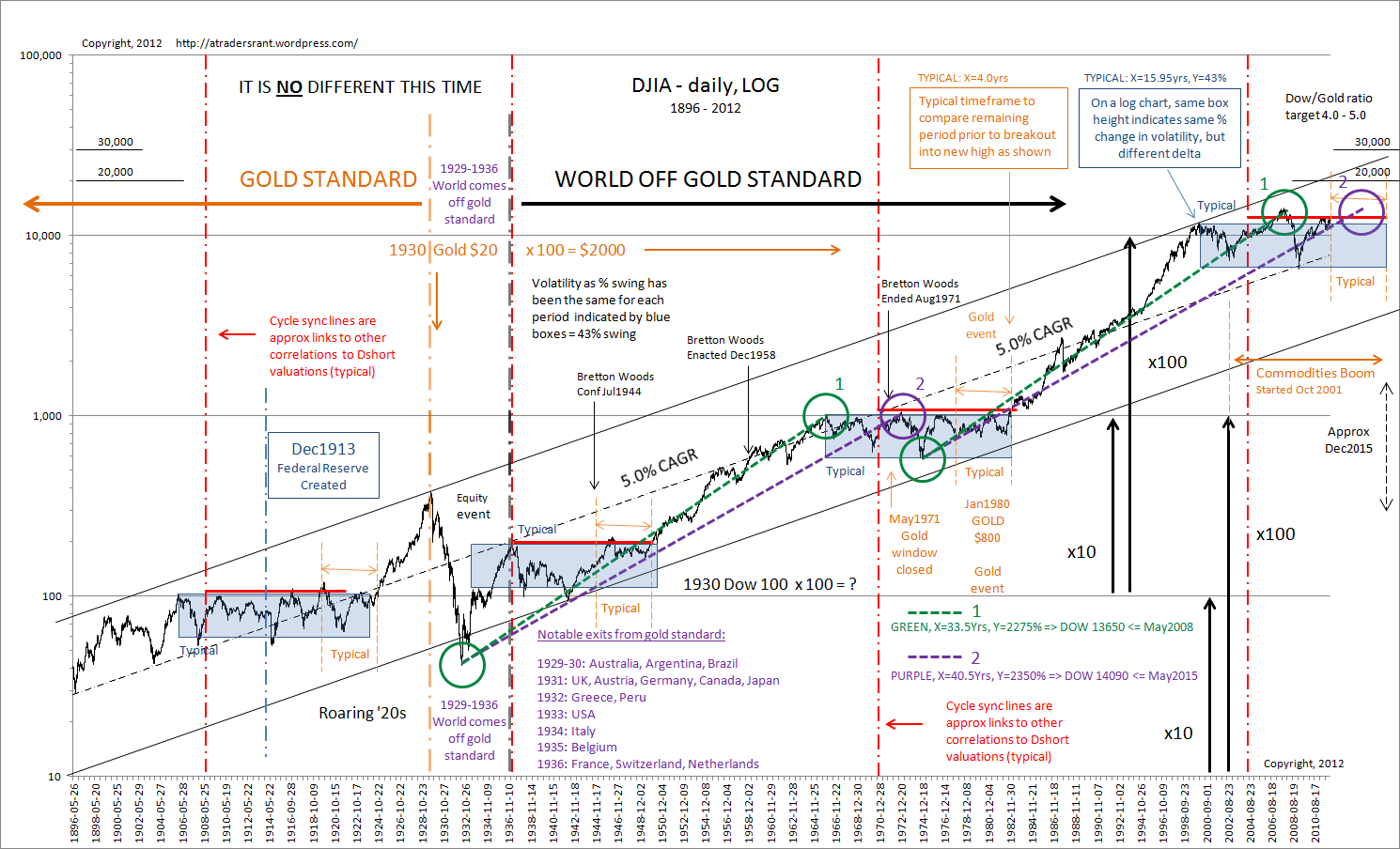

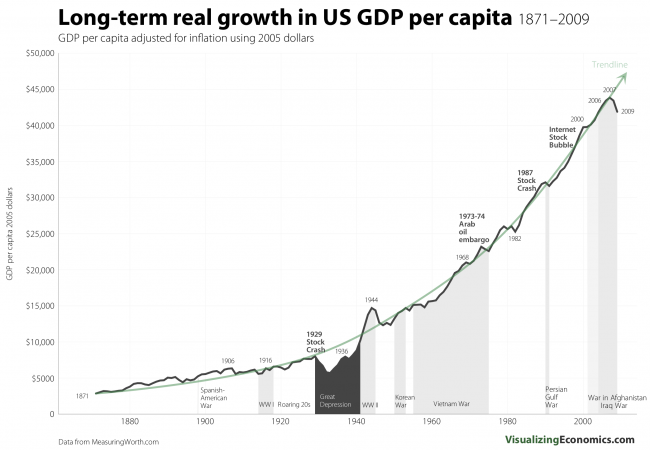

"Debt is bad and savings are good" is such a gross oversimplification as to be laughable. The total market capitalization of the US stock market is somewhere around $20-25 trillion. The total value of US corporate debt is somewhere around $25-30 trillion. Large cap, dividend paying US companies are the greatest wealth creating entities in the history of the world. They did not get this way cause a bunch of entrepreneurs sat around the dinner table and saved pennies to start a company. They financed heavily with debt, grew their revenues, used revenues to finance more debt, and eventually started making enough revenue to have a significant profit and pay a dividend while still servicing their debt. Every single industry and service sector (be it housing, autos, manufacturing, healthcare, education, technology, GOLD MINERS, insurance, retail, food) would collapse overnight if credit markets dried up, and that's exactly what would happen if we had a sudden reversion to the gold standard.