- Joined

- Apr 22, 2007

- Messages

- 22,315

- Reaction score

- 8,963

Okay,

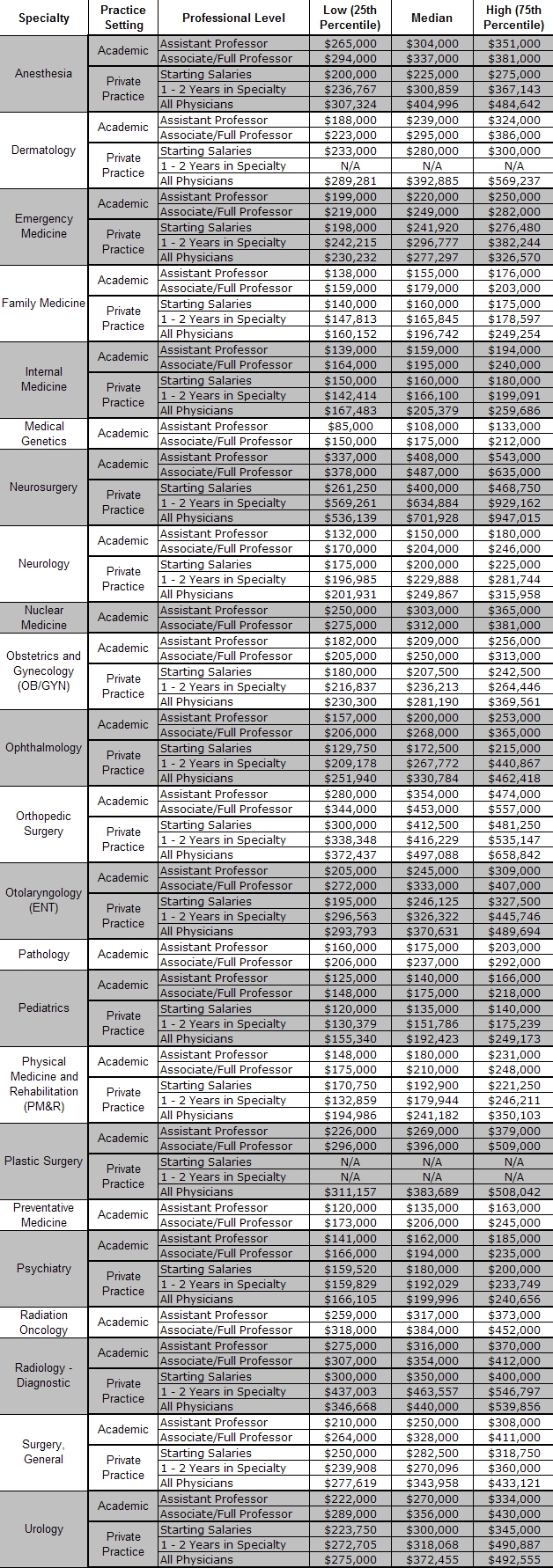

So which of the Anesthesia management companies offers the best retirement plan? Anyone know the numbers for the following:

1. Mednax/American Anesthesiology

2. Team Health

3. Northstar

4. Sheridan/Amsurg

I think Sheridan offers $5,000 per year to its Physician employees; the rest comes out of the salary.

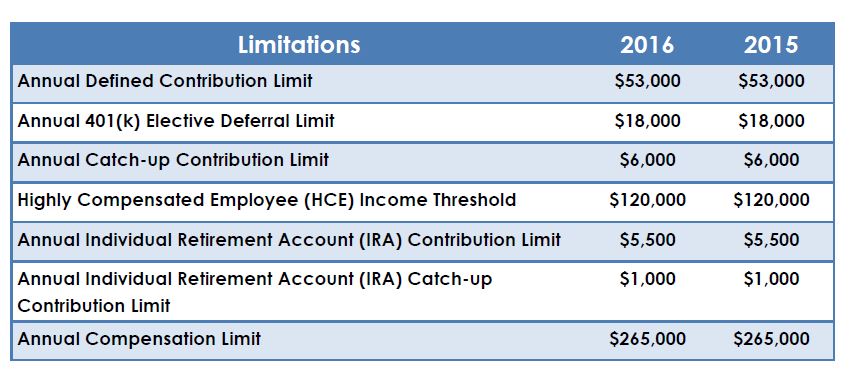

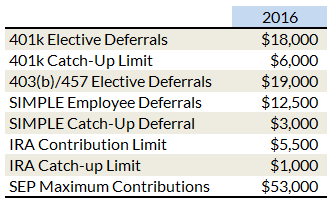

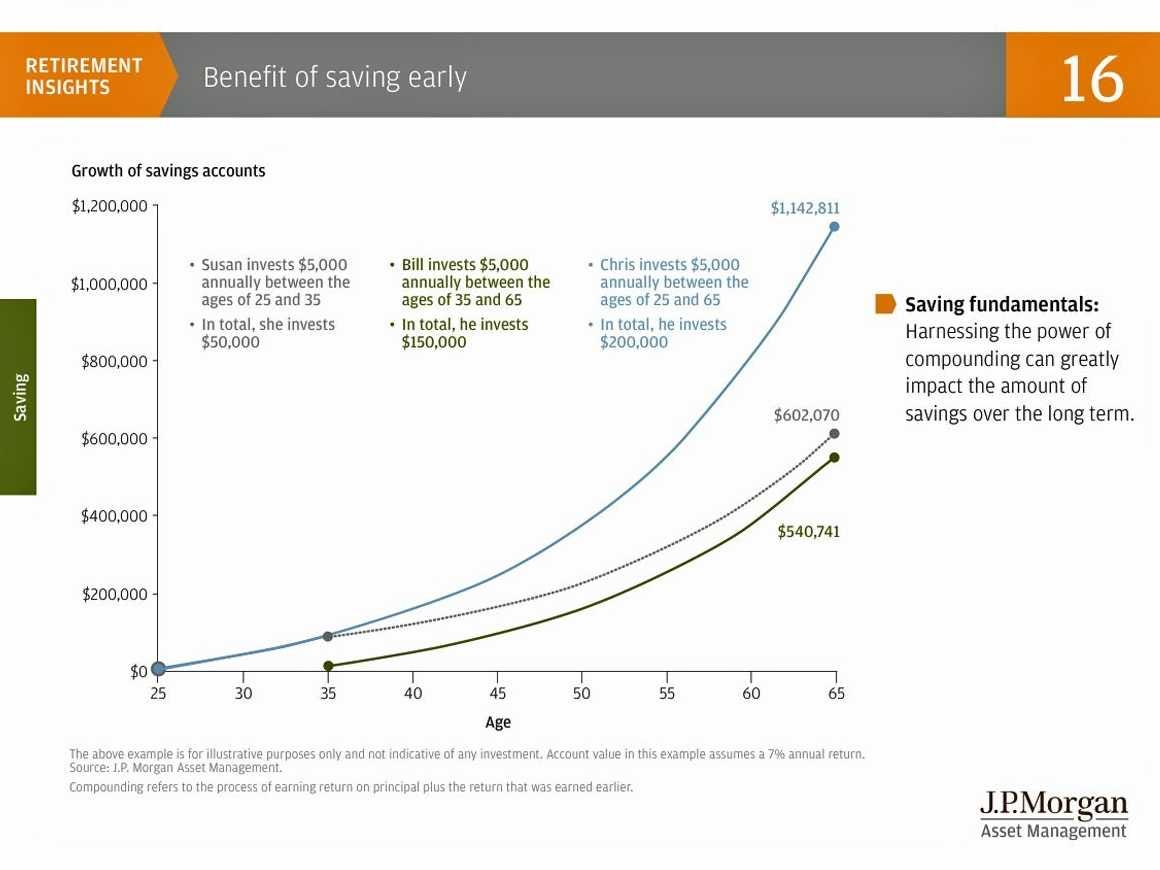

The problem with these poor plans are they do not allow you to MAX out your yearly contributions because the company's contributions are so low.

So which of the Anesthesia management companies offers the best retirement plan? Anyone know the numbers for the following:

1. Mednax/American Anesthesiology

2. Team Health

3. Northstar

4. Sheridan/Amsurg

I think Sheridan offers $5,000 per year to its Physician employees; the rest comes out of the salary.

The problem with these poor plans are they do not allow you to MAX out your yearly contributions because the company's contributions are so low.