Question math question I'm trying to wrap my head around. If I assume I will be in a higher tax bracket in retirement, would it be better to put investments in a 401k or use after tax money now and invest in a taxable account ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (stocks, bonds, real estate, retirement, just not gold)

- Thread starter BMBiology

- Start date

- Joined

- Dec 14, 2006

- Messages

- 1,671

- Reaction score

- 819

Neither. Use Roth IRA or Roth 401(k).Question math question I'm trying to wrap my head around. If I assume I will be in a higher tax bracket in retirement, would it be better to put investments in a 401k or use after tax money now and invest in a taxable account ?

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

China housing bubble is bursting? Bad things always come in threes. First, the U.S., then Europe. Now China?

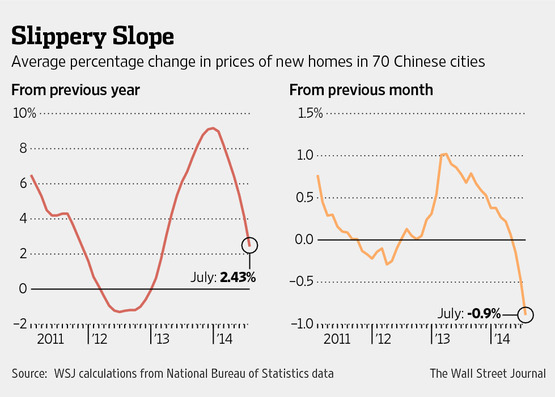

China Home Prices Slip Again in July

Developers Cut Prices as Sales Fall 10.5% Over First Seven Months of the Year

SHANGHAI—The average price of new homes in China fell for a third straight month in July, declining nearly twice as fast as in June, as property developers further cut prices in response to a market downturn.

Housing sales in China have fallen this year, dropping 10.5% by total value in the first seven months compared with the same period a year earlier. Analysts expect further price cuts as local governments and property developers grapple with a glut of apartments and tight credit conditions.

"I'm definitely not buying homes anymore," said Gan Xiaodong, 36 years old, who previously flipped several homes in the southwestern Chinese city of Chongqing. Mr. Gan said he was having trouble selling a particularly large house there, and "beginning in 2011, I couldn't raise the price anymore."

Real estate and construction are important drivers of China's economy, the world's second-largest. They account for more than 20% of China's gross domestic product when cement, steel, chemicals, furniture and other related industries are factored in, analysts estimate.

The average price of new homes in 70 cities slid about 0.9% in July from June, according to calculations by The Wall Street Journal based on data released Monday by the National Bureau of Statistics. This compares with a 0.5% fall in June from May and a 0.2% drop in May from April. The average price in July rose 2.4% from the same month a year earlier, less than the 4.1% increase recorded in June.

Excluding public housing, private-sector home prices fell in 64 of the 70 cities in July, up from the 55 cities that posted declines in June. Home prices rose only in the coastal Chinese city of Xiamen and in Dali, a city in southwest China. They were flat in the remaining four cities.

"Market expectations in the property market are still unclear, and home buyers chose to stay on the sidelines," Liu Jianwei, a statistician at the statistic bureau, said in a statement.

Some property developers have issued warnings in recent weeks about their first-half earnings.

Frenetic building in recent years has left many cities littered with low-occupancy ghost towns, which have eroded home prices.

"Every city has an oversupply problem. The question is the level of severity," said a housing official in Baotou, an industrial city in the Chinese region of Inner Mongolia.

According to private data provider China Real Estate Index System, 31 Chinese cities have excess housing inventories that will take more than three years to work down, after taking into account the amount of residential land sold between 2011 and 2013 and their respective annual housing sales.

Lanzhou, Ningbo and Jinan face some of the most serious oversupply problems, with inventories that will take more than five years to digest given current trends, CREIS estimated in a report last week.

To lure buyers back into the market, local authorities in around 30 cities in recent months have loosened property restrictions so home buyers can buy second or subsequent homes. Others are intervening in the credit market, asking banks to lower requirements for down payments on second homes and offering subsidies to banks that offer favorable mortgage rates. But these moves have had a limited impact on the housing market so far.

"Even after the lifting of restrictions on home purchases, sales didn't rebound in many cities. The wait-and-see sentiment is still strong," said Frank Chen, executive director at CBRE Research, a real-estate consulting company. He said that the key beneficiary of eased purchase restrictions are those looking to upgrade their homes, rather than investors.

http://online.wsj.com/articles/china-property-prices-continue-to-skid-1408327262

It has to correct itself sometime. The housing prices in major metros liken shanghai is insane. Shanghai is mor expensive than New York. But eventually you have to pay the piper and correct down to where people can actually afford. People saw that the real estate prices has always gone up and invested heavily in them, driving up the price. And early birds like my parents made a bundle, the late comers are left holding the bag. I am waiting to see how the Chinese government handles this, or would they resort to stimulus and bailouts just like here.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

Neither. Use Roth IRA or Roth 401(k).

Roth 401k is pretty rare though.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

It has to correct itself sometime. The housing prices in major metros liken shanghai is insane. Shanghai is mor expensive than New York. But eventually you have to pay the piper and correct down to where people can actually afford. People saw that the real estate prices has always gone up and invested heavily in them, driving up the price. And early birds like my parents made a bundle, the late comers are left holding the bag. I am waiting to see how the Chinese government handles this, or would they resort to stimulus and bailouts just like here.

It might be too late, but they can copy Singapore's rule on real estate and you will have no bubble.

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

It has to correct itself sometime. The housing prices in major metros liken shanghai is insane. Shanghai is mor expensive than New York. But eventually you have to pay the piper and correct down to where people can actually afford. People saw that the real estate prices has always gone up and invested heavily in them, driving up the price. And early birds like my parents made a bundle, the late comers are left holding the bag. I am waiting to see how the Chinese government handles this, or would they resort to stimulus and bailouts just like here.

they would only bail out if the banks there were involved heavily in financing all those mortgages. If that were the case, it is then the banks that would get bailed out, not street people, again just like here.

- Joined

- Apr 8, 2009

- Messages

- 3,470

- Reaction score

- 2,370

Roth 401k is pretty rare though.

You mean in terms of availability? I had the option at my former job, but at the time never really thought of using the Roth over the traditional. In hindsight, I probably should have done the Roth.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

I think the major banks in China are stated owned or at least controlled by the government. The question is not if the government will keep the banks running but how they would do it. As the the individual investors, no idea. But the thing with buying houses in China is 30-50% down payment is required, so the prices would have to go down quite a bit before the equity turns negative.they would only bail out if the banks there were involved heavily in financing all those mortgages. If that were the case, it is then the banks that would get bailed out, not street people, again just like here.

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

I think the major banks in China are stated owned or at least controlled by the government. The question is not if the government will keep the banks running but how they would do it. As the the individual investors, no idea. But the thing with buying houses in China is 30-50% down payment is required, so the prices would have to go down quite a bit before the equity turns negative.

so it could take a while. For the market to crash, it would take something less obvious which nobody or only a very few sees from the beginning imho...

- Joined

- Jun 23, 2003

- Messages

- 15,455

- Reaction score

- 6,725

I know, they've been talking about the emerging Chinese economic bubble since like 2011.Dude, you need to watch Vice. They covered this crap a while ago. It's the episode where they built a complete replica of Paris and it's straight up empty.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

I know, they've been talking about the emerging Chinese economic bubble since like 2011.

Also in the news, the chinese used up all the investor visas: http://money.cnn.com/2014/08/27/news/economy/china-us-visa/index.html?iid=HP_LN

I guess it's a good way to get the money back over here.

Over a year ago, one of my cousins and his wife came to California just to have their baby here. They paid lawyers, paid for mandarin speaking doctors, hospital, nanny, drivers, 100% out of pocket. God knows how much that cost for those 3 months. After that, they took the baby back to raise in shanghai. But the baby has US citizenship can come and go between the two countries at ease and attend universities here when the time comes.

Talking to him, I was really surprised. Apparently there is an entire industry in California to do this for the rich chinese couples. And here I thought that you can't get a US visa looking 9 months pregnant and obviously doing it for the citizenship.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

when will the stock market crash? i say by 2016

Business cycle/credit cycle have ups and downs. It will happen. Dunno when. Stay the course :-D

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

Talking to him, I was really surprised. Apparently there is an entire industry in California to do this for the rich chinese couples. And here I thought that you can't get a US visa looking 9 months pregnant and obviously doing it for the citizenship.

Yup, this is pretty common, though there was a crackdown a few years ago, probably just drove it all further underground. A lot of times, small enterprises would rent out houses and run these birth tourism businesses under everyones noses.

Honestly, it's probably easier coming in through Mexico. The focus is on illegal drugs, I don't think border patrol is prioritizing pregnant Chinese women coming through.

http://sanfrancisco.cbslocal.com/20...y-homes-child-gets-united-states-citizenship/

http://abcnews.go.com/US/chinese-women-pay-give-birth-california-maternity-mansion/story?id=17862251

http://articles.latimes.com/2012/dec/04/local/la-me-birthing-center-20121204

http://world.time.com/2013/11/27/chinese-women-are-flocking-to-the-u-s-to-have-babies/

http://www.nytimes.com/2011/03/29/us/29babies.html?pagewanted=all&_r=0

From the NYT article (2011):

Immigration experts say they can only guess why well-to-do Chinese women are so eager to get United States passports for their babies, but they suspect it is largely as a kind of insurance policy should they need to move. The children, once they turn 21, would also be able to petition the United States government to grant their parents permanent residence status.

- Joined

- Jul 29, 2011

- Messages

- 674

- Reaction score

- 187

when will the stock market crash? i say by 2016

I'd say 2016. To have a crash we actually had to have a recovery though. 40 million people on food stamps today. The actual unemployment rate is more like 12% due to the participation rate. The jobs that have been created are low wage part time jobs. Housing market is very poor despite very low interest rates. Wall Street and corporate execs are doing fine. And Momus.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

A bit off topic but got a letter from the corporate that I am now eligible for their non-qualified deferred compensation plan.

Never heard of these before, but a quick glance seem to suggest that its somewhat like a 401k, pre-tax investing that has no contribution $ cap, but not protected like 401k or pension. No retirement requirement or distribution age. Anyone had any experience with this? How does risk-benefit compared to investing using after tax dollars?

Never heard of these before, but a quick glance seem to suggest that its somewhat like a 401k, pre-tax investing that has no contribution $ cap, but not protected like 401k or pension. No retirement requirement or distribution age. Anyone had any experience with this? How does risk-benefit compared to investing using after tax dollars?

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

A bit off topic but got a letter from the corporate that I am now eligible for their non-qualified deferred compensation plan.

Never heard of these before, but a quick glance seem to suggest that its somewhat like a 401k, pre-tax investing that has no contribution $ cap, but not protected like 401k or pension. No retirement requirement or distribution age. Anyone had any experience with this? How does risk-benefit compared to investing using after tax dollars?

They're just deferring compensation to later which is where your main benefit is tax-wise.

It's just an unsecured promise to pay by your employer. Consider your risk tolerance and the stability of your employer before participating.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

They're just deferring compensation to later which is where your main benefit is tax-wise.

It's just an unsecured promise to pay by your employer. Consider your risk tolerance and the stability of your employer before participating.

I saw the difference where the contribution is not protected from creditors in the event of a bankruptcy. Just pre-tax vs posy tax investment can be huge.

Right now I'm on a plan to invesy ~$15k a year in after tax dollars toward retirement on top of 401k and Roth...but pretax would be $21k. Say the risk of company going bankrupt is 20% in the next 30 years. Damn, need to run some scenarios.

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

I saw the difference where the contribution is not protected from creditors in the event of a bankruptcy. Just pre-tax vs posy tax investment can be huge.

Right now I'm on a plan to invesy ~$15k a year in after tax dollars toward retirement on top of 401k and Roth...but pretax would be $21k. Say the risk of company going bankrupt is 20% in the next 30 years. Damn, need to run some scenarios.

Correct, you'd be an unsecured creditor along the same lines as a shareholder. Basically....pretend you're getting paid in company stock, lots and lots of company stock and you can't sell it right away.

I can't comment further since I don't know the full details of your non-qualified plan, and I've dealt with 457(b) plans more frequently than straight non-qual.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

Correct, you'd be an unsecured creditor along the same lines as a shareholder. Basically....pretend you're getting paid in company stock, lots and lots of company stock and you can't sell it right away.

I can't comment further since I don't know the full details of your non-qualified plan, and I've dealt with 457(b) plans more frequently than straight non-qual.

Thanks for the input. I did tell you that you have enough affinity for business to make DOP eventually right?

I need to research more and call HR on this Monday. This appears to be something that potentially have a big upside or downside. Also the letter didn't say how much the company is matching other than it's at the company discretion. I can run a ton of scenarios but until I narrow down several more variables, it would be just paralysis by analysis.

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

Thanks for the input. I did tell you that you have enough affinity for business to make DOP eventually right?

Yes you have, but I'm many moons and a few pay grades away from doing that. I have still much to learn on the clinical end.

I need to research more and call HR on this Monday. This appears to be something that potentially have a big upside or downside. Also the letter didn't say how much the company is matching other than it's at the company discretion. I can run a ton of scenarios but until I narrow down several more variables, it would be just paralysis by analysis.

You mean Tuesday? Definitely get the details and the length of time involved, and from what I've been reading, some companies are getting creative in order to circumvent the whole company assets/unsecured creditor issue (like buying universal life insurance policies that build value with you as beneficiary, which kind of makes the benefit irrevocable and untouchable by bk court).

Kind of exciting, without even knowing the details and only knowing scant pieces of your financial picture, this has more potential to be boon vs bust.

EDIT: ignore that part about life insurance, that's a funding mechanism to avoid ERISA oversight and would still be subject to creditor claims.

Last edited:

I am, but I have hardly anything in the market, most $ is going toward loan payoff. If I were to be seriously investing, I wouldn't go that way though. You don't have anything to rebalance with when stocks dip, so you won't have the funds available to pick up the "sale" priced stocks.Who is also 100% stocks/0% bonds?

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

- Joined

- Nov 27, 2007

- Messages

- 655

- Reaction score

- 142

I'm a total novice when it comes to investing so I met with an investment firm and was looking for feedback. Basically their recommendation was nothing more than investing in a mutual fund they picked, +13% return since inception over 40 years, 8-15% yearly returns on past 10 years. They charge a fee of 4.5% upfront if i invest 50k with them, and a 0.7% fund expense. Does this seem like a reasonable path to take and do I really need this firm to oversee things if the mutual fund is already managed by a different group? To reiterate my first line, this is a totally new domain for me so even if there is a moderate upcharge I wouldn't necessarily mind that given a second set of eyes to look over my investment and walking me through the process of starting.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

I'm a total novice when it comes to investing so I met with an investment firm and was looking for feedback. Basically their recommendation was nothing more than investing in a mutual fund they picked, +13% return since inception over 40 years, 8-15% yearly returns on past 10 years. They charge a fee of 4.5% upfront if i invest 50k with them, and a 0.7% fund expense. Does this seem like a reasonable path to take and do I really need this firm to oversee things if the mutual fund is already managed by a different group? To reiterate my first line, this is a totally new domain for me so even if there is a moderate upcharge I wouldn't necessarily mind that given a second set of eyes to look over my investment and walking me through the process of starting.

Front load 4.5% and ER 0.7%... Past performance does not guarantee future results. Run like your life depends on it.

Read Boglehead guide to investing. Or, Random Walk Down Wallstreet, after that you can ask a better question and you are not being taken advantage of. This will be the best purchase you will ever make in your investing career.

Last edited:

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

I'm a total novice when it comes to investing so I met with an investment firm and was looking for feedback. Basically their recommendation was nothing more than investing in a mutual fund they picked, +13% return since inception over 40 years, 8-15% yearly returns on past 10 years. They charge a fee of 4.5% upfront if i invest 50k with them, and a 0.7% fund expense. Does this seem like a reasonable path to take and do I really need this firm to oversee things if the mutual fund is already managed by a different group? To reiterate my first line, this is a totally new domain for me so even if there is a moderate upcharge I wouldn't necessarily mind that given a second set of eyes to look over my investment and walking me through the process of starting.

Investing is just common sense but SDN is the least likely place I would go to ask for advice on investing imho (again it is common sense lol). Also remember to read/check the poster's posting history/posts before taking on any info.

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

You mean Tuesday? Definitely get the details and the length of time involved, and from what I've been reading, some companies are getting creative in order to circumvent the whole company assets/unsecured creditor issue (like buying universal life insurance policies that build value with you as beneficiary, which kind of makes the benefit irrevocable and untouchable by bk court).

Kind of exciting, without even knowing the details and only knowing scant pieces of your financial picture, this has more potential to be boon vs bust.

EDIT: ignore that part about life insurance, that's a funding mechanism to avoid ERISA oversight and would still be subject to creditor claims.

Been up to my nose with other issues in the pharmacy so cqnt get back until now.

Anyway, some info from HR and the investment firm.

(1) pretax dollar investing, up to 50% of your base salary and 100% of bonus

(2) no company match (called credit in this case) as of now, but its at company discretion and can discriminate.

(3) a rabbi trust is in place to prevent change of heart, and offer some deterrence against creditors during bk

(4) can be terminated at any time by the company and distributed out, again offer some protection against bk.

(5) 2 distributiion options: retirement/separation and in-service. Retirement/separation is self explanatory, account value distributed out up to 5 years. In-service = you set up a point as long as it's at least 2 yrs out, and if you reach it and don't want it, you can delay it by 5 yrs indefinitely. Distribution can spread out over 5 yrs.

(6) Number of in-service accounts is unlimited... Lattering strategy?

(7) change of control clause: if the company ownership/leadership change triggers option to pull out

(8) The selection of funds are exactly as in our 401k, but at a higher tier ( so lower expense ratio).

Cons:

(1) no 100% protection against bk creditor claims even with above measures in place

(2) distribution other than retirement can put me in a higher tax bracket, but need to run some calculations of pretax dollar investing but taxed at 39% vs after tax investing... But having less control naturally means I'll invest more conservatively.. so also need to factor that in. Gets complicated.

(3) no company match, boo!

(4) 401k match $ is a % of salary, so deferring salary lows match $.

Need to think about it some more. One possibility is to defer enough so I can qualify for full 401k contribution limit (right now I get means tested out after about 6-7%) and some tax credits, ect. But that would require me to defer almost maximally, not sure I want to risk that.

Last edited:

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

They charge a fee of 4.5% upfront if i invest 50k with them, and a 0.7% fund expense. Does this seem like a reasonable path

WTF RUN AWAY.

That is the most horrible deal I've heard in a while.

It's so bad that it makes me think people say yes, and damn, I should open my own shop and charge that much.

Holy crap.

- Joined

- Nov 27, 2007

- Messages

- 655

- Reaction score

- 142

What (if any) is a reasonable upfront fee and fund expense for an index mutual fund?

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,314

- Reaction score

- 11,929

WTF RUN AWAY.

That is the most horrible deal I've heard in a while.

It's so bad that it makes me think people say yes, and damn, I should open my own shop and charge that much.

Holy crap.

Wouldn't that be great? Take a big chunk of their money upfront for yourself, put the rest of theirs into VTSAX, and take maybe 20 basis points a year for yourself. They'll still do pretty well, and so will you.WTF RUN AWAY.

That is the most horrible deal I've heard in a while.

It's so bad that it makes me think people say yes, and damn, I should open my own shop and charge that much.

Holy crap.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

What (if any) is a reasonable upfront fee and fund expense for an index mutual fund?

None. Front load mutual funds are a scam. They give no added value for investor. They give tons of value to the seller. In this case, your financial adviser is fattening his retirement account at your expense. You are being directed to high cost mutual fund with crazy front load because they get a back end commission out of it. It's stupid to pay upfront. Index funds will normally charge no upfront fee, and very low expense ratio (for example: Vanguard Total stock market Admiral charges 0.05% a year).

This is the catch, for every $ you put in, they will take 4.5 cents immediately. Holy sh1t. You are already losing -4.5% before you get anything! Seriously. If you want your money back a day later, you are out of $2250 (50k X 4.5%). After you pay them $2250, why do they care to perform at all?

Front load is also never ending fee, any additional funds you put in will get an immediate ax -4.5%. You are already losing against the market from day 1! If you need a seller in any product you offer (load funds, back load, high ER), it's a bad product. Good product sell themselves (Vanguards). These products are sold (by your sh1tty financial adviser), not bought.

- Joined

- Nov 27, 2007

- Messages

- 655

- Reaction score

- 142

Appreciate the feedback, its clear I need to do some reading before proceeding in any direction, and that direction will obviously not be with this firm.

- Joined

- Nov 27, 2007

- Messages

- 655

- Reaction score

- 142

Firm was urging to invest in this by the way: http://www.morningstar.com/invest/funds/54730-agthx-american-funds-growth-fund-of-amer-a.html

- Joined

- Jun 29, 2011

- Messages

- 2,881

- Reaction score

- 1,849

Dallas Cowboys season tickets. Haven't been to a game in years but resale values are through the roof. My seats cost $65 and they sell for $250+ on Stubhub. Sold my 49ers ticket for $400. Hey, it's an investment if it makes money right?

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

Firm was urging to invest in this by the way: http://www.morningstar.com/invest/funds/54730-agthx-american-funds-growth-fund-of-amer-a.html

Even worse than I thought.

AGTHX (Load 5.75, ER 0.7%, 12B-1 fee 0.24%) vs. VIGAX - Vanguard Large Growth Index Fund (no load, 0.09% ER, 0 marketing fee).

What are you paying 7X yearly for again (0.7/0.09)? Just to get beaten by a large growth index at the end? Not only that the salesmen want to get paid now, so fork over 5.75% just to get this amazing performance! luls..

Last edited:

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Even worse than I thought.

AGTHX (Load 5.75, ER 0.7%, 12B-1 fee 0.24%) vs. VIGAX - Vanguard Large Growth Index Fund (no load, 0.09% ER, 0 marketing fee).

What are you paying 7X yearly for again (0.7/0.09)? Just to get beaten by a large growth index at the end? Not only that the salesmen want to get paid now, so fork over 5.75% just to get this amazing performance! luls..

There was a study done that showed American funds outperformed the market 98% of the time after 30 years. This was after all costs added.

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

Goddammit, are we still having this stupid f*cking argument that people can regularly expect to beat the market by paying more for expensive funds, hedge funds, and so-called "market experts?"

It's like listening to people argue that climate change doesn't exist, or that Obama was born in Kenya.

It's like listening to people argue that climate change doesn't exist, or that Obama was born in Kenya.

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

This active vs passive argument is getting old. Really, who cares?

yup lol

like I have said before, this is the last place on earth I would come to ask for investment advice.... lol

- Joined

- Jul 29, 2011

- Messages

- 674

- Reaction score

- 187

yup lol

like I have said before, this is the last place on earth I would come to ask for investment advice.... lol

It's kind of like watching CNBC. Do the opposite of what they're pumping up today and you would be better off. Bulls make money, Bears make money, Hogs get slaughtered. Buy buy buy. Rah rah rah.

- Joined

- Feb 26, 2003

- Messages

- 8,860

- Reaction score

- 3,420

Walgreens is at $60 a pop, who is buying?

Anybody?

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

Walgreens is at $60 a pop, who is buying?

Anybody?

Hogs ?? lol

- Joined

- Aug 24, 2014

- Messages

- 60

- Reaction score

- 18

The mystery of 7. Looks like all three indices made the all-time high during the overnite session 7 days before the 1st of Tishri, Sept 25th. If this cycle holds true then we should see a steady decline thru the next year with a waterfall decline on the 29th of Elul which falls on a Sunday, Sept 13. The Friday before will be the (2x7) 14th anniversary.

- Joined

- Jun 23, 2003

- Messages

- 15,455

- Reaction score

- 6,725

UNEMPLOYMENT RATES:

U3 (headline rate) dropped 0.2 points from 6.1% to 5.9%.

U4 (includes discouraged workers) dropped 0.2 points from 6.6% to 6.4%.

U5 (includes "marginally attached") dropped 0.1 point from 7.4% to 7.3%.

U6 (includes involuntary part-time workers) dropped 0.2 points from 12.0% to 11.8%.

LABOR FORCE NUMBERS:

The labor force shrank by 97k people.

The labor participation rate dropped 0.1 point to 62.7%. After bouncing off 62.8% for the better part of a year, the LPR finally broke through that level. This is the lowest LPR since women entered the workforce in the 1970s.

At the same time, the number of people not in the labor force who want a job ("marginally attached") decreased by 375k to 6007k. Though not seasonally-adjusted, this number is up 232k from a year ago. The number of discouraged workers (people who have given up looking for work) decreased by 77k to 698k. Though not seasonally-adjusted, this number is down 154k from a year ago.

FULL - AND PART-TIME WORKERS:

The number of people employed full-time increased by 671k to 119.3 million.

The number of people employed part-time dropped by 384k to 27.4 million.

JOBS DISTRIBUTION:

Total nonfarm jobs increased by 248k to 139.4 million.

Of these new jobs, 236k came from the private sector.

Federal government jobs decreased by 2k.

State government jobs increased by 22k.

Local government jobs decreased by 8k.

REVISIONS:

July's job numbers were revised upward from +212k to +243k.

August's job numbers were revised upward from +142k to +180k.

Together, these revisions mean that 69k more jobs were created in the last two months than previously estimated.

Wow, how encouraging! And the dollar is strengthening, too. Euro down to $1.25. Pound about to hit $1.50. Might take a European trip next year. Our old friend gold is under $1200. I might actually buy a tad bit of gold and hold it if it goes below $900 or so. Wait until the next time the ******* libertarians decide to freak out en masse and sell it to the greater fool.

Similar threads

- Replies

- 17

- Views

- 2K