In a new report titled “2020 Vision: Long Live the Expansion,” Mr. Parker makes the case for why a recession is “far from imminent.” In that scenario, stocks still have much more room to run.

“Our best guess is that an S&P 500 peak of near 3000 is possible should the U.S. expansion prove to have five or more years left to it,” Mr. Parker said. The assumption is based on earnings growth of about 6% a year and an S&P 500 price/earnings ratio of about 17.

The S&P 500 swung between small gains and losses on Tuesday, climbing to an all-time intraday high of 2006.15. The index is up more than 8% this year and has surged nearly 200% from the March 2009 bottom.

Mr. Parker’s latest call comes as he has already been one of the more bullish strategists on the Street. He currently sees the S&P 500 climbing to 2050 by the middle of next year.

Here are the bullet points from Mr. Parker supporting Morgan Stanley’s long-term view on markets and the economy:

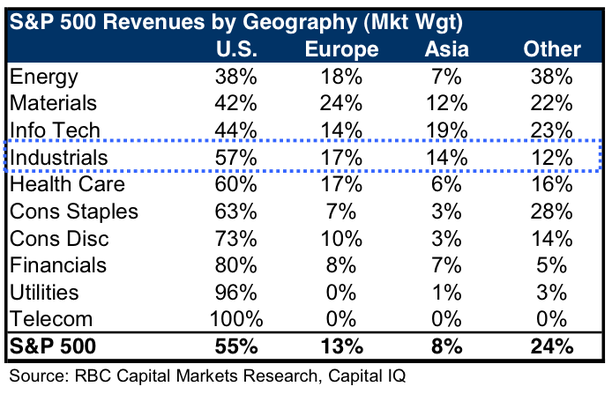

The world economy is not in sync. Major regional economies are at different points along the growth cycle. In general, DM is leading while EM is lagging.

- Volatility in the US continues to trend lower, which can extend the life of expansions.

- Deleveraging in the US is ongoing, albeit largely complete, and balance sheet priorities have shifted.

- Interest payments on debt burdens are ultra-low, and household debt dynamics suggest there exists a sizable cushion protecting consumers in a rising interest rate environment.

- Capital spending and inventories do not look stretched. Corporate management hubris and other corporate metrics of overheating remain muted.

- Several broad economic indicators in the US have only just reached “normal” expansionary levels and are far from looking unsustainable.

A combination of low volatility, low interest rates and the lack of excessive capital spending or corporate valuations gives Morgan Stanley reason to believe that the current recovery still has room to run.

“Business cycles don’t die of old age, they die of overheating,” Mr. Parker said. “Debt dynamics, particularly in the U.S., paint the picture of a more prudent household sector and well-managed corporate sector, both of which remain far from the heights of leverage typically associated with risks to business cycle expansions….The current expansion is more than five years old, and with little evidence of global synchronicity, there are no signs as yet that the global economy is overheating.”