Silver has been one of the best investments during the 21st century, even though it has been a lousy investment over the past couple of years. Silver traded at just $5 per ounce at the beginning of the century and it traded as high as $48 per ounce in 2011 before correcting. Despite a 60 percent correction to less than $20 per ounce, silver has markedly outperformed bonds and American stocks despite the fact that many analysts missed this run-up. Many of these same analysts are still not bullish on the silver market.

While investors looking to diversify away from more traditional assets often turn to gold, they should also consider purchasing silver. In fact, more aggressive investors should favor silver in their portfolios. Here’s why.

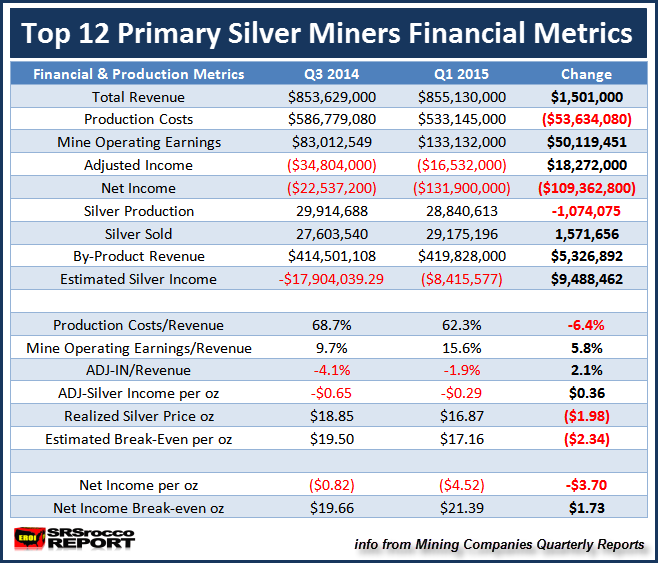

First, silver cannot be mined profitably at the current price. True, if you read many silver mining companies’ reports, they are claiming that they can produce silver at $17 per ounce or $18 per ounce, but this is a razor-thin margin, and if anything goes wrong, these companies will not be profitable. Furthermore, there are other companies that simply aren’t profitable at the current silver price.

The fact is that for silver miners to be comfortably profitable to the point that they are confident that their mines will be cash-flow positive, we need a minimum silver price of $25 per ounce to $30 per ounce.

Until we reach that point, there is going to be very little investment in silver mining, and this means that unless the price of silver rises from here, silver production is going to diminish. This in itself will force silver prices higher.

Second, despite the fact that silver mining is currently a tenuous business, industrial demand for silver has been growing. Industries are finding more and more usages for silver, from photovoltaic cells in solar panels to medical devices to smart phones. Furthermore this demand is inelastic, which means that so little silver is used in these products relative to their market value that the producers of these products will still buy silver and produce these products even if the price of silver rises substantially.

For instance, an iPhone contains about a third of a gram of silver that is worth roughly 20 cents. If silver trades to $100 per ounce, then the cost to Apple will be just 80 cents more per iPhone. Similar examples arise for other products in which we find silver.

This means that industrial demand for silver is here to stay, and as more global consumers utilize modern technologies, there will be greater demand for silver. This will push prices higher.

With a limited supply at current prices and rising demand for silver regardless of price, there is a very strong likelihood that silver will trade higher in the coming years. This may not happen overnight. There is a lot of negative sentiment in the silver market, and short sellers will be confident in their positions should the price remain depressed.

Therefore, we may continue to see depressed prices until industrial and investor demand for physical silver overwhelms the short sellers.

http://www.cheatsheet.com/business/heres-why-you-should-buy-silver.html/?a=viewall