- Joined

- Sep 20, 2016

- Messages

- 1,802

- Reaction score

- 502

Is that the magic number needed to retire and walk away from it all?

10 Mil?!? Who's gonna make that much....? Gonna take 25-30 years, no kids, no debt, crazy busy (fraudulently aggressive), abnormally high investment returns, and probably some luck. I'd be done, but sounds unrealistic...

10 Mil?!? Who's gonna make that much....? Gonna take 25-30 years, no kids, no debt, crazy busy (fraudulently aggressive), abnormally high investment returns, and probably some luck. I'd be done, but sounds unrealistic...

2-3 million.10 million in total assets not per year.

What do you think is realistic?

all depends on your expenses. expenses include taxation in your home state. for me 10 million is enough.Is that the magic number needed to retire and walk away from it all?

all depends on your expenses. expenses include taxation in your home state. for me 10 million is enough.

figure 1.5 - 2 million for a house leaves you 8 million. 8 million yielding 5 % gives you 400K a year without ever touching principal. . take home pay is

234,917 . your social security income will take care of property tax.

$400000 Federal Tax Calculator 2017/2018 | 2017 Tax Refund Calculator

most people do take money out of principal if they have no pension.

I think that's too much, for me anyways, although the more you can save, the better, obviously. I'm not planning on needing that much. But I do plan on having my house paid off by age 55, kids already put through college once retired, no more 529 plans to fund, no more house payments, no more student loans payments, not having to keep dumping money into the 401K once retired (obvious, but does reduce expenses compared to working years).10 million in total assets not per year.

What do you think is realistic?

i never said the income is from equities. you assumed that? 5% is too low for equity income. the 5% is from bonds. bond coupon income is not taxed as a capital gain. if you wish to make it equities you are assuming more risk which is OK but figure you would average higher, say 6.5% return or so.Wrong.

400k is capital gains, not regular income.

i never said the income is from equities. you assumed that? 5% is too low for equity income. the 5% is from bonds. bond coupon income is not taxed as a capital gain. if you wish to make it equities you are assuming more risk which is OK but figure you would average higher, say 6.5% return or so.

What You Need To Know About Capital Gains And Taxes

what was written in the original post is //Is that the magic number needed to retire and walk away from it all?//Why not keep most in stocks with higher dividend rates?

Whats the benefits of bonds if you have a significant financial cushion? Even with a 40% market drop, you could still ride it out with dividends if you dont sell the principal.

check out the Japan stock market chart before you decide to ride out a market drop.Why not keep most in stocks with higher dividend rates?

Whats the benefits of bonds if you have a significant financial cushion? Even with a 40% market drop, you could still ride it out with dividends if you dont sell the principal.

check out the Japan stock market chart before you decide to ride out a market drop.

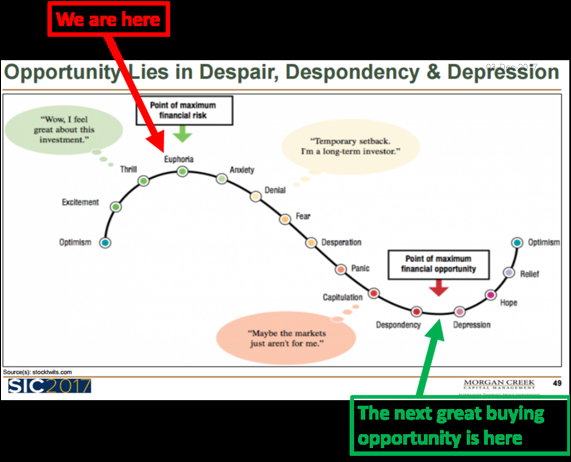

View attachment 226084

Being retired what scares me is severe inflation. If it costs 10K to buy a loaf of bread 10 million is not going to get you very far.

Seems unlikely, but some inflation hedges are not a bad idea either.

"How Ya Gonna Keep 'em Down on the Farm (After They've Seen Paree?)"If you love your job you never work a day in your life...

S&P 500 and USD, as usual. It's just a question of ratio depending on your retirement plans.So which market in the world is relatively stable to invest in now, considering both Nikkei and DJIA are inflated?

Incomes in the future could be lower with corporate America taking a slice of the pie through ownership of medical practices, so predictions about the future are difficult. Municipal bonds could tank or become insolvent under the tax bill currently being debated since their tax free status will be revoked. How much do you really need? It depends on your expectations. As you approach 60, if your house(s) are paid off, then the major expenditures are property taxes (that are not decreasing) and insurances. Most people, including doctors, will downsize from their 9700 sf houses on a lake to something more practical as they approach retirement. Clearly 10 million net worth is far more than most doctors will ever save in a lifetime unless they are extremely frugal (most are not) or exceptional in their investing (most are not). The 401k/pension plans are the best way to save tax deferred monies since they can be automatically deducted. Paying off the house as early as possible by doubling or tripling the amount paid each month increases net worth by 0.5-1 million in the long run compared to paying what is due on the loan. Me? I will be perfectly happy on far less net worth than 10 million

LETTER TO THE EDITORThat is a scary picture.

Going forward due to extreme P/E inflations of the current market coupled with artificially low interest rates, I would suspect a far lower return in almost any asset class than was seen over the last 30 years.

Stocks will return maybe 4% annually over the next 10-15 years, bonds return even worse, real estate is very inflated, etc.

The 10 million number is so high because I am assuming poor investment returns going forward for America.