- Joined

- Oct 30, 2016

- Messages

- 995

- Reaction score

- 634

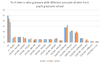

Was researching about student loan debt for psychologists and this website popped up first. Thought the attached pic was cute, and terrifying.

Also.....does anyone know of someone who has actually received PSLF? I have honesty only heard of horror stories where people think they are going to get it and then something goes wrong somewhere in the process.

Got debt?View attachment debt.pdf

Sent from my SM-G950U using SDN mobile

Also.....does anyone know of someone who has actually received PSLF? I have honesty only heard of horror stories where people think they are going to get it and then something goes wrong somewhere in the process.

Got debt?View attachment debt.pdf

Sent from my SM-G950U using SDN mobile

. And a similar article from apa published in 2011 showed the average debt was significantly lower. It just keeps climbing and climbing.

. And a similar article from apa published in 2011 showed the average debt was significantly lower. It just keeps climbing and climbing.