- Joined

- Dec 12, 2006

- Messages

- 2,981

- Reaction score

- 3,483

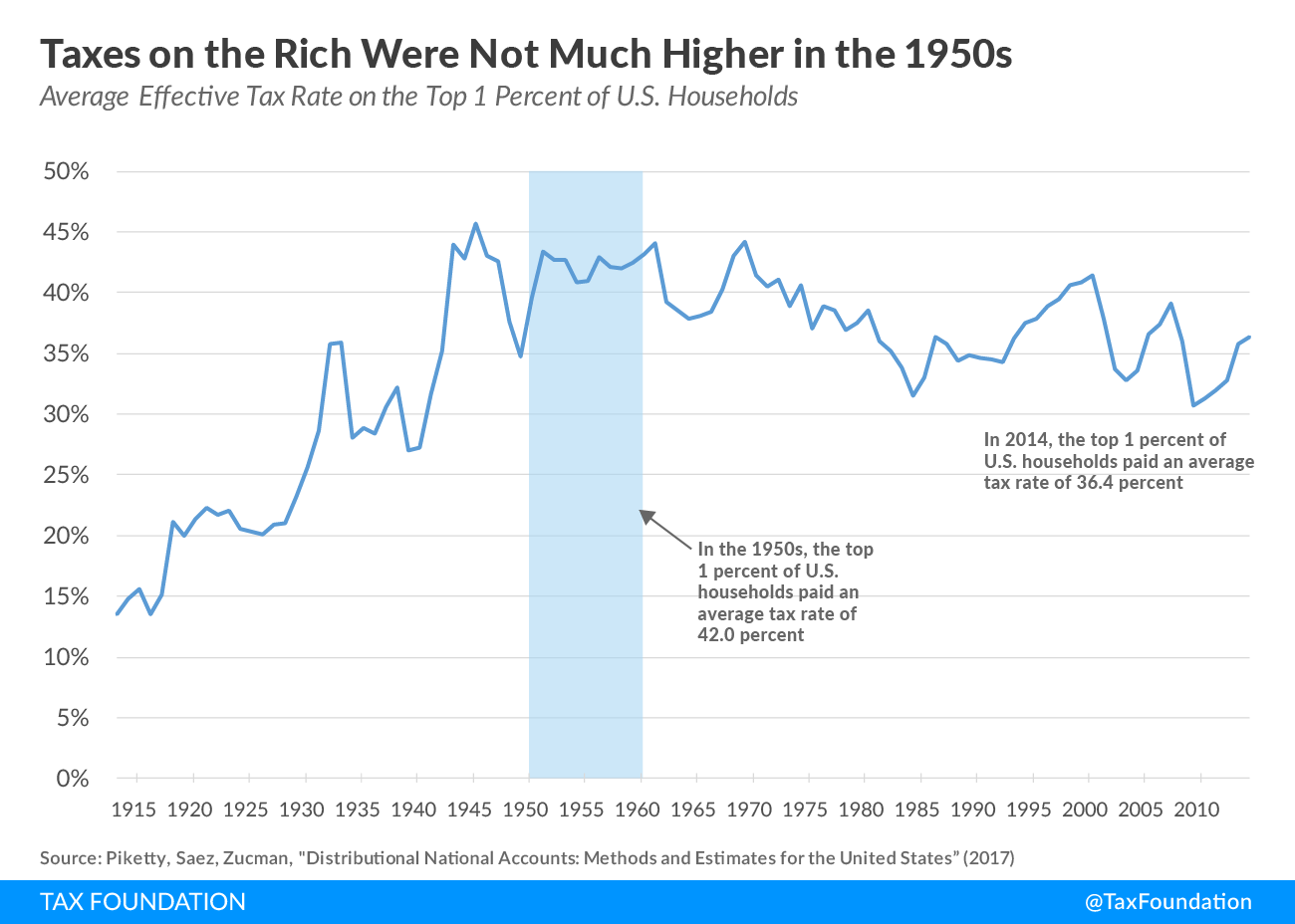

This is true, but the problem IS the government. You don't make a middle class by taxing the hell out of the 1% and giving it to the bottom 50%. You create a strong middle class by breaking up monopolies, ensuring fair/safe work practices (not "fair" wages), and getting out of the way of everything else. Taxing those who create and then supporting pet projects just creates an oligarchy, which is basically what we have now.you do not incorporate the vast wealth that is present in this small group in your calculations. the top 1% in income have 42% of the wealth and produce 20% of the income in the US.

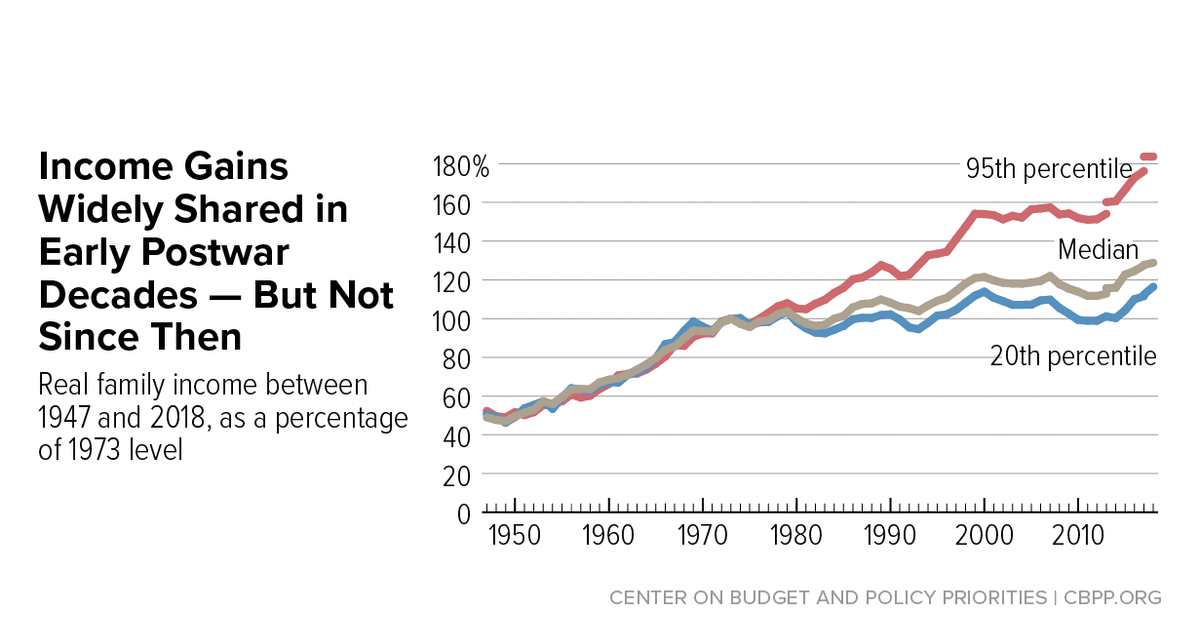

what I find is most fascinating is the fact that the average American so far has bought in to this thought that we should not tax the rich. this country has such a huge population that makes very little money now and a tiny population that makes tons. we are changing from a society with a predominance of middle class to one of a small super rich class and almost everyone else. when the poor finally realize this....

The reason we are losing our middle class is not because some people are rich, it's because we allow our products to be made in poor working conditions for super cheap wages in China and Mexico. If we mandated our major imports to be manufactured according to the same standards we apply to our own workers, there would be a robust middle class here.