@cyanide12345678

Do you mind educating us on these different funds you have your eye on? Ive been trying to learn syndications but its still very confusing to me.

Things to look for in syndication deals (kind of in order of importance in my opinion):

1) Sponsor quality. This is foremost the most important aspect of syndications. A good sponsor can salvage a bad deal and a poor sponsor can ruin a good deal. Pay a lot of attention to assets under management, years in the business (extra points if they've lived through the 2008 recession and came out of it stronger). Their track record (how many deals have they gone full circle on, what's the IRR, and equity multiple on average for their past deals). If they've lost investor money.

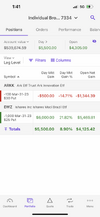

2) Sponsor Co-investment. This is the amount of money the sponsor is putting in the deal themselves. Tells me how much skin in the game the sponsor has. Average is considered 10% equity in a deal. Anything below than that and I'm usually turned off a lot by that. Anything more than that, then I get very intrigued because obviously the sponsor has A LOT of confidence in the deal and is willing to bet their money alongside you. You will find terrible deals where the sponsor puts in 5% or sometimes even 2.5%. It's ridiculous, I don't even bother reading those deals. If a sponsor puts in 2.5% then they are in a no lose situation. Because their fees are going to be higher than the investment they've put in. That's an absolute no no for me. On the other hand, I'm in a self storage fund with

ziffcre.com as sponsor, it was a 50 million dollar fund, 25 million (50% of the entire investment) was money from the principles of the business - that sort of co-investment is unheard of. I have 50k in that fund, for me to lose 50k, the sponsor has to lose 25 million. They are sure as heck going to protect that money lol. Ziffcre does ridiculous co-investments, they just did a retail plaza in south calorina where they were putting in 70% of the money.

3) Going in cap rate and cost basis in comparison to market comps. Cost basis really matters. Some deals are ridiculous and people are buying at a 3-4% cap rate. It's really ridiculous if the debt interest is higher than the cap rate they are going in at. The bare minimum should be that the cap rate should be higher than the debt interest rate otherwise that is much higher risk.

4) Debt terms - Long term fixed rate is best. The debt should be 1 or 2 years longer than the hold time. If market is bad, that should give time to hold property. Real estate losses are realized when debt comes due and the market is down. Success comes when you can just hold and cash flow.

5) DSCR - Debt service coverage ratio. So this is essentially the ratio between the money the property makes and the amount of money needed to pay off debt payments. Usually you want atleast a > 1.3 DSCR ratio. 1.5+ is a really safe deal.

6) Cash flow. I've moved away from development deals eventhough they usually yield higher returns. Now I personally look for deals that cash flow from day 1 and I start getting rental checks soon.

7) Market - Some markets are better than others. Places like austin, dallas, pheonix, atlanta, charlotte etc are growing a lot with a lot of positive migration. Some places are losing people. I try to invest in the path of growth usually. Population growth, income levels, population within 3-5 miles etc. That kind of stuff matters.

8) Fees - Waterfall structure 8% preferred return is average followed by a 70:30 split. That's about average. Sometimes there's a 50:50 split after a 20% IRR. 5% contruction hard cost and soft costs is about average, 2-3% gross revenue is average for property management fee, there's usually a 1% acquisition fee. This is about average.

9) this isn’t the least important, it’s something very important, i just forgot to mention it earlier and don’t feel like re-numbering. Exit cap rate assumption. Really evaluate if the exit cap rate is realistic. I’ve seen deals that are going in at a 6 cap and predicting a 5 cap exit. I mean…. Come on, you gotta be conservative on the exit cap. Unrealistic exit caps can really lower your return. A conservation estimate is a higher cap rate than what you bought the deal at.

There are other things that matter but I think these are the biggest ones.

Why syndications are amazing in my opinion:

1) Really really easy to diversify. I'm in multifamily, retail, office, hotels, self storage, in a bunch of different states and markets.

2) Literally no work and truly passive after you've done your evaluation of the deal and put your money in.

3) In theory the sponsor with decades of experience, millions/billions of assets under management is going to have financing access, deal access, and ability to execute the business plan in a far superior way than if I owned a property myself. If I owned something, I'll likely struggle to optimize the property in the way an experienced operator can.

4) Diversification of tenants - if i buy 1 house and put my money in it, and I get 1 bad tenant who doesn't pay and I have to evict them and they destroy my home in the process, I've lost a lot of money since 100% of my property is destroyed. If you're investing in a 200 unit building, and 5 units have bad tenants with evictions who destroy the property, that's still only 2.5% of the property getting damaged.

5) DEPRECIATION = Tax deferral. You will get rental cash, yet you'll show losses on your taxes (until you sell the property, but then you'll have depreciation from new deals hopefully to off-set that).

Why syndictions can suck:

1) Tax time will suck. Several K1s. Sponsors can sometimes suck in getting out their K1 in time. You will have to extend your tax deadline.

2) A LOT of state income taxes. Every place where i got a property, I have to file a state income tax there.

3) you have no control, if a sponsor underperforms - you just sit and watch.