On the bright side we are still so well off. Even if healthcare reform causes physician salaries to be cut in half, an extremely busy private practice pathologist working 60-70 hours a week or a top of the heap academic will still pull 200K-300K, that's not too bad. I know people were expecting a potential of 400K when they were entering residency, but that's not going to happen in this day and age.

Imagine how much worse it would be to be finishing up in journalism school right now or looking for a job in investment banking. Talk about hopeless. There was a NYT article a few months ago about how things changed so abruptly for young people in finance.

Here is the article and it was from back in September. Imagine how much worse it is 6 months later.

DIM LIGHTS, BIG CITY

For Young Financiers, Risk Hits Home

SIGN IN TO E-MAIL OR SAVE THIS

PRINT

SINGLE PAGE

REPRINTS

SHARE

By ALEX WILLIAMS

Published: September 19, 2008

BEFORE Nicole Wong took a job as an analyst at JPMorgan Chase after graduating from Brown University in 2001, she wasnt exactly sure what one did every day as a junior financier or, in New York mythology, apprentice master of the universe.

Enlarge This Image

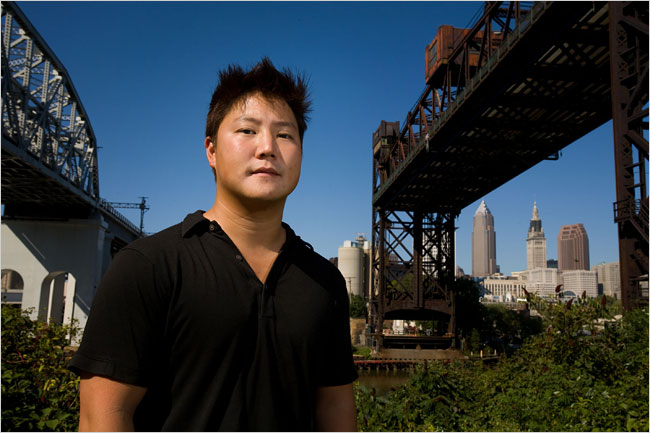

David Ahntholz for The New York Times

HESITANT Steven Song, a mentor to aspiring financiers, said they see less opportunity.

Yana Paskova for The New York Times

I really entered the industry not knowing what the heck people did, she recalled. But that hardly seemed to matter.

To her, Wall Street, not law or medicine, was where the action was, she said. Inspired by images of power and prestige from books like Liars Poker and movies like Wall Street, a life scrambling up the rungs of the financial services ladder seemed like an adventure as much as a vocation.

And for a time, thats just what it was. Days spent surrounded by multimillion-dollar trades were followed by lavish nights spent entertaining clients at hot restaurants like Nobu.

It was a challenging but exhilarating life, and somebody else was picking up the tab, said Ms. Wong, 28. I guess if I came from a wealthier background it wouldnt have been so dazzling. But to me, this was so glamorous. This is why I moved to New York.

And, yes, the money was good.

But after the seismic disruptions in the financial sector last week, she is not sure the Wall Street life will be quite the same any time soon, if ever.

The business is going to change, said Ms. Wong, whose position selling mortgage-backed securities for UBS was eliminated in the spring. There are just going to be far fewer people doing this, and far fewer clients to take out. Even if you do have clients to take out, youre not going to be spending as much out. This is definitely going to suck the fun out of the industry.

And perhaps not only the fun.

The most recent generation of strivers on Wall Street those in their 20s are too young to remember the last recession and too new to the business world to have experienced the dot-com bust or the post-9/11 gloom. They arrived in a New York boomtown: money was seemingly being minted in the hedge-fund and private-equity sectors; investment banks were paying gigantic bonuses.

For them, Wall Street was mythic terrain. For people with the conqueror gene, its outsized risks and rewards seemed like a personal challenge, a peak to be scaled.

Now, Wall Street is more like Survivor. Thousands of layoffs loom as the industry shrinks and consolidates. And even when recovery comes presuming it does traders and bankers said profits would most likely be lower, deals fewer, bonuses minuscule and regulation greater.

A result may be a more subdued Wall Street, one where professionals make a comfortable living but where the enormous payouts and outrageous bravado have faded. If so, this cultural shift could change not only the industry, but New York, which has adapted to a quarter-century-long (if occasionally interrupted) financial boom.

There was so much optimism, so much froth, said Delilah Rothenberg, 25, who now works at a private equity firm in Manhattan; she was an associate at Bear Stearns until that firm imploded in March. Even recently, she added, investment professionals in their 20s were buying all kinds of luxuries on credit because they expected the money to keep coming in: watches, cars, apartments, boats.

In recent years, compensation packages soared by double-digit rates, which of course created an impression of impregnability, said Adam Zoia, a managing partner of Glocap Search, a New York-based recruiter.

As recently as last year, a first-year investment banking analyst on Wall Street made $125,000 to $150,000, including bonuses, according to Options Group, a recruiting and consulting firm based in New York. An investment banking associate, which is one rung above that, made $250,000 to $300,000.

Bonuses will be substantially lower in investment banking as well as many other areas, said Michael Karp, the companys chief executive. The people who once browsed Porsche showrooms may simply be happy to have a job, any job.

The partys over, Ms. Rothenberg said.

And so is the compact that young bankers make with themselves: punishing workweeks for huge pay down the road.

The whole glamour of investment banking is that youre going to earn so much money that in the end its going to be worth it, said a 22-year-old former JPMorgan Chase analyst who was laid off in May and later found work at a private equity firm, but only after going to nearly 40 interviews. If you get rid of the bonus, then theres basically no point.

Young traders and bankers were willing to endure brutal hours and high stress to taste a rarefied New York life, said Dr. Rosalind S. Dorlen, a clinical psychologist in Summit, N.J., who said she sees a large number of Wall Street workers in her practice.

There is something nice about being king, Dr. Dorlen said, describing the mind-set of young Wall Street players. The sense of power, the sense of omnipotence, the sense of testosterone. What other reason are people attracted to being an investment banker than to flex muscles? Its Whose wallet is larger?

Such swagger meant that Wall Street hotshots were never beloved figures on New Yorks cultural landscape. Its no coincidence that the protagonists of books and movies like The Bonfire of the Vanities and American Psycho tended to be narcissistic jerks, or worse.

But New Yorks Gordon Gekkos played a crucial role in reinventing New York in the 1970s, when even the citys champions wondered if the nearly bankrupt city was going to go the way of Detroit, said Kurt Andersen, the writer and a co-founder Spy magazine at the height of the 1980s Wall Street boom.

If you look at two things, other than the ineffable spirit of New Yorkers, that made the city better again, you look at police and crime, and prosperity, Mr. Andersen said. And in speaking about prosperity, were talking about the tremendous sums of money that, despite 1987 and 2000, kept gushing into the city thanks to the people wearing yellow ties.

Wall Streets highfliers helped rebrand the city in the eyes of the world, Mr. Andersen said, from a tired postindustrial necropolis to a sleek 21st-century financial dynamo.

And that is the city today. Or it was.

Even before the recent carnage, the citys financial services sector had shed about 9,200 jobs from September 2007 to June, according to the state comptrollers office. Industry analysts predict that thousands more may disappear after the meltdowns at Lehman Brothers and Merrill Lynch. And even the leading Wall Street minds seem to have no idea when the industry might rebound; at the depths of the crisis last week 2010 sounded like an optimistic estimate.

And that makes business students very wary. Theres a certain scary factor thats come into this, said Roy C. Smith, a professor at the New York University Stern School of Business and a former general partner of Goldman Sachs. My students have a stunned look in their eyes.

Steven Song, 29, who started as an analyst at a Manhattan investment bank in 2001 and recently left a job at a hedge fund, runs a volunteer organization that provides mentoring and guidance to college undergraduates who aspire to work in finance. He said that several students he works with expressed reservations last week about pursuing jobs on Wall Street because of a perceived lack of opportunities.

There are fewer banks that are out there now, and each one thats out there remaining is hiring fewer people, he said.

One top student recently asked him for a list of smaller, boutique investment banks and brokerage firms instead of going for big-name shops, he said. In previous years that would never be the case unless you were a quote-unquote marginal candidate.

Merrill Lynch and Lehman Brothers could once be counted on to hire 20 to 30 graduates from the M.B.A. program at the Wharton School of the University of Pennsylvania, a spokeswoman for the university said. Those graduates will now have to look elsewhere, said Gautam Tambay, 26, a first-year student in the program, so there just arent as many opportunities anymore.

Another M.B.A. student said that students were starting to wonder where they would find jobs to pay off their student loans. So, imagine legions of M.B.A.s pinching pennies to pay off student loans. That will change New York as we know it.

New Yorks going to take a big hit, said Bryan Gunderson, 28, a former investment banker for Lehman Brothers. This city is priced for people who work on Wall Street. Its ridiculous that cocktails cost $15 in New York.

The 23-year-old Wall Street phenoms who are used to spending $300 or more for a bottle of vodka at a West Chelsea nightclub, he said, are going to have to tone it back.

Tom Wolfe, the author of The Bonfire of the Vanities, said that if Wall Street really does take a hard shot, it will diminish the image of New York as capital of the Western world.

But then, Wall Street and the fantasyland it helped create in New York was likely to shrink even without a credit crisis.

I hate to use the phrase masters of the universe, but theyre not in investment banking anymore, theyre in hedge funds, Mr. Wolfe said. And hedge funds dont need glass office towers. They can run $15 billion with 25 people in the leafy suburban sanctuaries where their directors live.

The new Wall Street, he said, is Greenwich, Conn.

In a possible indication of night life to come, Mr. Gunderson and his girlfriend invited friends to their West Village apartment last week to party like its 1929.

If all the radio stations were playing big band music and this message were headed your way through the main switchboard, I would swear this was the Great Depression, the invitation read.

Unless you just lost your job, the invitation continued, or your fund is down more than 20 percent, please bring beer or booze.