You've gotz to read this from LEAP2020: ( Google translation)

GEAB N ° 78 is available! The Americanization of the world began - emergence of solutions to a multipolar world by 2015

Today , October 15, 2013 , 2 ​​hours ago | LEAP/E2020

- Public announcement GEAB N ° 78 (15 October 2013) - There are moments in history or is accelerating . Whatever the outcome of the negotiations on the shutdown and debt ceiling , in October 2013 it is one of those . It is blocking too who opened the eyes of those who still supported the United States . A leader is followed when it is feared , not when it is ridiculous.

"Building a world desamericanise " there few years , the statement would have a ready smile. At most, it was going for a challenge Hugo Chavez. But when we see live the bankruptcy of the United States and that an agency official told the Chinese press (1 ), the impact is not the same. In reality it describes aloud an already widely begins process : simply , it is now tolerated to speak publicly. Blocking the U.S. government has at least the merit of delier languages ​​(2 ) . Let there be no mistake, this analysis is not published in a Chinese media by chance, it reflects the hawkish operates in Beijing .

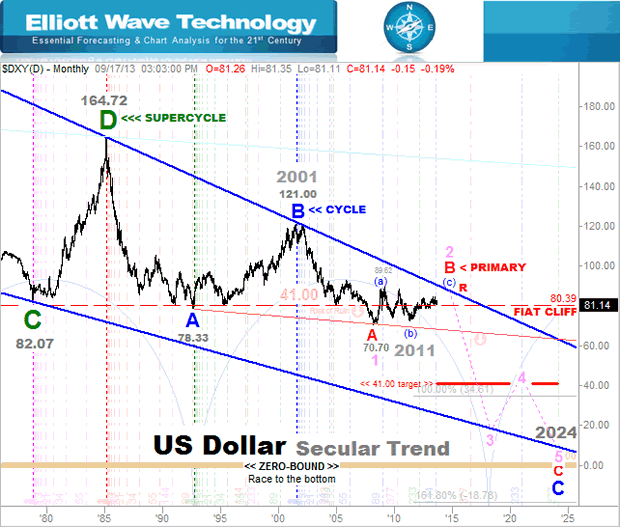

While the world holds its breath before the pathetic play of U.S. elites , not by compassion, is to avoid being prevails in the fall of the first world power. Everyone is trying to influence the American decoupler and loose U.S. definitely discredited by recent episodes of Syria, tapering , the shutdown and now the debt ceiling . The legendary power of the United States is no longer a nuisance power and the world realized it was time to desamericaniser .

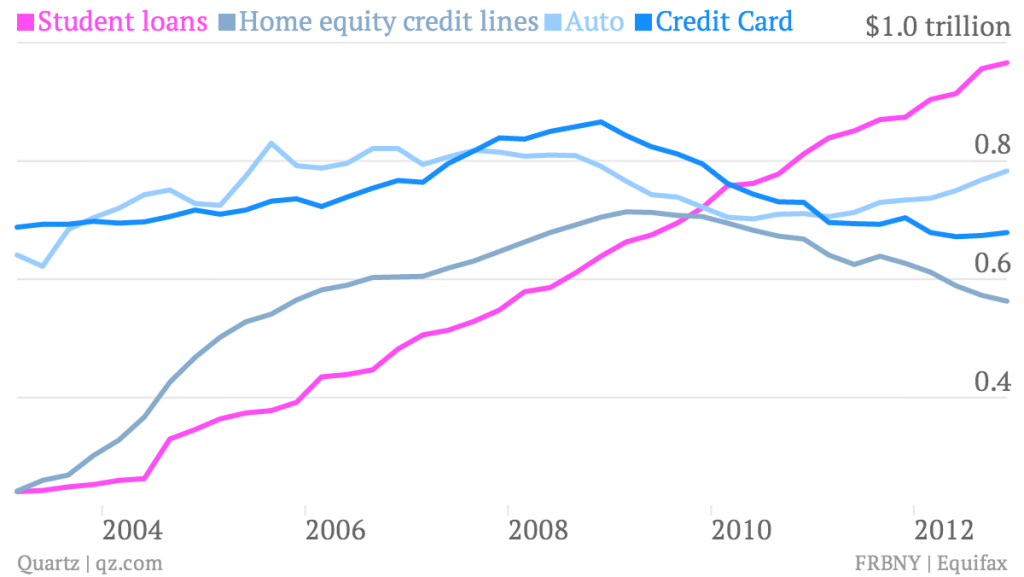

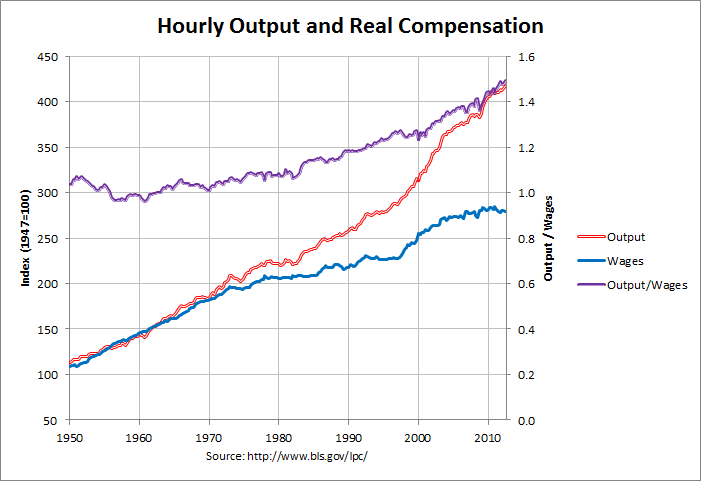

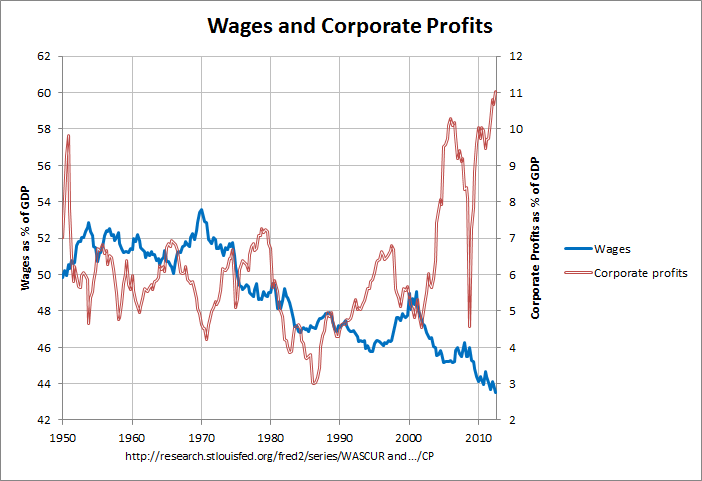

This perspective and the verbalization of the unspoken (3) finally free you a range of solutions that were previously in the state of the first fruits , or even repressed by some. These solutions accelerate the construction of the world and open -according to a multipolar world organized around major regional blocs. After a review of American setbacks , our team analysis in this issue of the GEAB forces shaping this changing world . We also back in the " Telescope " on the real state of the U.S. company that , behind the mirage of the stock market and finance, said the collapse of the American way of life and participated in this distancing with American model . Finally, we give the update of our annual assessment of country risk to complete the global picture , and of course the traditional recommendations and GlobalEurometre .

Plan the full article :

1 . "No we can not "

2 . Crisis burst

3 . Shutdown : the laughingstock of the world, but a forced laugh

4 . Americanization to all floors

5. The petrodollar is dead, long live the pétroyuan

6 . China takes Euroland hand

7 . Russia, South America, following the westernization

We present in this public announcement Parts 1, 2 and 3.

"No we can not "

As times change . The world has forgotten the words freedom , hope or the famous slogan "Yes we can " representative of the American Society in the eyes of previous generations to mention now that type , shutdown or ceiling . This is not exactly the same dynamic and positive image became frankly negative .

It is striking just how the current American situation confirms the adage that misfortune never comes alone . In a month and a half , first a slap on the Syrian issue by Russia itself. Can a central bank admits the impossibility of reducing the quantitative easing ( 4). The inability to pass a budget , which means the closure of the federal government . A shutdown that extends well beyond a reasonable (5). A negotiation on the debt ceiling impasse in the two days of the deadline. The United States are the G20 to ratify the reform of the IMF they block for three years, and by the World Bank and the IMF to put their finances in order (6). And now the Chinese shot across the bow .

Crisis burst

This succession of attacks is quite inquietante for the country and testifies to an unprecedented acceleration and impending shock. There was the fatality in these crises. But there is also a dose of strategic recovery . The shutdown was able to be instrumentalized by Obama to put pressure on the Republicans into voting raising the debt ceiling , much greater maturity in the United States . This is obviously a half- success , but it is all the same to expect a temporary enhancement , which reports a few weeks all the problems (7), it is still possible that the tragic path is chosen because it is no longer the domain of a rational decision and that could be anticipated.

While commentators focus on the Tea Party , which even we can say that the minority shareholders are able to control a company through a holding company , has managed to hijack the Republican party and the American Society , another reading can be made . Many Americans see the reality in front of their country was bankrupt. From then , it is better to delay the confrontation to reality , even to amplify the problems , or is it better to resolve them now? A large part of the population does not see a dim view of a default of payment ( 8). What other solution , moreover, a term? No he has not the will among Republicans to precipitate the crisis? This is the perfect opportunity they can to blame the Tea Party who stated bluntly that " no deal is better than a bad deal " ( 9) . What we want to say is that this time, or probably another occasion in a very near future , they may well be tempted to cut the Gordian knot.

Similarly, a strategic recovery has certainly occurred when the Fed did back machine to the reduction of its quantitative easing. Why was it suggested that decrease through QE3 , without making the final ? This is the first time she took investors by surprise all 100% convinced of tapering , she had made the forward guidance a well established principle . There he has no connection with the offenses of coarse AVERES insiders at the time of the announcement of the Fed (10) , who are worth billions of dollars to their authors? All this confirms our hypothesis of beleaguered American financial institutions that need to be bailed out discreetly by operations of this kind , even to put a hurt the credibility of the Fed. Even the short-term solutions that worsen the situation, but pushing a little fatal maturity . On these americaines banks, we're not the only ones sounding the alarm: the Bank of England expects bankruptcies of major banks as it would have lost the status of " too big to fail " ( 11) . So we reiterate our warning about it.

As a boxer, these balances shots made ​​the groggy country and there is no lack for a last defeat . If it does not come with a default of payment American in October , it will be another maturity that has been repulsed but , that it does not yield .

Shutdown : the laughingstock of the world, but a forced laugh

When we wrote in GEAB No. 77 on the budget vote , " no doubt a compromise will be found at the last minute , or more likely a few hours or a few days after the deadline ," it is clear that we still underestimate the political differences in Washington as the "few days" we had in mind were transformed into weeks. Le Monde as even in one of its site, " the sorry spectacle of Washington " ( 12). But ultimately it does not have a shutdown demesure on financial markets (13) impact , so it's all for the better, many Republicans seem to think that adapt well to a paralysis of the federal state and the reduction public expenditure that follows.

This is not the opinion of the country possessing a high amount of U.S. treasure bills , which feel like hostages ( 14) in the United States . They are stunned by the unbearable lightness of the United States and by the irresponsible attitude of what recently was still "the boss" . If the country does default on its debt , indeed, the shock wave will certainly terrible . Nevertheless, it would not be the end of the world since eventual default could simply take the form of a late payment of a few days, also the different parts of the world would be affected very unequally according to their degree of decoupling with the U.S. economy . No, the countries that suffer most from this solution ( and any other for that matter) will be much the United States themselves. For the record , remind held by them two-thirds of their own debt.

This is why most countries have already begun rudders this great decoupling , in which China head who knows from Sun Tzu that "when the thunder breaks out , it is too late to ears . "( 15)