I wonder how much you save/invest every year with that kind of spending. What specialty are you in...?More than that, although given — a lot now is on kids.

It’s highly dependent on where you live. I’m not into the luxury cars etc. but I do like a nice house in a great/safe area with lots of trails and with some land. There are some areas of the country where you can’t get that for less than a million- and I’m not even talking Manhattan, San Fran or LA (where a million won’t get you anything).

In retirement, won’t have to pay for house/kids, but I anticipate vacation/travel expenses to be much higher (and I take 3 nice vacations a year now and that could easily be 15k/pop); also, even with house paid off, expect a major renovation or project every 3 years - that could easily run 2k/month even if the project isn’t a new kitchen or basement (could just be fence+ landscaping).

Obviously you don’t need to do this if you are happy with an aging house close to other places or are ok in a low-cost neighborhood.

20k/mo is about 6 million in retirement accounts, by the way— which I think is a very attainable realistic goal for vast majority of physicians if they are not terrible at saving and aren’t trying to retire with a super-short career.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Plan to FIRE in 10 years. I need some suggestions...

- Thread starter Splenda88

- Start date

- Joined

- Sep 14, 2006

- Messages

- 24,059

- Reaction score

- 49,799

I think people's ideas of extravagant change as their income rises. It is why doctors tend to dramatically under accumulate wealth. Ask most people whether a 45k vacation budget a year is extravagant and they will agree it is, but ask a bunch of doctors and you have people thinking that is a totally modest amount because reasons.

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

20k per month is extravagant by any account, how much does your house cost?

6.5k/mo. Then again paying it off in 10 yrs and just about done.

Extravagant is obviously relative- I have plenty of friends on the same income that own two equally priced homes, 3 luxury cars and only fly first class. Either they are inheriting or saving a lot less. I’m aware that my spend is definitely extravagant to the average American (or resident/fellow).

The bottom line is that for most physicians (except maybe primary care) it should not be that difficult to save 120k/yr especially using all available tax shelters. Do that over a 20-25 year career (which isn’t that long) and you easily exceed 6m well before retirement.

2m in 10 years is about as easy as 6m in 20 though, if you go back to the original premise of the thread.

Last edited:

- Joined

- Jul 6, 2006

- Messages

- 7,475

- Reaction score

- 2,429

The bottom line is that for most physicians (except maybe primary care) it should not be that difficult to save 120k/yr especially using all available tax shelters. Do that over a 20-25 year career (which isn’t that long) and you easily exceed 6m well before retirement.

Yeah, I don't think I'll ever be able to save $120K per year.

I also don't think I'll get to the point of spending 10K per month once a house and student loans are paid off. I've been a little too close to poverty to jump that high and not have anxiety attacks.

- Joined

- Oct 13, 2008

- Messages

- 7,347

- Reaction score

- 5,622

I mean factually those constraints get you pretty close to doing one or the other if you're taking home ~$180k.Yeah, I don't think I'll ever be able to save $120K per year.

I also don't think I'll get to the point of spending 10K per month once a house and student loans are paid off. I've been a little too close to poverty to jump that high and not have anxiety attacks.

- Joined

- Jul 6, 2006

- Messages

- 7,475

- Reaction score

- 2,429

I mean factually those constraints get you pretty close to doing one or the other if you're taking home ~$180k.

Yeah, that's the issue--I'm being quoted $160-180K for salary, which means where I live, I'll be taking home about 110K (after 401K contribution and taxes)--so it's literally impossible for me to save 120k per year, and saving anything will take me way down from spending 10K per month, so....

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

My dawg. Best advice on this thread. And yet glossed over 🙂FIRE in the next decade? Start buying ETH or BTC, and autonomous driving tech. There are three companies right now at the autonomous driving technology and you have probably heard of all of them.

What are the other 2 beside Tesla?FIRE in the next decade? Start buying ETH or BTC, and autonomous driving tech. There are three companies right now at the autonomous driving technology and you have probably heard of all of them.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

What are the other 2 beside Tesla?

uber and Lyft. Wait for a pullback to load up on either of these names. It’s coming at some point starting late Jan. Good prices at some point bet late Feb to early March

- Joined

- Oct 13, 2008

- Messages

- 7,347

- Reaction score

- 5,622

Gambling on individual companies or industries is not good investing advice for someone seeking to reliably plan a retirement.My dawg. Best advice on this thread. And yet glossed over 🙂

- Joined

- Mar 31, 2008

- Messages

- 1,855

- Reaction score

- 2,705

Highest ROI (compensation/hr) job. Intra-specialty income variance can be just as, if not greater, than inter-specialty income differences. Max out 401k, IRA, HSA, funnel the rest into low cost index funds. Hit 4-5 mil (in investable assets) for blockbuster FI. Don't gamble like an idiot. See FlowRate's post above.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

Highest ROI (compensation/hr) job. Intra-specialty income variance can be just as, if not greater, than inter-specialty income differences. Max out 401k, IRA, HSA, funnel the rest into low cost index funds. Hit 4-5 mil (in investable assets) for blockbuster FI. Don't gamble like an idiot. See FlowRate's post above.

My bank account disagrees. OP asks for a solution to be FIRE in 10 years, I gave him the answer. It seems like the collective mind of the market agrees with me.

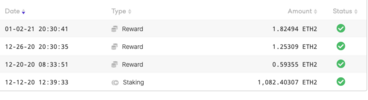

Disclosure: on target to hit $100K off staking Ethereum as passive income.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

This thread is going to age well when I check back in a few years with a screenshot of my ETH holding. Haters going to hate. I’m too happy with my life to care.

100k seems great... How much you got invested in the market?My bank account disagrees. OP asks for a solution to be FIRE in 10 years, I gave him the answer. It seems like the collective mind of the market agrees with me.

Disclosure: on target to hit $100K off staking Ethereum as passive income.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

100k seems great... How much you got invested in the market?

800K in ETH at current price of $735 earning me about 2 ETH per week. I spent about 250K buying up ETH for cheap around $250-270 18-20 months ago. Been DCA with another 1K per month of my resident salary past 6-9 months buying more ETH. I have another 500K in my Roth account, 100% going to into airlines or LYFT/UBER.

Money is made from entry points and then just chilling.

How can you do all that on a resident's salary? Did you have another before medicine?800K in ETH at current price of $735 earning me about 2 ETH per week. I spent about 250K buying up ETH for cheap around $250-270 18-20 months ago. Been DCA with another 1K per month of my resident salary past 6-9 months buying more ETH. I have another 500K in my Roth account, 100% going to into airlines or LYFT/UBER.

Money is made from entry points and then just chilling.

Last edited:

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

800K in ETH at current price of $735 earning me about 2 ETH per week. I spent about 250K buying up ETH for cheap around $250-270 18-20 months ago. Been DCA with another 1K per month of my resident salary past 6-9 months buying more ETH. I have another 500K in my Roth account, 100% going to into airlines or LYFT/UBER.

Money is made from entry points and then just chilling.

Do you truly have 60% of your net worth in ETH (and 40% of the rest in a couple stocks)?

Hope you know it’s a super-risky investment strategy.

I give you 50% chance to have lost half your net worth, 40% to slightly outperform the market and 10% to make a killing over the next 5 years.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

Haha yep. People in medicine either don’t take risks at all or take ******* risks. I can’t speak for ETH, but BTC is duh way. HFSP to all those haters out there 😂😂😂My bank account disagrees. OP asks for a solution to be FIRE in 10 years, I gave him the answer. It seems like the collective mind of the market agrees with me.

Disclosure: on target to hit $100K off staking Ethereum as passive income.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

I can’t speak for ETH - I have a good amount in BTC. 5-10x within 12 months. Average price: 7500.Do you truly have 60% of your net worth in ETH (and 40% of the rest in a couple stocks)?

Hope you know it’s a super-risky investment strategy.

I give you 50% chance to have lost half your net worth, 40% to slightly outperform the market and 10% to make a killing over the next 5 years.

The super-risky investment is keeping money in the bank. SP500 is ok but who wants 8 percent gains a year?

Sacrifice a few years of pay for a chance to retire within 6 years or work until 65. The choice is clear.

Let’s make some bread fellas 🥖 🚀

- Joined

- Sep 14, 2006

- Messages

- 24,059

- Reaction score

- 49,799

Not sure about bitcoin but most of the ethereum trading is from pyramid scheme activities. Better hope you guess right about when to get out and that governments don't crack down in a way that locks up your money forever.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

This bull cycle top will occur October through December of 2021. It’s at 30,000 today. 100-300K coming this year.

Down is illegal this year 🙂

Down is illegal this year 🙂

- Joined

- Mar 31, 2008

- Messages

- 1,855

- Reaction score

- 2,705

This is a good article by WCI on the discussion of picking individual stocks/Bitcoin etc. If I want more money, as a 1099, I can simply pick up a couple more patients (with how fast I can see patients right now, it’s about at least ~400 dollars into my bank account for each hour of work). Whether we do it at work or during our off time, we are all hustling. The strategy is finding the most efficient way with least risk. I’ll highlight the part I find most relevant.

“While I suppose it is entirely possible that you may be smarter or work harder than a mutual/hedge/pension fund management team, the question you should be asking yourself is whether that is really the best use of your time. Let's say by applying your smarts and hard work to your portfolio that you can boost the returns on your $1 Million portfolio by 1% per year. That works out to be an extra $10,000. I don't know exactly what that will work out to be on an hourly rate for you, but the likelihood that this is the best place to spend extra time and effort as a physician seems very low to me. I can think of three ways that are likely to have a higher return for your time and effort:

# 1 Work more in or on your practice

Most docs make $100-300 an hour. $10,000/$300 = 33 hours. For less than one additional hour a week of work, you could generate more of a return on your time.”

www.whitecoatinvestor.com

www.whitecoatinvestor.com

“While I suppose it is entirely possible that you may be smarter or work harder than a mutual/hedge/pension fund management team, the question you should be asking yourself is whether that is really the best use of your time. Let's say by applying your smarts and hard work to your portfolio that you can boost the returns on your $1 Million portfolio by 1% per year. That works out to be an extra $10,000. I don't know exactly what that will work out to be on an hourly rate for you, but the likelihood that this is the best place to spend extra time and effort as a physician seems very low to me. I can think of three ways that are likely to have a higher return for your time and effort:

# 1 Work more in or on your practice

Most docs make $100-300 an hour. $10,000/$300 = 33 hours. For less than one additional hour a week of work, you could generate more of a return on your time.”

Why Talking About Individual Stocks (and Sectors) Makes You Look Dumb | White Coat Investor

Wondering why everyone is snickering when you mention you buy individual stocks based on the recommendation of a newsletter? Here's the secret that better-informed investors already know.

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

This is a good article by WCI on the discussion of picking individual stocks/Bitcoin etc. If I want more money, as a 1099, I can simply pick up a couple more patients (with how fast I can see patients right now, it’s about at least ~400 dollars into my bank account for each hour of work). Whether we do it at work or during our off time, we are all hustling. The strategy is finding the most efficient way with least risk. I’ll highlight the part I find most relevant.

“While I suppose it is entirely possible that you may be smarter or work harder than a mutual/hedge/pension fund management team, the question you should be asking yourself is whether that is really the best use of your time. Let's say by applying your smarts and hard work to your portfolio that you can boost the returns on your $1 Million portfolio by 1% per year. That works out to be an extra $10,000. I don't know exactly what that will work out to be on an hourly rate for you, but the likelihood that this is the best place to spend extra time and effort as a physician seems very low to me. I can think of three ways that are likely to have a higher return for your time and effort:

# 1 Work more in or on your practice

Most docs make $100-300 an hour. $10,000/$300 = 33 hours. For less than one additional hour a week of work, you could generate more of a return on your time.”

Why Talking About Individual Stocks (and Sectors) Makes You Look Dumb | White Coat Investor

Wondering why everyone is snickering when you mention you buy individual stocks based on the recommendation of a newsletter? Here's the secret that better-informed investors already know.www.whitecoatinvestor.com

The thing is it seems many of the posters here feel their “smarts” will not boost their portfolio 1% but instead will boost it 100%.

I’m not sure they realize their “smarts” also may cause a 70% loss of the portfolio as well.

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

I can’t speak for ETH - I have a good amount in BTC. 5-10x within 12 months. Average price: 7500.

The super-risky investment is keeping money in the bank. SP500 is ok but who wants 8 percent gains a year?

Let’s make some bread fellas 🥖 🚀

I wouldn’t call money in the bank “super risky”.... it’s not a good investment as you’ll lose 1-2% due to inflation but the actual outcome is very predictable.

Same with a diversified portfolio in index funds and bonds- depending on the year most likely you’ll be up 8%, good year (like this one) up 20%, super bad year maybe down 10%. Still a narrow although riskier spread than the bank.

On the other hand, my opinion is that stuff like ETH and bitcoin prepare to double your money.... but also prepare to lose near all of it. Sure, put some money there if you want to gamble but a large proportion of your retirement portfolio is pretty crazy.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

Pretty low risk to me especially when you are buying the future world currencies post USD

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

Pretty low risk to me especially when you are buying the future world currencies post USD

You many be right. Then again, the tulip “miners” in holland in the 1600s thought the same thing.

The only problem I have with bitcoin and all other cryptocurrency is that 1) additional crypto currencies can be “made up” and it’s possible to change the algorithm to create more supply (unlike gold) 2) unlike currencies created by governments they aren’t backed by militarys with lots of weapons.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

I wouldn’t call money in the bank “super risky”.... it’s not a good investment as you’ll lose 1-2% due to inflation but the actual outcome is very predictable.

Same with a diversified portfolio in index funds and bonds- depending on the year most likely you’ll be up 8%, good year (like this one) up 20%, super bad year maybe down 10%. Still a narrow although riskier spread than the bank.

On the other hand, my opinion is that stuff like ETH and bitcoin prepare to double your money.... but also prepare to lose near all of it. Sure, put some money there if you want to gamble but a large proportion of your retirement portfolio is pretty crazy.

Inflation at 1-2 percent a year? That’s the BS CPI that they brainwash you in believing. Look at the Chapwood index, it’s a good 10 percent.

Lets not look at coke, French fries, etc. but look at **** people want to buy. Look at the stock market. Look at homes. Look at assets that people care about. It’s 10 percent. Now look at health care costs and education. Are the costs rising 2 percent a year? 20 percent maybe 😂 😂

Money in the bank is lost money.

You can lose all your money with bitcoin? Really? Last I checked it went from less than a cent in 2009 to 32K today. No asset can match BTC’s prowess in a five year time period.

We are now in the midst of bitcoin’s great fourth bull run with the trough being 3K (2019) and current price almost 11x (32K) from the low! And it’s just starting. You have to understand market cycles.

Double your money? More like 5-20x your money. Life changing profits.

I am not trying to convince you to get any - please don’t. Everyone buys at the price they deserve. I am trying to stop the spread of misinformation.

Last edited:

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

You many be right. Then again, the tulip “miners” in holland in the 1600s thought the same thing.

The only problem I have with bitcoin and all other cryptocurrency is that 1) additional crypto currencies can be “made up” and it’s possible to change the algorithm to create more supply (unlike gold) 2) unlike currencies created by governments they aren’t backed by militarys with lots of weapons.

Study the history of world currencies and understand the transition process of diff world currencies through the decades. It’s never about the bullets and firepower. It’s about the trust of the currency by the users. With obvious worldwide money printing, central bankers are facing that ugh oh moment where there is now a loss of trust in all fiat currencies. For that reason, the people are now demanding a world currency alternative to fiat that can handle the modern world economy. It’s not gold or silver bc the new gen of kids don’t want to carry around bullions for transaction. We are too cool for that.

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

Inflation at 1-2 percent a year? That’s the BS CPI that they brainwash you in believing. Look at the Chapwood index, it’s a good 10 percent.

Money in the bank is lost money.

You can lose all your money with bitcoin? Really? Last I checked it went from less than a cent in 2009 to 32K today. No asset can match BTC’s prowess in a five year time period.

We are now in the midst of bitcoin’s great fourth bull run with the trough being 3K (2019) and current price almost 11x (32K) from the low! And it’s just starting. You have to understand market cycles.

Double your money? More like 5-20x your money. Life changing profits.

Only time will tell. Plenty of things go up 10 fold in a 5 year period, doesn’t mean that will be a new historical trend.

1-2% I was referring to money lost (inflation minus any return In a money market etc).

Anyway, carry on with your investing strategy as you see fit!

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

I wouldn’t call money in the bank “super risky”.... it’s not a good investment as you’ll lose 1-2% due to inflation but the actual outcome is very predictable.

Same with a diversified portfolio in index funds and bonds- depending on the year most likely you’ll be up 8%, good year (like this one) up 20%, super bad year maybe down 10%. Still a narrow although riskier spread than the bank.

On the other hand, my opinion is that stuff like ETH and bitcoin prepare to double your money.... but also prepare to lose near all of it. Sure, put some money there if you want to gamble but a large proportion of your retirement portfolio is pretty crazy.

I bought ETH at ~260, with an original investment around $260-280K. There is only a few occasions in life in which you can make 200x your money. This is one of those opportunities. If it goes to zero, I will gladly take a $260K tax deduction on my future income in the future. No stress. Part of the process if you want to be FIRE.

At this moment, up $600-700K from my original investment 18 months ago.

Attachments

- Joined

- Jul 27, 2013

- Messages

- 38,617

- Reaction score

- 76,043

Estate taxes don't kick in until 11.58 million, so like... Probably fine. My wife is no doubt going to outlive me so not an issue for me, but if I were single I'd probably donate it to charity which is another way to keep the government's hands off of it entirelyOf course its Sad FIRE, its all we have here now in California: Sad FIRE or die on the financial treadmill of a heart attack, pick your death.

Work harder, watch them cut Medicare reimbursements, make less, work 3x as hard to run in place and watch taxes eat everything to zero eventually, but I wont let the government have one dime when I pass. If I have to drop my "pile of money" on a Vegas hotel room full of hookers and a giant pile of blow I will. Live free and die.

- Joined

- Jul 27, 2013

- Messages

- 38,617

- Reaction score

- 76,043

My god, around here you can live in a new home in one of the nice suburbs with a public school system ranked over most private schools in the nation for 1 million (with access to NYC in under an hour), and once the mortgage is paid off taxes are around 1.6k a month in a property that expensive. With a paid off car, no clue how I'd manage to spend a further 18k/month, even with kids.More than that, although given — a lot now is on kids.

It’s highly dependent on where you live. I’m not into the luxury cars etc. but I do like a nice house in a great/safe area with lots of trails and with some land. There are some areas of the country where you can’t get that for less than a million- and I’m not even talking Manhattan, San Fran or LA (where a million won’t get you anything).

In retirement, won’t have to pay for house/kids, but I anticipate vacation/travel expenses to be much higher (and I take 3 nice vacations a year now and that could easily be 15k/pop); also, even with house paid off, expect a major renovation or project every 3 years - that could easily run 2k/month even if the project isn’t a new kitchen or basement (could just be fence+ landscaping).

Obviously you don’t need to do this if you are happy with an aging house close to other places or are ok in a low-cost neighborhood.

20k/mo is about 6 million in retirement accounts, by the way— which I think is a very attainable realistic goal for vast majority of physicians if they are not terrible at saving and aren’t trying to retire with a super-short career.

- Joined

- Jul 27, 2013

- Messages

- 38,617

- Reaction score

- 76,043

That salary is painful. If it's academics, it makes sense. But an academic career in a high CoL area is basically trading a job you love for never being able to afford leaving itYeah, that's the issue--I'm being quoted $160-180K for salary, which means where I live, I'll be taking home about 110K (after 401K contribution and taxes)--so it's literally impossible for me to save 120k per year, and saving anything will take me way down from spending 10K per month, so....

- Joined

- Sep 14, 2006

- Messages

- 24,059

- Reaction score

- 49,799

If you have a spare 260k then you don't really need to worry about whether you can FIRE unless you lose it all in needlessly risky investments and plan on spending recklessly in retirement.I bought ETH at ~260, with an original investment around $260-280K. There is only a few occasions in life in which you can make 200x your money. This is one of those opportunities. If it goes to zero, I will gladly take a $260K tax deduction on my future income in the future. No stress. Part of the process if you want to be FIRE.

At this moment, up $600-700K from my original investment 18 months ago.

- Joined

- Jul 9, 2003

- Messages

- 1,703

- Reaction score

- 7,132

If you have a spare 260k then you don't really need to worry about whether you can FIRE unless you lose it all in needlessly risky investments and plan on spending recklessly in retirement.

That’s the thing. 260k In equities at 8% compounded over 30 years is north of 3 million, and moderately sure to get that return over that time horizon. That’s the opportunity cost we are talking.

The poster thinks he’s going to get 200x (50 million) from this investment which I highly doubt. I give that less than 0.001% but who knows. I think the chances of being negative in the long term is significant, thus negating the “pretty sure” 3 million in retirement. As in all things you trade risk for possible returns but no one can say they know the actual odds.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

That’s the thing. 260k In equities at 8% compounded over 30 years is north of 3 million, and moderately sure to get that return over that time horizon. That’s the opportunity cost we are talking.

The poster thinks he’s going to get 200x (50 million) from this investment which I highly doubt. I give that less than 0.001% but who knows. I think the chances of being negative in the long term is significant, thus negating the “pretty sure” 3 million in retirement. As in all things you trade risk for possible returns but no one can say they know the actual odds.

Position is now worth over 1 mil. Check back with me again in a year.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

Position is now worth over 1 mil. Check back with me again in a year

The Seer says... November 2021...

ETH hits 10,000 from its current price of 965 and your bag is now worth 10M from a 260K investment, a casual 40x return over 20 months. Not bad, not bad.

Keep us posted playa.

HFSP lol (it pays to have an open mind 🙄).

Last edited:

- Joined

- Jan 13, 2009

- Messages

- 174

- Reaction score

- 143

Have extreme respect for Crypto investors putting majority of their net worth into in ETH and BTC. Good buddy of mine has 90% of his liquid net worth in ETH and BTC since 2016. and I'm really happy it is going to the moon just because of the courage to do that. He's up 8 figures in his late 30s and has only cashed out 5% of it so far just to take care of the mortgage completely, blows my mind. Pretty sure pure greed driving his decision making now. I have 3% of my wealth in BTC and that's about the limit for me. Hope everyone wins big whether you're an index fund investor or YOLO option players or Crypto investors!!!

- Joined

- Oct 13, 2008

- Messages

- 7,347

- Reaction score

- 5,622

Early crypto investors--those whose money wasn't stolen by some of the prominent exchange issues--are certainly getting a lot of return thanks to significant risk tolerance. It's easy to look at crypto in hindsight but it's never been--and still isn't--a sure thing. Plus trying to keep up with different forks and until recently it wasn't so easy to actually cash out your position. I was trying to read up on it the other day and it's not clear to me whether there are still limits on the rate that you can divest?Have extreme respect for Crypto investors putting majority of their net worth into in ETH and BTC. Good buddy of mine has 90% of his liquid net worth in ETH and BTC since 2016. and I'm really happy it is going to the moon just because of the courage to do that. He's up 8 figures in his late 30s and has only cashed out 5% of it so far just to take care of the mortgage completely, blows my mind. Pretty sure pure greed driving his decision making now. I have 3% of my wealth in BTC and that's about the limit for me. Hope everyone wins big whether you're an index fund investor or YOLO option players or Crypto investors!!!

What sort of theoretical return has your buddy had from his investment?

Last edited:

- Joined

- Jul 27, 2013

- Messages

- 38,617

- Reaction score

- 76,043

Darien, CT is the place I had in mind. Can get a home in the 750k range on the low end or a decent home for around 1-1.25 million, schools are ranked in the top 75 in the nation, and it's a short hop away from NYCMind sharing the general region? Sounds perfect if its not too rural or lacks too many amenities. I always thought anywhere near the DC-NYC-BOS megalopolis was pretty rough for COL.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

Mad respect. If he is at 8 figures now, he has a good chance to hit 9 figures this cycle. That is insane. Props.Have extreme respect for Crypto investors putting majority of their net worth into in ETH and BTC. Good buddy of mine has 90% of his liquid net worth in ETH and BTC since 2016. and I'm really happy it is going to the moon just because of the courage to do that. He's up 8 figures in his late 30s and has only cashed out 5% of it so far just to take care of the mortgage completely, blows my mind. Pretty sure pure greed driving his decision making now. I have 3% of my wealth in BTC and that's about the limit for me. Hope everyone wins big whether you're an index fund investor or YOLO option players or Crypto investors!!!

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

During the depths of despair during the most recent bear market (January - March 2019), BTC was at 3000 and ETH was at 85. A casual 10-12x return in the last 18 months. So you are right, a lot of risk tolerance (will crypto die?? Btc had gone from 20K to 3K and ETH from ~1400 to 85), but a ton of reward.Early crypto investors--those whose money wasn't stolen by some of the prominent exchange issues--are certainly getting a lot of return thanks to significant risk tolerance. It's easy to look at crypto in hindsight but it's never been--and still isn't--a sure thing. Plus trying to keep up with different forks and until recently it wasn't so easy to actually cash out your position. I was trying to read up on it the other day and it's not clear to me whether there are still limits on the rate that you can divest?

What sort of theoretical return has your buddy had from his investment?

Very easy to cash out any position if you stick to the majors. Tons of liquidity.

- Joined

- Oct 13, 2008

- Messages

- 7,347

- Reaction score

- 5,622

For a while you were limited by pretty low amounts through the exchanges, has that changed? What's the process? I think I saw some companies that basically buy your crypto for a fee?During the depths of despair during the most recent bear market (January - March 2019), BTC was at 3000 and ETH was at 85. A casual 10-12x return in the last 18 months. So you are right, a lot of risk tolerance (will crypto die?? Btc had gone from 20K to 3K and ETH from ~1400 to 85), but a ton of reward.

Very easy to cash out any position if you stick to the majors. Tons of liquidity.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

For a while you were limited by pretty low amounts through the exchanges, has that changed? What's the process? I think I saw some companies that basically buy your crypto for a fee?

That hasn’t been my experience. I didn’t have any problem making 400-600K buy and sell orders a few times on coinbase as I reposition my entry prices for the past 12 months.

- Joined

- Feb 23, 2003

- Messages

- 234

- Reaction score

- 63

There is tons of liquidity. The bitcoin coinbase volume today is over 1B. You won't have any issue buying or selling. The fees are higher than for stocks (pre no fees), I think under 0.5 percent or so.For a while you were limited by pretty low amounts through the exchanges, has that changed? What's the process? I think I saw some companies that basically buy your crypto for a fee?

Jameson Lopp's Bitcoin Resources

A comprehensive guide to educational Bitcoin information and resources. Hundreds of links that help answer the question: What is Bitcoin?

Is a good Q/A website

- Joined

- Oct 13, 2008

- Messages

- 7,347

- Reaction score

- 5,622

That's good, I think that's a change within the last couple of years. Used to be that even at high tier levels your withdrawal limit was quite low (when considering the theoretical sums of money involved in crypto.)That hasn’t been my experience. I didn’t have any problem making 400-600K buy and sell orders a few times on coinbase as I reposition my entry prices for the past 12 months.

750k is A LOT for a home. I always think anything above 500k is outrageous even if one makes 300k-400k/yr. It's safe to say I can never live in the northeast or the west or the Washington DC area.Darien, CT is the place I had in mind. Can get a home in the 750k range on the low end or a decent home for around 1-1.25 million, schools are ranked in the top 75 in the nation, and it's a short hop away from NYC

- Joined

- Jan 13, 2009

- Messages

- 174

- Reaction score

- 143

He's right, guy I was referring to uses Coinbase and has never had problems getting funds to his bank account. Sells 3-4 coins or something of that nature at a time when needed. Tons of liquidity. I have been meaning to ask how he deals with the tax implications, its something I haven't looked into really.During the depths of despair during the most recent bear market (January - March 2019), BTC was at 3000 and ETH was at 85. A casual 10-12x return in the last 18 months. So you are right, a lot of risk tolerance (will crypto die?? Btc had gone from 20K to 3K and ETH from ~1400 to 85), but a ton of reward.

Very easy to cash out any position if you stick to the majors. Tons of liquidity.

- Joined

- Jul 27, 2013

- Messages

- 38,617

- Reaction score

- 76,043

If you want a place that will continue to appreciate and save you 20-50k/year on private school for your kids, it actually is a better buy than a 500k home in an area with lackluster schools and a less robust real estate market. Also, living in wealthier communities can afford you connections that can help you grow your wealth further and get your kids where they need to be.750k is A LOT for a home. I always think anything above 500k is outrageous even if one makes 300k-400k/yr. It's safe to say I can never live in the northeast or the west or the Washington DC area.

This is not a place I'd recommend for the FIRE crowd though, more an example of I don't know how a person could burn through 20k a month if you can live in a really nice area for far less

Similar threads

- Replies

- 6

- Views

- 2K

P

- Replies

- 1

- Views

- 1K