If we want to talk about philosophical stance, philosophically, I have a major issue with the cost of education and interest rates on educational loans. I believe that educational loans should bear zero interest at all or <1%. If someone paid 25 years on educational loans, that’s pretty much the same as paying off a 25-year mortgage. If one’s loans increase 20% or more over the course of grad school and postdoc because of interest alone (when they’re in no position to pay it back) that seems ridiculous to me. Student loan companies make a killing precisely because one can’t afford to pay on them during grad school, one can’t discharge them with bankruptcy, and credit can be destroyed and wages get garnished with defaulting, etc. It’s a sweet deal for loan companies.

And yes, for-profit schools are an issue, and I don’t have a problem with further scrutinizing these and closing many and limiting loan limits if we actually provide increased funding for grad students in many public programs as well (they also take out loans, although fewer on average).

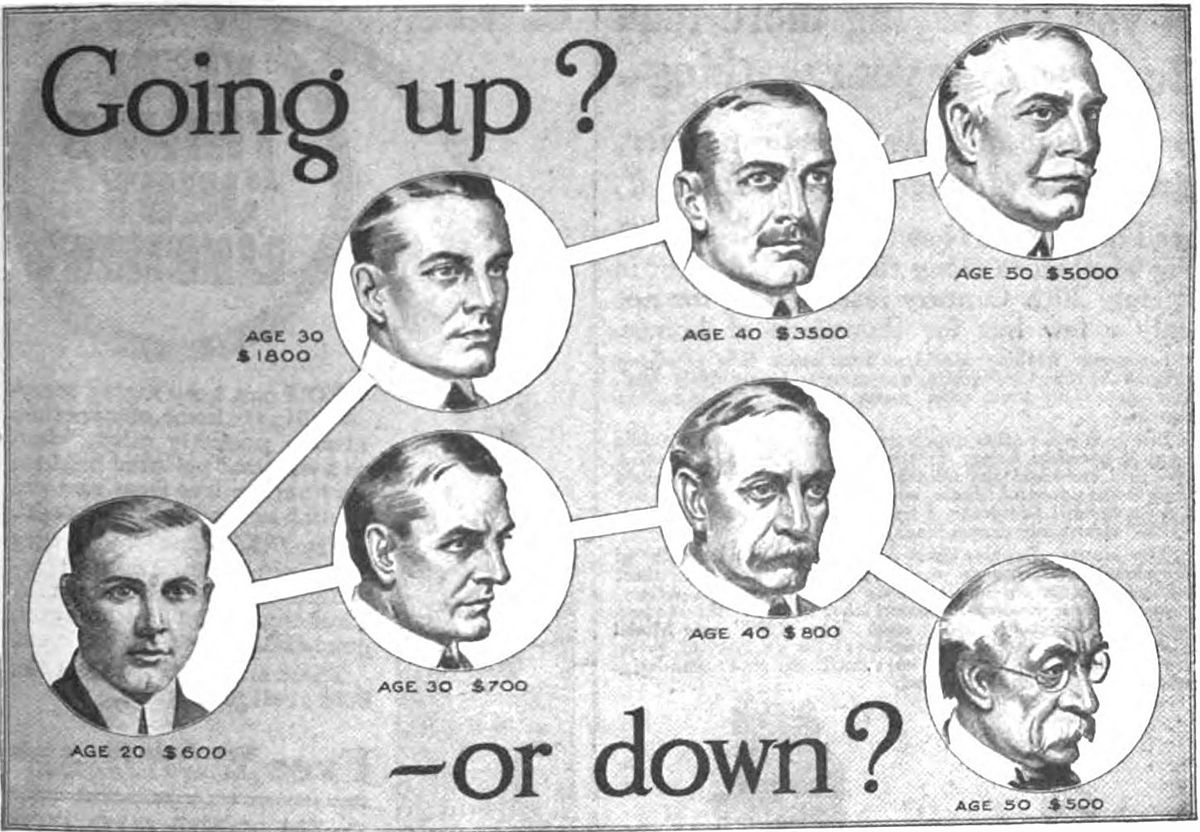

This combined with what

@tr shared regarding social mobility suggests that the people who are probably suffering the most under student loan debt are likely those who had fewer resources to begin with (I.e. folks from lower SES), perpetuating the cycle. I think it’d be interesting to research what proportion of grad students from lower SES/working class homes graduate public doctoral programs with zero debt vs. those from other classes. If folks from lower SES at public/nonprofit universities graduated with higher debt than middle class folks, would

we be so quick to judge folks with student loans?