- Joined

- Jan 22, 2009

- Messages

- 1,380

- Reaction score

- 13

Not sure if politics/economics is considered off limits in the forums these days, but was curious to hear what posters were thinking regarding the economy. I recall a lot of doom and gloom a few years back and was wondering how people feel about the American and/or global economy.

In the US, the unemployment rate is only 5.0%. That said, labor participation and long-term unemployment remain low and high, respectively.

The Dow Jones and S&P 500 are both down ~3% this year, but still up about 30% from their highs prior to the recession.

People were worried about oil prices, but right now, oil is as low as it's been in 10+ years. This has to do with the economy not being at previous levels obviously, but there's an undeniable increase in renewable energy and domestic natural gas production. Estimates are that the US has over 50 years of recoverable natural gas we could rely on if needed.

Inflation, which was previously posited on this board to be 8%+ in 2007 isn't even 1% this year, using the CPI. The AIER "Everyday Price Index" which started the previously mentioned thread has it roughly the same and is even flirting with deflation given the continued low prices for gas.

None of the above is to offset the fact that wages are pretty stagnant for the bottom and middle class which I think many agree with have long-term negative consequences for the economy. That said, household debt payment as a percent of disposable income is down to near normal levels (~10%), and the total household debt to GDP ratio is coming down (not a whole lot of data for that one though).

That said, Europe is in no better shape (the US is expected to grow faster than any major European economies over the next 2-3 years). And of the BRIC economies, India seems to be the only 1 of the 4 that people are still hopeful about. Brazil is in economic and political upheaval, and Russia's economy has been set back 10 years by their invasion of Ukraine and the resulting sanctions, plus the fall in oil prices. Finally, no one really knows what's going on in China right now apart from the fact that it clear there's a slowdown occurring. Chinese administrators at all levels have been cooking the economic books for so long to get promoted that even the Politburo doesn't have reliable economic figures.

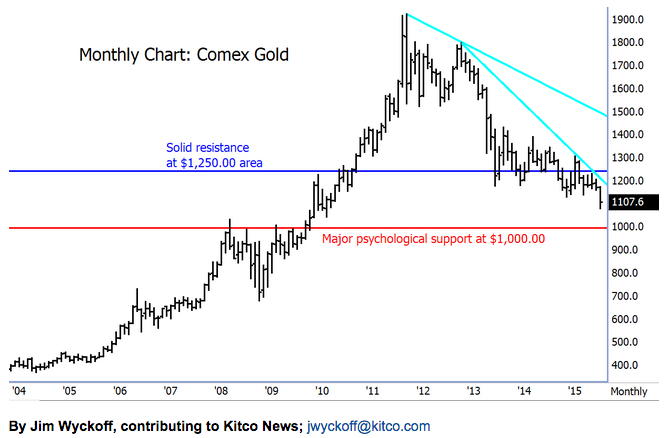

Last, just for some good-natured trolling, are people still pleased about their gold purchases? If you purchased in 2009, you're still good, but I'm hoping people didn't put too much money in gold around 2012.

In the US, the unemployment rate is only 5.0%. That said, labor participation and long-term unemployment remain low and high, respectively.

The Dow Jones and S&P 500 are both down ~3% this year, but still up about 30% from their highs prior to the recession.

People were worried about oil prices, but right now, oil is as low as it's been in 10+ years. This has to do with the economy not being at previous levels obviously, but there's an undeniable increase in renewable energy and domestic natural gas production. Estimates are that the US has over 50 years of recoverable natural gas we could rely on if needed.

Inflation, which was previously posited on this board to be 8%+ in 2007 isn't even 1% this year, using the CPI. The AIER "Everyday Price Index" which started the previously mentioned thread has it roughly the same and is even flirting with deflation given the continued low prices for gas.

None of the above is to offset the fact that wages are pretty stagnant for the bottom and middle class which I think many agree with have long-term negative consequences for the economy. That said, household debt payment as a percent of disposable income is down to near normal levels (~10%), and the total household debt to GDP ratio is coming down (not a whole lot of data for that one though).

That said, Europe is in no better shape (the US is expected to grow faster than any major European economies over the next 2-3 years). And of the BRIC economies, India seems to be the only 1 of the 4 that people are still hopeful about. Brazil is in economic and political upheaval, and Russia's economy has been set back 10 years by their invasion of Ukraine and the resulting sanctions, plus the fall in oil prices. Finally, no one really knows what's going on in China right now apart from the fact that it clear there's a slowdown occurring. Chinese administrators at all levels have been cooking the economic books for so long to get promoted that even the Politburo doesn't have reliable economic figures.

Last, just for some good-natured trolling, are people still pleased about their gold purchases? If you purchased in 2009, you're still good, but I'm hoping people didn't put too much money in gold around 2012.