Sorry grandma - time to move in with your daughter.

For 1000s of years this has been the way human society has worked.

Only in the last century has the western world adopted this expensive concept of a government payroll for independently living senior citizens, and limitlessly expensive assisted living and skilled nursing facilities.

Admittedly, much of that is because people live so much longer now, many with chronic diseases that would have bumped off 1900 era grandmas decades before she hit 70.

I'm certainly not the only one here who's opined that an enormous downward recalibration in the American standard of living is coming - at least materially. I don't really doubt this at all any more. I do wonder what social and cultural changes will accompany it, e.g. will we see a lot more parents and grandparents downsizing into their kids' households.

Surely having one less 70" 3D HDTV and one more crotchety old in-law in the living room will make some people miserable, but it would work out in the end.

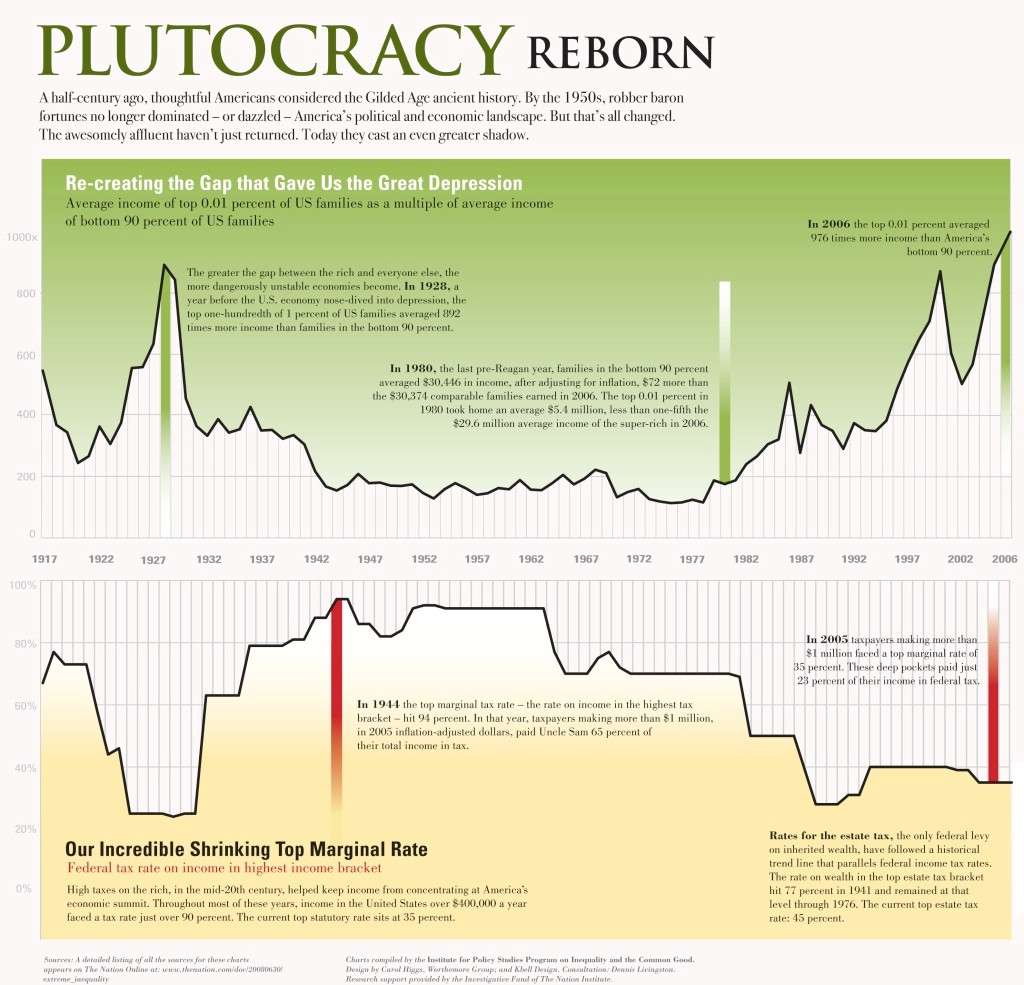

As for taxes - most high earners would be OK with higher taxes, if there was some tangible sense of shared sacrifice with everyone. I'd barely notice a 3% tax hike on the top end, but honestly -

what's the point if it's just sucked up by continued increases in spending?

We need both increased revenue and reduced spending. The people who think we can't or shouldn't abruptly balance the budget this way because it would trigger a depression are missing the point. The "depression vs no depression" branch on the decision tree was passed long ago. Unless someone invents seawater-fueled cold fusion in the interim, there's no dodging the pain. I'd rather face it sooner than later.

I was actually talking to some people in my class about this piece earlier... one of them said that exact same quote...

I was actually talking to some people in my class about this piece earlier... one of them said that exact same quote...