owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,314

- Reaction score

- 11,929

In the mean time, every other car makers are making EV too. There is a big chance my next car in 10 yrs isn't a Tesla. It will be some random EV Automakers.

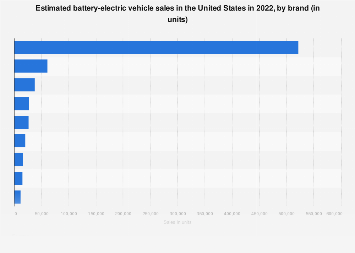

No one thinks that Tesla won't eventually have real competition. But other car makers are dragging their feet or making halfhearted attempts at best. If every other car maker is making EV too, why does Tesla own the EV market? You would think that with their decades of experience making cars they could crush an upstart. When in fact it is the opposite that is happening.

I actually doubt that many legacy car makers will be able to make the transition, more likely other new EV manufacturers will emerge to challenge. Apparently it is just too hard to make the transition to electric.