- Joined

- Feb 28, 2018

- Messages

- 305

- Reaction score

- 91

The next 9 years! Even I'm not that bearish. I hope this isn't the case. Let's have a two-three year bloodbath then put in a bottom at Dow 5000.

goldWhat is on a central bank balance sheet that isn't a debt instrument? Hint: Most put it as line item one under assets. That's a big clue to it's role in a debt deflation.

gold

real estate

cash in your mattress

silver

bitcoin

pottery

large stone coins

corn

sea shells

Monsato crap grows better and gives higher yields bro!Corn...keep heirloom seeds, no Monsanto crap. Broccoli and cauliflower much easier to grow. Corn's a H2O hog.

Monsato crap grows better and gives higher yields bro!

GMO's are the future!!!!!!!!!!!!!!

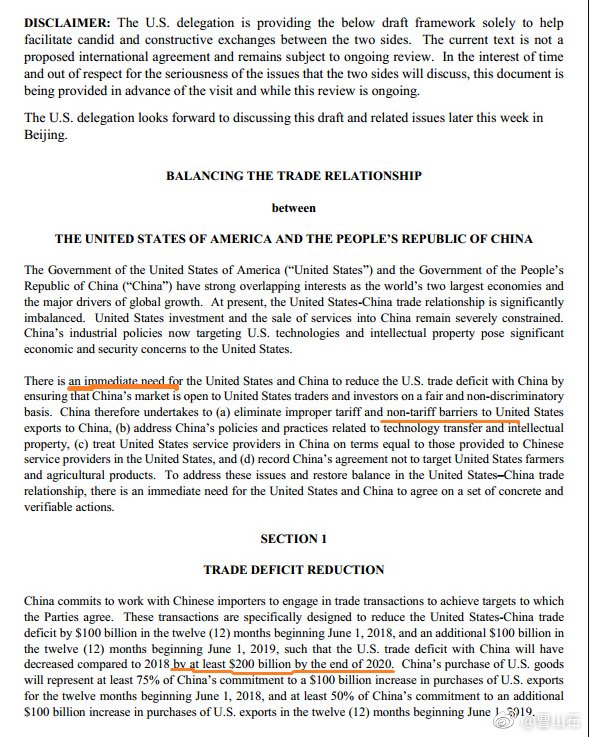

Carol is Alpha? Is that you???.Analysts: US trade demands could make deal with China harder

And here we go. It's in the MSM news. For this to happen the RMB must strengthen and the USD weaken. The US Treasury, ESF, and BIS will have to take the boot off the neck of gold and let it fly. China long ago knew this day would come and that's why she's been accumulating gold like mad. The higher gold price will more than compensate for US Treasury losses. No more peg at 1350.

Monsato crap grows better and gives higher yields bro!

GMO's are the future!!!!!!!!!!!!!!

I am mocking him - I fully support GMO's - maybe that is because my parents grow them - if you want to feed the world you need gmoYou’re being sarcastic? GMOS are widely proven to be safe, harmless, providing better yields with less pesticide needed, etc. They most certainly are the future... especially for feeding people in third world countries and elsewhere stricken by poverty and lack of food.

Please, let’s continue down this rabbit hole. If you’re non-gmo, you’re just as stupid as an antivaxxer, or pro-organic person.

Maybe we need to make a new thread, don’t want to clutter the investment thread with more of Carols nonsense.

Sent from my iPhone using SDN mobile

I am mocking him - I fully support GMO's - maybe that is because my parents grow them - if you want to feed the world you need gmo

I just blocked them - too much spam and not even funnyWord. I’ve seen you post enough to know that you’re educated and not delusional (carol... can’t say the same about).

Sent from my iPhone using SDN mobile

If we go into a recession in 1-2 years, what would you be doing now? Pay off debt? Hoard cash?

JP Morgan’s Wall Street chief talks China and bitcoin and is preparing for a big downturn in stocks JP Morgan’s Wall Street chief talks China and bitcoin and is preparing for a big downturn in stocks

View attachment 234117

Sent from my iPhone using SDN mobile

Sounds like a great card for frequent traveler.So I found a new credit card I like I thought I'd share.

U.S. Bank Altitude Reserve Visa Infinite® Card

US Bank Altitude Infinity Visa. 3x points back on all travel purchases as well as all purchases made via mobile wallet apps. $400 annual fee (yikes)...BUT...you get $325 in travel reimbursement. They also claim high point density (50,000 points is worth $750 in travel rewards). So while that annual fee seems steep up front, you get $325 of it back when the "card is used for purchases made directly from airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines." So that works out to be a $75 annual fee.

So let me get this straight...if I were to, say, get a newer Samsung with the magnetic stripe emulator (aka MST...if you use Samsung pay, it will let you use your phone like a magnetic stripe card...it's really neat if you've never seen it used before...)...I could just use that EVERYWHERE in person...use Android Pay for EVERYTHING online...So 3x points...times 1.5 point density...you can effectively get 4.5% cash back on everything.

Is there a glaring hole in my rationale here?

The downside is that you have to be a US Bank account holder. I'd literally have to drive to like Ohio to open a new account to become eligible. Which seems silly...but over time...that's potentially thousands of dollars.

So I found a new credit card I like I thought I'd share.

U.S. Bank Altitude Reserve Visa Infinite® Card

US Bank Altitude Infinity Visa. 3x points back on all travel purchases as well as all purchases made via mobile wallet apps. $400 annual fee (yikes)...BUT...you get $325 in travel reimbursement. They also claim high point density (50,000 points is worth $750 in travel rewards). So while that annual fee seems steep up front, you get $325 of it back when the "card is used for purchases made directly from airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines." So that works out to be a $75 annual fee.

So let me get this straight...if I were to, say, get a newer Samsung with the magnetic stripe emulator (aka MST...if you use Samsung pay, it will let you use your phone like a magnetic stripe card...it's really neat if you've never seen it used before...)...I could just use that EVERYWHERE in person...use Android Pay for EVERYTHING online...So 3x points...times 1.5 point density...you can effectively get 4.5% cash back on everything.

Is there a glaring hole in my rationale here?

The downside is that you have to be a US Bank account holder. I'd literally have to drive to like Ohio to open a new account to become eligible. Which seems silly...but over time...that's potentially thousands of dollars.

Thanks, didn't know about this. Looks like it competes with Chase Sapphire Reserve and Amex Platinum.

Probably when they have their next ecoli outbreak. I just can't get into Chipotle. Ingredients are basically the same as Taco Bell, it's dark and drab inside and you sit on benches like a high school cafeteria. Millenials seem to love it though.

You can get mutual funds that target certain sectors. https://money.usnews.com/funds/mutu...anguard-information-technology-index-fd/vitaxLet's talk 529 plans... who has em?

Currently looking at USAA's 529 and their portfolio options, their best has a 8.16% return since inception, with 1.08% total annual fees... I assume Vanguard would be a better option but haven't looked there yet. Thoughts?

edit: AMD... I guess it was 2-3 years ago when I had a lot of AMD stock ~$4/share. Gotta love hindsight... hit $17 this week.

Anyone here have a position in IQ or HUYA?

Let's talk 529 plans... who has em?

Currently looking at USAA's 529 and their portfolio options, their best has a 8.16% return since inception, with 1.08% total annual fees... I assume Vanguard would be a better option but haven't looked there yet. Thoughts?

Welp...there goes all our 2018 gains.

- stock market will be flat or negative

Got in at 600, you?AMZN still going up and up and up

My 2018 prediction has been right so far. Expect more turbulence.

Sent from my iPhone using SDN mobile

Better hope it goes down more, currently 3.33% ytd. On pace for 7% for s&p500. NASDAQ over 11%.

Big deal...add inflation, opportunity cost it is flat or negative. Besides, we are not talking about just the S&P 500.

Weren’t you the one who said 2018 is going to be the same as 2017 when it gained 30%?

Sent from my iPhone using SDN mobile

. With fuel, food, and interest rates down it has been the perfect storm for tech to thrive.It has been a turbulent year for me. My non-retirement investments are in tech, batteries, and a broad market fund. Guess which of these is the only one to remain positive over the past six months.

It has been a turbulent year for me. My non-retirement investments are in tech, batteries, and a broad market fund. Guess which of these is the only one to remain positive over the past six months.

SCHB. It's a very low fee ETF.What is broad market fund? (jeopardy)