- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

Subtracting mommy money -$200k, I still have 1.85M NW. What's your point? Just jealous as usual? LMAO.Subtract your mommy’s money and you would be average!

Subtracting mommy money -$200k, I still have 1.85M NW. What's your point? Just jealous as usual? LMAO.Subtract your mommy’s money and you would be average!

Subtracting mommy money -$200k, I still have 1.85M NW. What's your point? Just jealous as usual LMAO.

150k tuition from parents in 08. In just 1 yr working my networth was more than 150k, every year since I have been adding about 200k/yr just being an average index investor. Boo hoo no one cares about your stupid opinion or your inflated ego boasting your imaginary money. At least, what I have is real.If you had graduated with $200 k in debt, you wouldn’t have money to invest so you would not have invested when the stock market was cheap.

He goes around telling people how much paper money he has like he did something great.

I have more money than you and I didn’t need mommy’s help!

150k tuition from parents in 08. In just 1 yr working my networth was more than 150k, every year since I have been adding about 200k/yr just being an average index investor. Boo hoo no one cares about your stupid opinion or your inflated ego boasting your imaginary money. At least, what I have is real.

I said it again you are a jealous pathetic person.

Do anyone care? HahahahYou are a big fish in a small pond.

Even when you were losing money last year, I kept on earning. Maybe one day, you get to play with the big boys.

Do anyone care? Hahahah

Sad little man.

You think I calculated with 9% annual increase..Let see where you would be 10 years from now. This fool keeps on think he will get 9% a year. That is the average

You think I calculated with 9% annual increase..

Fu3k that noise.All of your money is in Vanguard! Even Vanguard is predicting a much lower return for the next 10 years. The bulls run is over! Better adjust your paper “NW”

View attachment 251237

Why do you constantly attack him? It adds nothing and detracts from the forum.

All of your money is in Vanguard! Even Vanguard is predicting a much lower return for the next 10 years. The bulls run is over! Better adjust your paper “NW”

You are aware that Vanguard has more than just stock funds, right?

LMFAO at having 200k after graduating in 2008 and then constantly preaching buy and hold. Yeah, I mean I'd love to "buy and hold" after the worst recession since the Great Depression.

Wish I had 200k cash to invest in 08. Got my license Oct 08 with 0 student loans.LMFAO at having 200k after graduating in 2008 and then constantly preaching buy and hold. Yeah, I mean I'd love to "buy and hold" after the worst recession since the Great Depression. Not against family wealth. That's how it should be. But you might have a bit of a different perspective from most investors in history that don't just get to triple their money in 10 years by investing in the broad market.

Being absolutely lazy and still ending up with millions is pretty cool.This argument really makes no sense. Rentals generally have a rate of return around 10%. Sure you can do better but that's not for everyone. A lot of people also don't want their money tied up in rentals which is where places like fundrise come in.

This argument seems to be who is right when in the end it's how much work do you want to put in. Most people who are like me with a family don't want to spend time on rentals whether it's doing it on your own or paying someone, we're lazy and just want the market to do its job.

If you want to put in the work, go for these other ways to allow you to diversify, neither way is wrong in the end of the day.

I will end with this, I don't do any extra work and I'll be retired by 50. None of that is needed unless you enjoy it.

Yep, lucky times but I'm sure everyone you know with the same circumstances ended up the same at 34 after pharmacy school.The number doesn't change my argument one bit. Graduating in 2008 with no loans was a gift from the heavens compared to graduating now in this oversaturated job market and overvalued stock market.

Um no... hopes were pretty much gone by 2011.I started pre-pharm in 2011. Back then there was still hope (there still is if you have work experience and fight for the good remaining jobs). And because of my home state location pharmacy offered a better ROI than pretty much anything else (in-state rural, scholarships). If I were to have gone to high school pretty much anywhere else I would probably be finishing dental school right now. Telling someone else to clean someone's teeth and reminding them to brush for 150k+ at 35 hours a week sounds nice (PICs make the same as dentists in some parts of the country btw). Not sure how real threat of automation is to dentists/orthodontists what with Smile Direct and all. Soon they too will be working for CVS. But I think we're starting to digress...

Yep, lucky times but I'm sure everyone you know with the same circumstances ended up the same at 34 after pharmacy school.

I wouldn't be caught dead with PharmD degree in 2019.

About 140k from the top, and gained 160-170k. I am up to 2.05M. I wish it went down moreHow much money did you lose in 2018?

About 140k from the top, and gained 160-170k. I am up to 2.05M. I wish it went down moregot 31 yrs to buy stocks.

Nope. He likes to talk sh1t when people are doing greatDo you feel bullied by BMB ?? Lol

My yearly dividend alone from taxable account can sustain me for the next 10 yrs.What if you got laid off or your hours got cut?

My yearly dividend alone from taxable account can sustain me for the next 10 yrs.

I also have a YouTube channel and a blog in the making. I have 2 days off nowadays, it feels like I have a week off. That's why I start making them. I can fully focus on that if I get laid off. Not gonna reveal it hereHope to quit working in pharmacy if it does well.

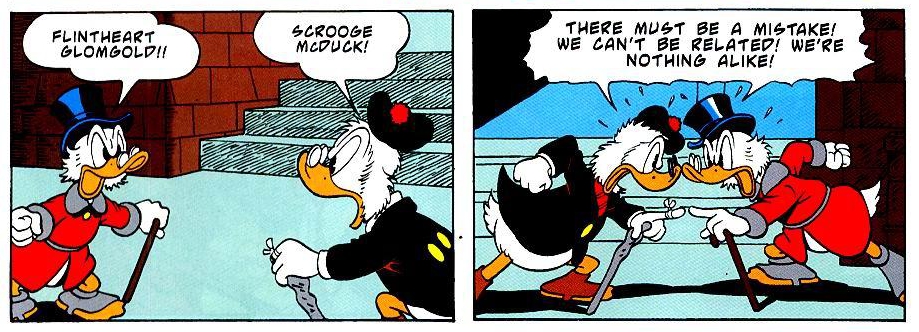

@owlegrad this needs done.They need to merge all momus and BMB posts into a superthread. Either that or make a poll to decide if they should have their own subforum. "Do nothing" is not an option.

They need to merge all momus and BMB posts into a superthread. Either that or make a poll to decide if they should have their own subforum. "Do nothing" is not an option.

Do not lump me with a person whose sole existence here is to bash others.They need to merge all momus and BMB posts into a superthread. Either that or make a poll to decide if they should have their own subforum. "Do nothing" is not an option.

Without members like me, Momus and a few others, this thread would have been dead a long time ago. There is a reason why we doing are so well.

Do not lump me with a person whose sole existence here is to bash others.

With twitch, you need a regular time to stream. People expect you to be online at a certain time of the day. Without tits and ass, you can't make it there unless your skill level is at god mode. To get god mode, you need to train and stream 8-12 hours a day, meaning you have to quit your job. It's like a second job to log in to twitch and stream every day. I am more like a hobbyist. You can make videos whenever and talk about whatever, not just gaming. It's more versatile. Sponsored video, and merch are where the big money is with Youtube. There are many others. Residual viewers are also nice with youtube. Once you have a bunch of videos uploaded, it'll always be there and you can collect some ad revenue as long as the platform exists for people to view them.I thought YouTube didn't pay too well and compensation continues to trend down. I think you can make like $5k off a video that hits a million views? If it hits a million views. Last time I checked Twitch had much more growth potential and you could post your content on YouTube. More time investment though. Mostly live content and all about marketing. Would be cool to make good money playing video games. I think competition is high though.

Since this post,

CVS up 7.5%

JPM up 11.7%

Not too late to get on CVS. It's going to 85-90

Looks like it's going 55-60 now...

Patience. Hoping it would go lower to add but it's settling around my cost basis.Looks like it's going 55-60 now...

CVS employees will feel this pain. It has a mountain of debt. If money is not coming from its business, then it will come from employees’ pocket.

Larry Merlo’s job is on the line. Swim or sink.

What is the point of buying all of these companies for exorbitant amounts? Target, Omnicare, now Aetna, will they ever profit from these aquisitions? Seems like they'd be better off if they did nothing.

The number doesn't change my argument one bit. Graduating in 2008 with no loans was a gift from the heavens compared to graduating now in this oversaturated job market and overvalued stock market.

Because CVS and Walgreens won't be here in the future if they don't.

With twitch, you need a regular time to stream. People expect you to be online at a certain time of the day. Without tits and ass, you can't make it there unless your skill level is at god mode. To get god mode, you need to train and stream 8-12 hours a day, meaning you have to quit your job. It's like a second job to log in to twitch and stream every day. I am more like a hobbyist. You can make videos whenever and talk about whatever, not just gaming. It's more versatile. Sponsored video, and merch are where the big money is with Youtube. There are many others. Residual viewers are also nice with youtube. Once you have a bunch of videos uploaded, it'll always be there and you can collect some ad revenue as long as the platform exists for people to view them.

I remember you were talking about making a channel about fishing?My yearly dividend alone from taxable account can sustain me for the next 10 yrs.

I also have a YouTube channel and a blog in the making. I have 2 days off nowadays, it feels like I have a week off. That's why I start making them. I can fully focus on that if I get laid off. Not gonna reveal it hereHope to quit working in pharmacy if it does well.

Merlo wanted a bigger slice of the healthcare pie because he wanted more negotiation power but he ended up overpaying for those assets. Even worse, he used debt to buy them.

Merlo knows his neck is on the line. He would gladly throw you and all the pharmacists overboard, just so he doesn’t have to go down with a sinking ship.

Merlo wanted a bigger slice of the healthcare pie because he wanted more negotiation power but he ended up overpaying for those assets. Even worse, he used debt to buy them.

Merlo knows his neck is on the line. He would gladly throw you and all the pharmacists overboard, just so he doesn’t have to go down with a sinking ship.

He has a net worth of $47 million. Does he care if he loses his position?

So I don't know if you guys have noticed, but the mods are trying to make all financial and job market topics off-topic on this forum. They are trying to make us use a subforum.

Please show your displeasure along with me in this thread.