- Joined

- Oct 5, 2004

- Messages

- 744

- Reaction score

- 332

- Points

- 5,336

How many of you use financial services planners? I dont, but am starting to wonder if it might be a good idea.

My fiancé is a tax accountant so he sees the work of financial planners first hand. According to him, most of them have no idea what they are doing and a lot of them make recommendations that are most advantageous for them, rather than most advantageous for you. So, if you are going to hire a financial planner, find a GOOD tax accountant to review the plan and prepare your taxes on a yearly basis.

I have family who are financial planners.

They say tax accountants who give financial advice have no idea what they are talking about.

Haha

He doesn't give financial planning advice. He gives tax planning advice 😉I have family who are financial planners.

They say tax accountants who give financial advice have no idea what they are talking about.

Haha

I have family who are financial planners.

They say tax accountants who give financial advice have no idea what they are talking about.

Haha

Anyways as I was admonishing a friend of mine about this he really got me thinking. He asked if I could mow my own lawn. I said sure, he knew I had someone do it.

Let me weigh in here. My dad is a broker, I have been in the financial services industry and personal investing and money management is something that interests me. I think the need for an advisor depends on how complex your financial picture is.

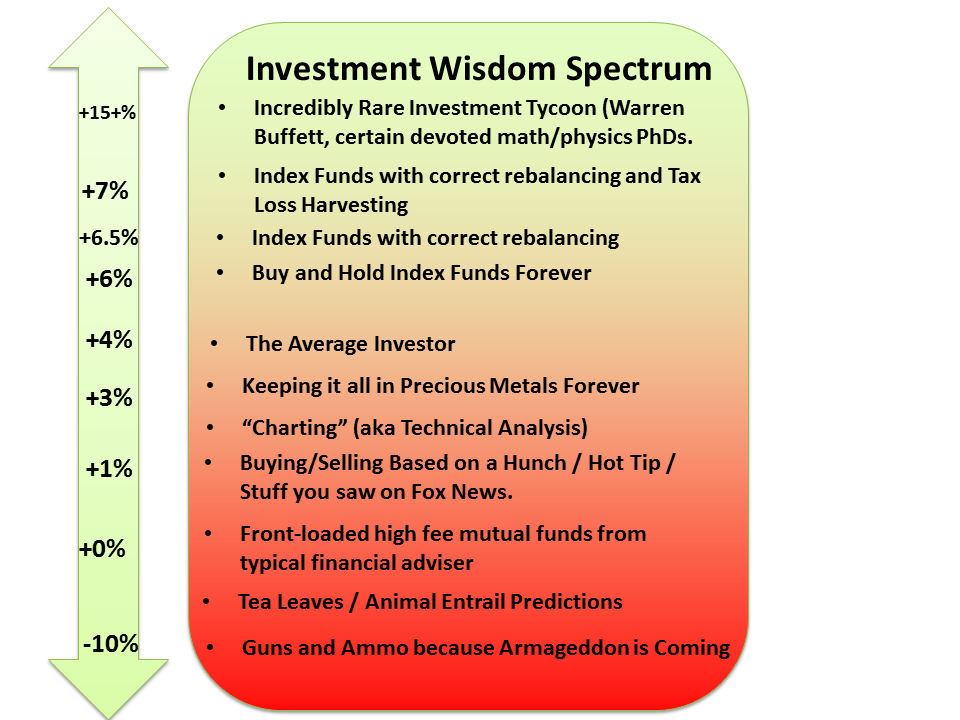

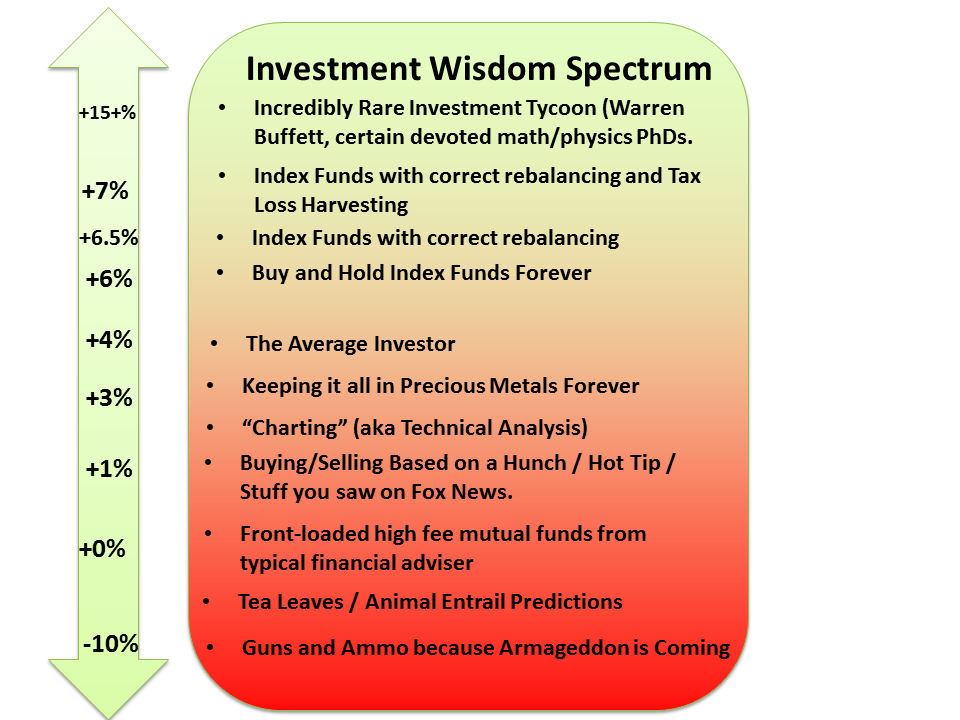

If all your "real" money is sitting in retirement accounts, its easier. If you need help with tax loss harvesting and other time intensive stuff then maybe an advisor is a good idea.

Also, there are some automated options weathfront betterment etc.

Anyways as I was admonishing a friend of mine about this he really got me thinking. He asked if I could mow my own lawn. I said sure, he knew I had someone do it.

Do you pay $30K a year to get your lawn mowed? Lots of docs are paying that to have their finances managed. At the typical price at which most financial advice is offered ($5-30K a year) I feel like I can "mow my own lawn."

Easy fix. Just get the guy that mows your lawn to also do your finances.

Is it worth getting into betterment/wealth front?

Step 1: Pay off all high interest (eg credit card, >10% ARP)How many of you use financial services planners? I dont, but am starting to wonder if it might be a good idea.

He doesn't give financial planning advice. He gives tax planning advice 😉

It's a platform to invest. A roboinvestor. Is it worth it is my QWhat do you mean by getting into?

He asked if I could mow my own lawn. I said sure, he knew I had someone do it.

It's a platform to invest. A roboinvestor. Is it worth it is my Q

5) REad this book: Physicians GUide to investing.

It's a platform to invest. A roboinvestor. Is it worth it is my Q

Tax avoidance is more important for doctors than investing. Make market rate, don't be greedy, save your money. I promise you will not beat indexes over 30 years, unless you have a rockstar manager who is charging >1.5% and prob. wants $1M buy-in.

But don't listen to me--listen to the Michael Jordan of investing: http://www.ft.com/cms/s/0/946ade3c-f235-11e4-892a-00144feab7de.html#slide0

That thing is awesome. Where did you find that?Yep....

When it comes to deciding whom to hire and when, you should ask not only can you do something, but at what cost when compared with your time.Let me weigh in here. My dad is a broker, I have been in the financial services industry and personal investing and money management is something that interests me. I think the need for an advisor depends on how complex your financial picture is.

If all your "real" money is sitting in retirement accounts, its easier. If you need help with tax loss harvesting and other time intensive stuff then maybe an advisor is a good idea.

Also, there are some automated options weathfront betterment etc.

Anyways as I was admonishing a friend of mine about this he really got me thinking. He asked if I could mow my own lawn. I said sure, he knew I had someone do it.

When it comes to deciding whom to hire and when, you should ask not only can you do something, but at what cost when compared with your time.

I can manage all of my accounts in less than 10 hours per year. If I go into primary care, that time will be worth approximately $1,250 if I'd worked instead at $125/hr. Therefore, any advisor that costs me over $1,250 per year is resulting in a net loss of income versus managing things myself.

Now let's look at lawns. If I've got a lawn that takes me half an hour to mow, and I'm mowing it once a week for 36 weeks a year, that comes to 18 hours of work, at a total opportunity cost of $2,250. If I can find a guy to mow my lawn for $35 an hour, that lawn mowing service will cost me a total of $630, for a net savings of $1,620/year. Above a certain income, there are things that are stupid to do yourself (unless you enjoy them) because the opportunity cost is too great.

When it comes to deciding whom to hire and when, you should ask not only can you do something, but at what cost when compared with your time.

I can manage all of my accounts in less than 10 hours per year. If I go into primary care, that time will be worth approximately $1,250 if I'd worked instead at $125/hr. Therefore, any advisor that costs me over $1,250 per year is resulting in a net loss of income versus managing things myself.

Now let's look at lawns. If I've got a lawn that takes me half an hour to mow, and I'm mowing it once a week for 36 weeks a year, that comes to 18 hours of work, at a total opportunity cost of $2,250. If I can find a guy to mow my lawn for $35 an hour, that lawn mowing service will cost me a total of $630, for a net savings of $1,620/year. Above a certain income, there are things that are stupid to do yourself (unless you enjoy them) because the opportunity cost is too great.

It isn't how one should look at everything, but it is how one should look at tasks that they view as work. You can pay off the guy mowing your lawn by putting in an extra 10 minutes of work a week, basically by seeing one extra patient, which means the effort involved is essentially not worth your time, as you could pay the guy off by working one extra 6 hour shift per year to never have to worry about your lawn. You may choose to enjoy your cheesy poofs, but when it comes to finances, the savvy amongst us aren't lazy cheesy poof eaters- we break things down analytically, to find the best way to deal with something from a financial perspective. If you can hire a maid and a lawn care guy, and all you'll have to do is pick up two extra weekend shifts for the entire year to not impact your bottom line while simultaneously freeing up well over a work week's worth of time, why not?This only works under the assumption that you are going to work with all of your additional free time, which is generally not the case. Most people will keep their standard shift load and eat cheesy poofs on their couch while someone mows their lawn each week. Some may do it though.

It isn't how one should look at everything, but it is how one should look at tasks that they view as work. You can pay off the guy mowing your lawn by putting in an extra 10 minutes of work a week, basically by seeing one extra patient, which means the effort involved is essentially not worth your time, as you could pay the guy off by working one extra 6 hour shift per year to never have to worry about your lawn. You may choose to enjoy your cheesy poofs, but when it comes to finances, the savvy amongst us aren't lazy cheesy poof eaters- we break things down analytically, to find the best way to deal with something from a financial perspective. If you can hire a maid and a lawn care guy, and all you'll have to do is pick up two extra weekend shifts for the entire year to not impact your bottom line while simultaneously freeing up well over a work week's worth of time, why not?

I can't convince you to value your time at what it is worth, however. Only you can tell yourself your time is worthwhile.

Op asked a finance question though- you're going to end up with a more financially disciplined crowd answering financial questions. You can take or leave the advice, that's on you. And regardless of whether you work more to make up for certain expenses, the time/value equation still holds true in regard to what you should find a valuable use of your free time, as your free time is worth far more than the average individual since you could be making far more money during it, and the amount you'd have to spend to protect that free time is a far smaller fragment of your overall income.You sound like the person who says they financed their new car instead of paying cash due to the "opportunity cost of money", arguing that they will invest the $400 a month and obtain better returns on the money. Which can in theory be true, except that literally no one ever does this.

If you actually do these things, then of course the logic is sound. But the majority of people do not.

I do not use a financial adviser.

I get phone calls a couple times a month from advisers offering their services (have turned them down but they keep calling).

Have read their brochures but honestly don't see what I'm missing. It's basic math and quick internet research. I doubt any adviser would make a better return to cost ratio than a simple ETF porfolio, certainly not using high-cost funds and 1% AUM.

I also mow my own lawn and change the oil/brakes/timing-belt/general maintenance/etc on my car/motorcycles. Why? Because I don't trust someone else to do it and it's way easier/quicker for me to just do it myself rather than having to get someone to drive me to a shop, wait around, be car-less for a day, etc.

It isn't how one should look at everything, but it is how one should look at tasks that they view as work. You can pay off the guy mowing your lawn by putting in an extra 10 minutes of work a week, basically by seeing one extra patient, which means the effort involved is essentially not worth your time, as you could pay the guy off by working one extra 6 hour shift per year to never have to worry about your lawn. You may choose to enjoy your cheesy poofs, but when it comes to finances, the savvy amongst us aren't lazy cheesy poof eaters- we break things down analytically, to find the best way to deal with something from a financial perspective. If you can hire a maid and a lawn care guy, and all you'll have to do is pick up two extra weekend shifts for the entire year to not impact your bottom line while simultaneously freeing up well over a work week's worth of time, why not?

I can't convince you to value your time at what it is worth, however. Only you can tell yourself your time is worthwhile.

Clearly you don't drive a fancy car!

I only say that because some of my co-res have fancy BMers, Benzs, Audis and they inform me that when they get their cars checked out, they are offered a nice rental in return.

Your co-residents drive BMWs, Benz's and Audi's? That's insane. Also makes me feel a little less guilty about paying for the Honda with leather, lol.

Some.

Ya I'm happy with my Toyota

Fancy cars aren't assets, they're liabilities.

I'm interested in some of yalls take on leasing cars. I don't do this and generally everything I've read shows it's a waste, but I see plenty of physicians and lawyers, business folks doing this.

There are plenty of MDs and JDs with $200k+/y salary but low net worths because of terrible choices, I just don't get it. Just save your money, it's not that hard. I'm more debt averse than most (thanks, Dave Ramsey), so I'm more focused on paying off student loans than saving for retirement. We're still maxing my wife's matched retirement, but every penny beyond that goes to paying off student loans. I've paid off nearly 80k while in residency. Although I know I'm not saving for retirement yet, I figure if my wife and I can put 40% of our net (plus nearly all of my extra moonlighting money) to student loans, 20% of a much higher salary directly to a 401K shouldn't be that hard.

I think it was WCI that recently said "stop leasing cars, that's what poor people do."

Seriously, any time I hear an attending giving me financial advice, I nod and smile then remember to do exactly the opposite. Whether it is people telling me the benefits or an ARM mortgage, letting my student loans ride so I can invest, lease a car, using a "great" financial advisor, etc.

Keep it simple. Marry a frugal spouse and stay married. Keep your fixed expenses low. Be compulsive about paying off your student loans. Have an emergency fund. Pay cash for everything but your home. Get a fixed rate mortgage (preferably 15y). Don't be house poor or car poor. Max retirements and put them on auto-deduct.

http://www.nbc.com/saturday-night-live/video/dont-buy-stuff/n12020

I think balance is key. It's difficult to justify living a sybaritic lifestyle fresh out of residency. That being said... most of us sacrificed over a decade of our lives for advanced learning and self sacrifice to get to this point. We above all specialties should be the most in tune with our own mortality. After living like a resident for a few years after residency, I then finally decided to just enjoy life...within reason. I have no idea when my number might be up or God might call me home. Most of us all know at least one physician or colleague who has died unexpectedly and at a relatively young age. I honestly have a hard time picturing myself in my 80s and am convinced something terrible will happen to me well before I reach that point. That being said, I save, I pay down debt aggressively but I've decided not to save much for retirement until I pay off my high interest loans (at which point I'll dump an equal amount to retirement). I bought a nice house and I'll fully admit that it's too big for me. You know what though? I like it and it makes me happy. I have a nice watch and I have a nice car. I also like having some of the latest gadgets. I've started going on more vacations and like to splurge for a nice trip at least 3 times a year. I don't think that's financial suicide and I consider that just part of trying to live and enjoy life. Hell, I'm in my 40s now and if I lived in a 1 bedroom apartment saving every dime I earn and working as many hours as I could to pay down X or save for Y, I'd have a heart attack in 5 years. Just enjoy your life. Enjoy your relationships and loved ones. Work on your personal life, but don't punish yourself and lose out on some of the most valuable years of your life in the name of maximum financial gain. There's no reason to have a warped sense of guilt when you decide to enjoy some of the benefits from all those years of sacrifice and hard work. You've earned it.

Kind of a tangent, but back on topic... I've used financial planners and never been very impressed. Vanguard or Fidelity mutual funds are not that complicated and they have plenty of managed account options that are low cost and fairly hands off and painless.

There are plenty of MDs and JDs with $200k+/y salary but low net worths because of terrible choices, I just don't get it. Just save your money, it's not that hard. I'm more debt averse than most (thanks, Dave Ramsey), so I'm more focused on paying off student loans than saving for retirement. We're still maxing my wife's matched retirement, but every penny beyond that goes to paying off student loans. I've paid off nearly 80k while in residency. Although I know I'm not saving for retirement yet, I figure if my wife and I can put 40% of our net (plus nearly all of my extra moonlighting money) to student loans, 20% of a much higher salary directly to a 401K shouldn't be that hard.

I think it was WCI that recently said "stop leasing cars, that's what poor people do."

Seriously, any time I hear an attending giving me financial advice, I nod and smile then remember to do exactly the opposite. Whether it is people telling me the benefits or an ARM mortgage, letting my student loans ride so I can invest, lease a car, using a "great" financial advisor, etc.

Keep it simple. Marry a frugal spouse and stay married. Keep your fixed expenses low. Be compulsive about paying off your student loans. Have an emergency fund. Pay cash for everything but your home. Get a fixed rate mortgage (preferably 15y). Don't be house poor or car poor. Max retirements and put them on auto-deduct.

http://www.nbc.com/saturday-night-live/video/dont-buy-stuff/n12020