This excerpt from a Forbes article regarding a student loan repayment strategy which I posted on the Finance and Investment forum

http://www.forbes.com/sites/davidmarotta/2015/07/26/how-quickly-should-i-pay-my-student-loans/):

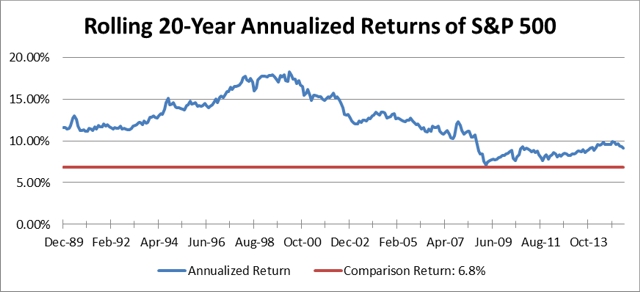

If you lengthen the time horizon to twenty-year periods between 1970 and 2015, then 100% of 306 twenty-year time periods have returns greater than 6.8%. This means that if you are investing for the long term (i.e. for retirement in your Roth IRA as a 22-year-old), then the odds are even more in your favor for investing while paying the minimums.

If you have graduated with student loans you are probably anxious to leave those loans behind you and get on with your life. The best way to accomplish this is to pay the minimum and start saving and investing toward your future financial security.

Megan Russell co-authored this article.

Keep in mind that if you're in PAYE and have a significant amount forgiven, you've likely paid an effective interest rate(what you paid over the life of the loan including the loan forgiveness tax liability) that is lower that the stated interest rate (what's stated on the promissory note). This articles' comparison rate is 6.8% which may be higher than the PAYE effective interest rate.

The concern here is opportunity cost - what financial opportunities are you delaying by aggressively paying down your debt.

In terms of retro-active changes to income driven repayment (ICR, IBR, PAYE & proposed REPAYE) programs and PSLF (which is a forgiveness program, not a repayment option), it's my opinion that's highly unlikely. But there will be changes to PSLF & income driven repayment (IDR) programs for future borrowers. Here are several reasons why I feel there will not be retro-active changes:

- Dept of Ed has not retro-actively modified the terms of loan programs. Their practice has been to designate "New borrower/Old borrower" categories. Old borrowers will be grandfather under the original terms of the old borrower's repayment term. New borrowers might be defined as 1st time federal student loan borrowers, say as of July 1, 2016. I do believe their repayment programs and PSLF might be modified, and not so generous, for new borrowers.

- The terms of IBR, PAYE, and PSLF are in your Master Promissory Note, which is a contract. Those borrowers most aggressively pursuing PAYE and PSLF are lawyers, who probably appreciate the obligation of the MPN. Below is the language from a current MPN regarding PAYE & PSLF:

Pay As You Earn Repayment Plan (Pay As You Earn Plan)

Under the Pay As You Earn Plan, your monthly payment amount is generally 10% of your annual discretionary income, divided by 12. Discretionary income for this plan is the difference between your adjusted gross income and 150% of the poverty guideline amount for your state of residence and family size. If you are married and file a joint federal income tax return, the income used to determine your Pay As You Earn Plan payment amount will be the combined adjusted gross income of you and your spouse.

The Pay As You Earn Plan is available only to new borrowers. You are a new borrower for the Pay As You Earn Plan if:

(1) You had no outstanding balance on a Direct Loan Program or FFEL Program loan as of October 1, 2007, or you have no outstanding balance on a Direct Loan Program or FFEL Program loan when you obtain a new loan on or after October 1, 2007, and

(2) You receive a disbursement of a Direct Subsidized Loan, Direct Unsubsidized Loan, or student Direct PLUS Loan (a Direct PLUS Loan made to a graduate or professional student) on or after October 1, 2011, or you receive a Direct Consolidation Loan based on an application received on or after October 1, 2011. However, you are not considered to be a new borrower for the Pay As You Earn Plan if the Direct Consolidation Loan you receive repays loans that would make you ineligible under part

(1) of this definition.

In addition to being a new borrower, to initially qualify for the Pay As You Earn Plan and to continue to make payments that are based on your income, the amount you would be required to pay on your eligible student loans under the Pay As You Earn Plan (as described above) must be less than the amount you would have to pay under the Standard Repayment Plan. If your Pay As You Earn Plan payment amount is less than the amount you would have to pay under the Standard Repayment Plan, you are considered to have a "partial financial hardship."

If you are married and file a joint federal income tax return, the loan amount we use to determine whether you have a partial financial hardship will include your eligible loans and your spouse’s eligible loans.

While you are repaying under the Pay As You Earn Plan, you must annually provide documentation of your income and certify your family size so that we may determine whether you continue to have a partial financial hardship. Your monthly payment amount may be adjusted annually based on the updated income and family size information that you provide. If we determine that you no longer have a partial financial hardship, you may remain on the Pay As You Earn Plan, but your monthly payment will no longer be based on your income. Instead, your monthly payment will be what you would be required to pay under the Standard Repayment Plan, based on the amount you owed on your eligible loans at the time you entered the Pay As You Earn Plan.

Under the Pay As You Earn Plan, if your loan is not repaid in full after you have made the equivalent of 20 years of qualifying monthly payments and at least 20 years have elapsed, any remaining loan amount will be forgiven. You may have to pay federal income tax on the loan amount that is forgiven. (Sigma added the emphasis)

Public Service Loan Forgiveness

A Public Service Loan Forgiveness program is also available. Under this program, we will forgive the remaining balance due on your eligible Direct Loan Program loans after you have made 120 payments on those loans (after October 1, 2007) under certain repayment plans while you are employed full-time in certain public service jobs. The required 120 payments do not have to be consecutive.