yup...what he said...just giving to God

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Help paying off student loans

- Thread starter Muse600

- Start date

- Joined

- May 29, 2012

- Messages

- 487

- Reaction score

- 97

I finally got around to reading that book. According to that equation, I am just a bit over, so an Average Accumulator of Wealth. And I thought I was fairly frugal, and saving and investing lots of money, lol. So I agree that it's going to be quite hard for pharmacists to be PAWs especially in their 30s. Then, the PAW level increases by 0.2 of your annual income each year or $26k, so even if you invest about $50k per year, it might take a decade or so to catch up.

That's how I see it as well. It's not as easy as some people seem to make it. I also used to think I live frugally, but after reading Stop Acting Rich by the same author, I came to realized I'm not all that frugal when measured on the same scale as frugal millionaires. In fact, I was actually "acting rich!" I highly recommend that book if you'd like to see where you can improve in terms of living frugally. The living frugal part is actually extremely hard for professionals earning high incomes. This is because of the mindset that you're somewhat accomplished, educated, hard working, and earning a high income... so why not live a little and splurge on that fancy European luxury car, dine at fine restaurants, play golf at upscale private country clubs, etc... YOLO, right?

man...who actually plays golf at upscale private country clubs?

but I ditched the $400 payments on a bmw 325i...now mostly riding my '95 yamaha FZR600 sportbike (42mpg!)...or driving a CNG camry ($2.25-$2.75/gallon)...try to do as much work as I can myself when they require repairs....finest dining I'll do is ~$8-$10 at a chipotle or similar establishment...daily budget for food/gas: $22/day

but I ditched the $400 payments on a bmw 325i...now mostly riding my '95 yamaha FZR600 sportbike (42mpg!)...or driving a CNG camry ($2.25-$2.75/gallon)...try to do as much work as I can myself when they require repairs....finest dining I'll do is ~$8-$10 at a chipotle or similar establishment...daily budget for food/gas: $22/day

Last edited:

- Joined

- May 29, 2012

- Messages

- 487

- Reaction score

- 97

You’d be amazed how many people out there would pay top dollars to swing their golf clubs and rub shoulders with "the rich” at country clubs in Beverly Hills and the likes. It makes them feel superior, as if they belong to part of a high income/net worth club even though they’re heavily mortgaged and are barely able to make the payments for their blinged out 5-Series in the parking lot. I know, it doesn’t make sense to me either, but there are no shortages of people like that out there.

Although I would get a motorcycle to save on gas, I’d rather stick to fuel efficient cars. With the number of bad drivers out on the streets, I feel that the risk of riding a motorcycle is not worth the savings.

Although I would get a motorcycle to save on gas, I’d rather stick to fuel efficient cars. With the number of bad drivers out on the streets, I feel that the risk of riding a motorcycle is not worth the savings.

I don't recommend motorcycles to anyone that hasn't already been riding awhile...fuel economy aside, they're way too dangerous!!

I've weighed the risks and benefits...and it's only something I do alone...I started on a dirtbike 16 years ago, and on the street 11 years ago

plus from a cost standpoint - motorcycle tires only last ~6-7,000 miles, cost $120/tire (+ installation), valves need adjustment, chain/sprockets need to be replaced yearly, you spend $1,200 on proper gear and replace helmets ($150-$400) and boots ($200) every 3 years or so...with the additional insurance/registration of the motorcycle, the gas savings hardly cancel out the added cost

for the money, an economy car is hands down the cheapest way to go....buy a used 30mpg (or more) gas car that cost $240 to replace all 4 tires, get it used and drive it into the ground. If you're mechanically savvy, do the corrective repair work yourself. Pep Boys wanted $320 to replace an ignition coil...I bought the part from autozone for $70 and just had to take out 2x10mm nuts to replace it. They also wanted $190 to clean the idle air control valve - bought a can of carb/choke cleaner for $5 and hosed it down (didn't change anything...the IAC was working fine to begin with). They also wanted $144 to replace spark plug wires - parts were $30 on amazon (for NGK wires) - done. They also wanted nearly $400 to replace both front struts - buy a monroe quickstrut for $75 and swap it yourself.

as for club membership - I don't know what that's like, nor do I want to...how can I be more frugal? I'm going to read stop acting rich!

edit: found the pdf

I've weighed the risks and benefits...and it's only something I do alone...I started on a dirtbike 16 years ago, and on the street 11 years ago

plus from a cost standpoint - motorcycle tires only last ~6-7,000 miles, cost $120/tire (+ installation), valves need adjustment, chain/sprockets need to be replaced yearly, you spend $1,200 on proper gear and replace helmets ($150-$400) and boots ($200) every 3 years or so...with the additional insurance/registration of the motorcycle, the gas savings hardly cancel out the added cost

for the money, an economy car is hands down the cheapest way to go....buy a used 30mpg (or more) gas car that cost $240 to replace all 4 tires, get it used and drive it into the ground. If you're mechanically savvy, do the corrective repair work yourself. Pep Boys wanted $320 to replace an ignition coil...I bought the part from autozone for $70 and just had to take out 2x10mm nuts to replace it. They also wanted $190 to clean the idle air control valve - bought a can of carb/choke cleaner for $5 and hosed it down (didn't change anything...the IAC was working fine to begin with). They also wanted $144 to replace spark plug wires - parts were $30 on amazon (for NGK wires) - done. They also wanted nearly $400 to replace both front struts - buy a monroe quickstrut for $75 and swap it yourself.

as for club membership - I don't know what that's like, nor do I want to...how can I be more frugal? I'm going to read stop acting rich!

edit: found the pdf

Last edited:

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

Ever since I started working, I've naturally spent more on things that I might have seen as excessive back in college. Here's a few things on my list:

1) Premium parking at the airport (~$25/day vs. $10/day economy lot)

2) Uber-X instead of public transit ($2 & 1hr travel time vs. $18-20 & 30mins travel time)

3) Boutique/4-star hotels vs. Days Inn/La Quinta Inn ($250/night vs. $75/night)

4) Buying more organic/branded food vs. store brand items (depends if it's worth it)

5) Getting a haircut vs. cutting my own hair ($20 incl. tip vs. $0 sometimes lopsided)

I wouldn't consider myself "frugal" or "thrifty" but I'm definitely not excessive. Then again, someone reading my list above would think I'm being excessive. My rationale is the benefit I receive is worth more to me than the $$ I paid. Like with premium parking....a long weekend away I paid $100 to park vs. $40 in the economy lot, but I landed late and got home ~30mins earlier than had I had to wait for a shuttle. 30 mins might not seem like a lot, but coming home at 12am vs. 1230am makes a difference when you work the next day.

1) Premium parking at the airport (~$25/day vs. $10/day economy lot)

2) Uber-X instead of public transit ($2 & 1hr travel time vs. $18-20 & 30mins travel time)

3) Boutique/4-star hotels vs. Days Inn/La Quinta Inn ($250/night vs. $75/night)

4) Buying more organic/branded food vs. store brand items (depends if it's worth it)

5) Getting a haircut vs. cutting my own hair ($20 incl. tip vs. $0 sometimes lopsided)

I wouldn't consider myself "frugal" or "thrifty" but I'm definitely not excessive. Then again, someone reading my list above would think I'm being excessive. My rationale is the benefit I receive is worth more to me than the $$ I paid. Like with premium parking....a long weekend away I paid $100 to park vs. $40 in the economy lot, but I landed late and got home ~30mins earlier than had I had to wait for a shuttle. 30 mins might not seem like a lot, but coming home at 12am vs. 1230am makes a difference when you work the next day.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

Ever since I started working, I've naturally spent more on things that I might have seen as excessive back in college. Here's a few things on my list:

1) Premium parking at the airport (~$25/day vs. $10/day economy lot)

2) Uber-X instead of public transit ($2 & 1hr travel time vs. $18-20 & 30mins travel time)

3) Boutique/4-star hotels vs. Days Inn/La Quinta Inn ($250/night vs. $75/night)

4) Buying more organic/branded food vs. store brand items (depends if it's worth it)

5) Getting a haircut vs. cutting my own hair ($20 incl. tip vs. $0 sometimes lopsided)

I wouldn't consider myself "frugal" or "thrifty" but I'm definitely not excessive. Then again, someone reading my list above would think I'm being excessive. My rationale is the benefit I receive is worth more to me than the $$ I paid. Like with premium parking....a long weekend away I paid $100 to park vs. $40 in the economy lot, but I landed late and got home ~30mins earlier than had I had to wait for a shuttle. 30 mins might not seem like a lot, but coming home at 12am vs. 1230am makes a difference when you work the next day.

1. I am using Flightcar for a month... free parking LOL

2. Dunno what this is

3. Hotwire... Priceline for me, not paying freaking retail

4. Store brand all the way >_>

5. Cut my own hair - thanks to Youtube!

6. Still using the same razor blade for 4 years

7. Wash my own car

8. Eat out only once a week most of the time. With friends, frequency becomes non-issue

9. Free movies from thepiratebay.org >_> 1080p + your own home = beats theater

10.Free music from Frostwire

11.Buying clothes <$40 max only and can't remember when I last bought one...

12.Cell phone plan $25/mo... using VOIP

etc...

I guess I am pretty frugal :-O

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

1. I am using Flightcar for a month... free parking LOL

2. Dunno what this is

3. Hotwire... Priceline for me, not paying freaking retail

4. Store brand all the way >_>

5. Cut my own hair - thanks to Youtube!

6. Still using the same razor blade for 4 years

7. Wash my own car

8. Eat out only once a week most of the time. With friends, frequency becomes non-issue

9. Free movies from thepiratebay.org >_> 1080p + your own home = beats theater

10.Free music from Frostwire

11.Buying clothes <$40 max only and can't remember when I last bought one...

12.Cell phone plan $25/mo... using VOIP

etc...

I guess I am pretty frugal :-O

1) Dude, that's gross...I'd never trust anyone with my car that I'm not having sex with.

2) Uber is awesome...regular cabs suck, and public transit is okay except the "public" part. Yuck.

3) Travelzoo is better...but concept is still the same, paying more for the nicer hotel room.

9) Oh forgot about this one...I used to be a cord cutter, but now I have tricked out internet + premium cable & that fancy ass new DVR from Comcast. Gotta love that DVR and HBO Go...I stopped torrenting years ago, didn't feel like getting sued.

11) I work so much now I just have dress pants and dress shirts...I have the same jeans and t-shirts from college. I actually don't know how to dress up casual, I'm either in full on work mode or I look like a bum.

12) I'm an upgrade and speed freak so I pay extra for that "upgrade every 6 month" thing and opted to go with verizon for their 4G LTE.

Yeah you're downright a miser compared to me, hahah.

you guys are hilarious

1.) didn't know about flightcar...I will do this in the future! (as long as people know how to fill a CNG vehicle) - was also thinking about signing my car up for www.relayrides.com...but otherwise, I try not to travel if I can...$400 for a flight, $50 for a rental car....gas...food...it destroys my $600/month budget!

2.) UberX - wow, I wish I used this when I flew to Sacramento! I waited about an hour for public transit to pick me up

3.) staying by myself? 3 star and up...staying with friends/family? then it's 4 stars and up...always book on hotwire/priceline...

4.) I also go store brand - but for groceries I'm starting to do more research: for 1 month I'm going to track each item I buy, and shop around (and use coupons) to get the best price on food

5.) don't know how to cut my own hair - going to try next time!

6.) razor - like your gillete razor?!?

7.) I also wash my own cars - usually go to the $1 power was station and spend ~$5...no hose at my apt...

8.) I eat out too much...gotta learn to cook!

9.) I always watch at home, unless it's a new movie w' family

10.) I hardly d/l music anymore...I ride m/c to work, so no music plays...

11.) also only buy clothes from TJ Maxx clearance section (and target for khaki pants...also on clearance - usually <$10 for pants)

12.) how did you get cell phone for $25/month?! I got an unlimited text/data, 1200 mins, and it's ~$36/month

- Joined

- Aug 23, 2007

- Messages

- 2,950

- Reaction score

- 320

you guys are hilarious

1.) didn't know about flightcar...I will do this in the future! (as long as people know how to fill a CNG vehicle) - was also thinking about signing my car up for www.relayrides.com...but otherwise, I try not to travel if I can...$400 for a flight, $50 for a rental car....gas...food...it destroys my $600/month budget!

2.) UberX - wow, I wish I used this when I flew to Sacramento! I waited about an hour for public transit to pick me up

3.) staying by myself? 3 star and up...staying with friends/family? then it's 4 stars and up...always book on hotwire/priceline...

4.) I also go store brand - but for groceries I'm starting to do more research: for 1 month I'm going to track each item I buy, and shop around (and use coupons) to get the best price on food

5.) don't know how to cut my own hair - going to try next time!

6.) razor - like your gillete razor?!?

7.) I also wash my own cars - usually go to the $1 power was station and spend ~$5...no hose at my apt...

8.) I eat out too much...gotta learn to cook!

9.) I always watch at home, unless it's a new movie w' family

10.) I hardly d/l music anymore...I ride m/c to work, so no music plays...

11.) also only buy clothes from TJ Maxx clearance section (and target for khaki pants...also on clearance - usually <$10 for pants)

12.) how did you get cell phone for $25/month?! I got an unlimited text/data, 1200 mins, and it's ~$36/month

che,

1) what's that? Oh, that's right, this is not cali.

2) see 1

3) give me a clean bed and room is enough... unless the company is paying

4) store brand. Protein, carb when digested becomes the same amino acids and sugars.

5) cut my own hair? forget that! NOT interested in learning hair cutting, and definitely not gonna experiment on myself.

6) electric razor, change one every 3 years or so. 5 minutes saved shaving is 5 more minutes sleeping.

7) Car wash? I called it rain.

8) most days lunch in cafeteria or eat out. I love tasty food, probably the biggest luxury I afford myself.

9) cut the cord last year. 2 kids means no time for TV. Netflix + youtube + amazon prime do me just fine

10) NPR while driving, spotify for music

11) cloth? wife does shopping for fun, but then she gets me light purple/peach shirts... yeeeeah

12) just switched to t-mobile family plan. $70 + tax/mo with employee discount + cost of nexus 5.

- Joined

- Aug 13, 2010

- Messages

- 76

- Reaction score

- 20

12.) how did you get cell phone for $25/month?! I got an unlimited text/data, 1200 mins, and it's ~$36/month[/quote]

What phone service do you use? I pay over $76 per month for 200 text, unlimited data and 450mins per month with AT&T. And this includes a 15% discount.

What phone service do you use? I pay over $76 per month for 200 text, unlimited data and 450mins per month with AT&T. And this includes a 15% discount.

I use Virgin Mobile prepaid:

$45/month - unlimited text/data, 1200 minutes

-10% off employee discount

-5% store's debit card

-10% off - storewide weekend 10% off sale

--------------------------------------------

$34.62/month

without the weeked sale, it would normally be $38.47/month...but when they were offering the extra 10% off, I bought 6 monts worth...

$45/month - unlimited text/data, 1200 minutes

-10% off employee discount

-5% store's debit card

-10% off - storewide weekend 10% off sale

--------------------------------------------

$34.62/month

without the weeked sale, it would normally be $38.47/month...but when they were offering the extra 10% off, I bought 6 monts worth...

nevermind...I can't join your ranks...I'm not frugal at ALL!!

the middle 1/3rd of "Millionaire Next Door" says: Budget! which for me, translates to:

(1.) track ALL my expenses - for skipped expenses, I'm really just lying to myself

(2.) know my daily and monthly (and even yearly) budget goals

(3.) be consistent

(4.) put the rest into my loans

February Budget: I disgracefully spent $3,466 last month: A single guy, no kids, no house, no BMW, did not "go out and party every weekend"...I only attended 1 kids bday party.

That includes these mandatory expenses:

- $975 (rent)

-$180 (gas)

-$200 (church)

-$369 (student loans - this is low because I changed my payment plan...so the regular $1088 got pushed to next month)

-$25.20 (ebay fees for items I sold + $10 to see W2 electronically)

-$82.98 (utilities: gas, refuse, electricity, internet)

-------------------------------------------------------------

$1,633.82 - is what I spent after accounting for "fixed" mandatory expenses.

Random Monthly Money Eaters:

1.) The front right wheel bearing fell apart on the car! I couldn't do it myself, so I had Pep Boys do it...when they were in there, they said the left one was on its way out...so they did both: total charges (using all the coupons I could find online) $360.18. Add +$23.82 (oil change) + $41.42 for tools (I got a combo hydraulic jack and jack stands on sale so I can do my brakes next month) = $425 spent this month on auto maintenance.

2.) I had a lingering $455 bill from the ER visit I had in december...

So after those 2 "random monthly money eaters", I still spent $753 on controllable expenses!

-$148 was recreational eating ($42 w' friends, rest @ work) - each meal ranged from $2-$9....groceries $80 = total monthly food cost $228

-$7.63: clothes

-$70.33: motorcycle (bought a ramp, chocks, and brake lever)

-$30: quarters for laundry

-$34.77: household items/toiletry

-$137.23: "other" people expenses: wrapping paper/gifts for little kids' bday parties, surprise gifts, meals for a couple hobos, helping random people

-$68.08: My rental car + food from my Sacramento trip didn't post until Feb

-------------------

$175 - I have no idea where I spent this - these were cash withdrawals that I did not record the spending of

So March goals:

-track everything!!!

-spend less on food!! Set budget to $150/month! Eat more from home!

-cut back on spending money on hobo's/random people...helping multiple people adds up. Try only helping 2-3 people/month. Stop "surprising" friends with food. Make it @ home & drop off tupperware instead of ordering out.

-hopefully: won't end up in ER for anything, won't need to spend $$$ on car repairs, won't need to take any flights

the middle 1/3rd of "Millionaire Next Door" says: Budget! which for me, translates to:

(1.) track ALL my expenses - for skipped expenses, I'm really just lying to myself

(2.) know my daily and monthly (and even yearly) budget goals

(3.) be consistent

(4.) put the rest into my loans

February Budget: I disgracefully spent $3,466 last month: A single guy, no kids, no house, no BMW, did not "go out and party every weekend"...I only attended 1 kids bday party.

That includes these mandatory expenses:

- $975 (rent)

-$180 (gas)

-$200 (church)

-$369 (student loans - this is low because I changed my payment plan...so the regular $1088 got pushed to next month)

-$25.20 (ebay fees for items I sold + $10 to see W2 electronically)

-$82.98 (utilities: gas, refuse, electricity, internet)

-------------------------------------------------------------

$1,633.82 - is what I spent after accounting for "fixed" mandatory expenses.

Random Monthly Money Eaters:

1.) The front right wheel bearing fell apart on the car! I couldn't do it myself, so I had Pep Boys do it...when they were in there, they said the left one was on its way out...so they did both: total charges (using all the coupons I could find online) $360.18. Add +$23.82 (oil change) + $41.42 for tools (I got a combo hydraulic jack and jack stands on sale so I can do my brakes next month) = $425 spent this month on auto maintenance.

2.) I had a lingering $455 bill from the ER visit I had in december...

So after those 2 "random monthly money eaters", I still spent $753 on controllable expenses!

-$148 was recreational eating ($42 w' friends, rest @ work) - each meal ranged from $2-$9....groceries $80 = total monthly food cost $228

-$7.63: clothes

-$70.33: motorcycle (bought a ramp, chocks, and brake lever)

-$30: quarters for laundry

-$34.77: household items/toiletry

-$137.23: "other" people expenses: wrapping paper/gifts for little kids' bday parties, surprise gifts, meals for a couple hobos, helping random people

-$68.08: My rental car + food from my Sacramento trip didn't post until Feb

-------------------

$175 - I have no idea where I spent this - these were cash withdrawals that I did not record the spending of

So March goals:

-track everything!!!

-spend less on food!! Set budget to $150/month! Eat more from home!

-cut back on spending money on hobo's/random people...helping multiple people adds up. Try only helping 2-3 people/month. Stop "surprising" friends with food. Make it @ home & drop off tupperware instead of ordering out.

-hopefully: won't end up in ER for anything, won't need to spend $$$ on car repairs, won't need to take any flights

Last edited:

- Joined

- Aug 23, 2007

- Messages

- 467

- Reaction score

- 8

nevermind...I can't join your ranks...I'm not frugal at ALL!!

the middle 1/3rd of "Millionaire Next Door" says: Budget! which for me, translates to:

(1.) track ALL my expenses - for skipped expenses, I'm really just lying to myself

(2.) know my daily and monthly (and even yearly) budget goals

(3.) be consistent

(4.) put the rest into my loans

February Budget: I disgracefully spent $3,466 last month: A single guy, no kids, no house, no BMW, did not "go out and party every weekend"...I only attended 1 kids bday party.

That includes these mandatory expenses:

- $975 (rent)

-$180 (gas)

-$200 (church)

-$369 (student loans - this is low because I changed my payment plan...so the regular $1088 got pushed to next month)

-$25.20 (ebay fees for items I sold + $10 to see W2 electronically)

-$82.98 (utilities: gas, refuse, electricity, internet)

-------------------------------------------------------------

$1,633.82 - is what I spent after accounting for "fixed" mandatory expenses.

Random Monthly Money Eaters:

1.) The front right wheel bearing fell apart on the car! I couldn't do it myself, so I had Pep Boys do it...when they were in there, they said the left one was on its way out...so they did both: total charges (using all the coupons I could find online) $360.18. Add +$23.82 (oil change) + $41.42 for tools (I got a combo hydraulic jack and jack stands on sale so I can do my brakes next month) = $425 spent this month on auto maintenance.

2.) I had a lingering $455 bill from the ER visit I had in december...

So after those 2 "random monthly money eaters", I still spent $753 on controllable expenses!

-$148 was recreational eating ($42 w' friends, rest @ work) - each meal ranged from $2-$9....groceries $80 = total monthly food cost $228

-$7.63: clothes

-$70.33: motorcycle (bought a ramp, chocks, and brake lever)

-$30: quarters for laundry

-$34.77: household items/toiletry

-$137.23: "other" people expenses: wrapping paper/gifts for little kids' bday parties, surprise gifts, meals for a couple hobos, helping random people

-$68.08: My rental car + food from my Sacramento trip didn't post until Feb

-------------------

$175 - I have no idea where I spent this - these were cash withdrawals that I did not record the spending of

So March goals:

-track everything!!!

-spend less on food!! Set budget to $150/month! Eat more from home!

-cut back on spending money on hobo's/random people...helping multiple people adds up. Try only helping 2-3 people/month. Stop "surprising" friends with food. Make it @ home & drop off tupperware instead of ordering out.

-hopefully: won't end up in ER for anything, won't need to spend $$$ on car repairs, won't need to take any flights

I've followed this thread from the beginning and you're definitely doing good things, but don't let budgeting down to the last cent get the best of you. Though ballpark numbers are useful, meticulous tracking doesn't seem necessary as a pharmacist, especially since you don't have an insurmountable loan burden. I tend to follow Ramit Sethi's advice which is something along the lines of: don't waste time trying to save by cutting out $3 Starbucks lattes (if that's something you enjoy) and instead focus your energy on the big wins (ie, income streams from a side business, negotiating a raise at work or offer on a house, investing when you're young).

Obviously I'm not saying go out and blow $200 at the bar every weekend, but it caught me off-guard when you said you want to save money by helping fewer people/not surprising your friends as much (except for the hobos, that I can understand). If that's something you enjoy doing, don't let a little bit of money stop you from that. I know people say they're going to be really, really frugal now in order to retire early and live the good life later, but when you live that ultra-frugal life for so long, it doesn't just disappear overnight. I guess I'm just saying you don't want to be that 70 year old guy with $10 million in the bank who is inside cutting coupons instead of out enjoying life.

TL;DR You have more than enough financial sense to have your loans paid off in no time and money in the bank without the intense budgeting. Spend money on things you really enjoy and focus on the big wins.

Has anyone paid the minimum on their loans and tried investing the money they would put into their loans into stocks? E.g. pay the minimum, invest in your company's stock (bad idea in most cases) but with Obamacare on the way, I would speculate the stock of pharmacys will be going up in the future (e.g. RAD from .20 cents to $6.50). On top of that, usually, you can buy company stocks at 10-15% discount (but you have to hold for a year.) So if your student loan interest is 5-7%, crossing your fingers that your company stock doesn't dip and even possibly increase by a few percent (or whatever stocks you choose to invest in), you could be making 2-7%+> in profit that you can contribute towards student loans later. I know this is risky and very speculative. What are your thoughts?

I'm already a very aggressive trader already with 90% of my portfolio with the stock called GFA. My hopefully get out of student loans quickly plan.

EDIT: Also, since you have to pay taxes on your capital gains (15% on long term gains) does that mean you have to effectively make over 22% just to break even?

I'm already a very aggressive trader already with 90% of my portfolio with the stock called GFA. My hopefully get out of student loans quickly plan.

EDIT: Also, since you have to pay taxes on your capital gains (15% on long term gains) does that mean you have to effectively make over 22% just to break even?

Last edited:

rx golfer - yes, and I consistently got less than 6.8% trading individual stocks. If you can do it, go for it. Company stocks might be a good way, but my company never offered it. I gave up on trading individual stocks and decided on just opening a Vanguard account and letting it grow without my (bad luck?) interference.

homeslice: I see myself spending more, and enjoying more...when I have more. Right now I'm upside down - more school debt than wealth! Also - what are the big wins?

also fun for me is relative...when it's "active" fun - I'm finishing these small projects (like the truck bed), when it's "passive" fun, it's just watching TV/movies and eating...

but most importantly: if I don't budget, that means I don't have a plan. I won't know where my money goes...and I just end up spending more than I realize. yes it's boring/tedious, but do it once/month for 1 hour and I guarantee gains in your student loan payoff. I did it in its entirety as I waited at the laundromat for my clothes to clean and dry.

PAW's generally agree with these statements:

1.) I spend a lot of time planning my financial future

2.) Usually, I have sufficient time to handle my investments properly

3.) when it comes to allocation of my time, I place the management of my own assets before my other activities

UAW's generally say:

1.) I can't devote enough time to my investment decisions.

2.) I'm just too busy to spend time with my own financial affairs.

Planning is a strong habit of people who can accrue wealth..."Planning and wealth accumulation are significant correlates even among investors with modest incomes." They tend to spend more time than UAW's on it, and start it earlier in life. And it doesn't "require you to quick your day job" But know that it's also not an automatic slam dunk - planning is one of many key ingredients to becoming wealthy.

homeslice: I see myself spending more, and enjoying more...when I have more. Right now I'm upside down - more school debt than wealth! Also - what are the big wins?

also fun for me is relative...when it's "active" fun - I'm finishing these small projects (like the truck bed), when it's "passive" fun, it's just watching TV/movies and eating...

but most importantly: if I don't budget, that means I don't have a plan. I won't know where my money goes...and I just end up spending more than I realize. yes it's boring/tedious, but do it once/month for 1 hour and I guarantee gains in your student loan payoff. I did it in its entirety as I waited at the laundromat for my clothes to clean and dry.

PAW's generally agree with these statements:

1.) I spend a lot of time planning my financial future

2.) Usually, I have sufficient time to handle my investments properly

3.) when it comes to allocation of my time, I place the management of my own assets before my other activities

UAW's generally say:

1.) I can't devote enough time to my investment decisions.

2.) I'm just too busy to spend time with my own financial affairs.

Planning is a strong habit of people who can accrue wealth..."Planning and wealth accumulation are significant correlates even among investors with modest incomes." They tend to spend more time than UAW's on it, and start it earlier in life. And it doesn't "require you to quick your day job" But know that it's also not an automatic slam dunk - planning is one of many key ingredients to becoming wealthy.

Last edited:

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

I'm already a very aggressive trader already with 90% of my portfolio with the stock called GFA. My hopefully get out of student loans quickly plan.

Good to know you are only a student

and most importantly: if I don't budget, that means I don't have a plan. I won't know where my money goes...and I just end up spending more than I realize. yes it's boring/tedious, but do it once/month for 1 hour and I guarantee gains in your student loan payoff. I did it in its entirety as I waited at the laundromat for my clothes to clean and dry.

Budgeting pennies takes so much of your time. I just don't buy what I don't need.

pfft...momus: you don't need any instructions Mr. PAW!

3/1: met my food goal:

$2.33 - bag of pre-cut salad & banana

$1.08 - bean/cheese/rice burrito from del tco

$1.00 - box of wheat pasta for dinner (already had sauce)

-----------------------------------------

$4.41

I only had 1/2 the salad yesterday - going to finish it today for lunch with some more pasta mixed with chicken (already have a bag of frozen tenderloins)...couple fried eggs on toast and a cup of oatmeal for breakfast.

dinner - will make some mixed grains for starch, then some moong daal (indian lentils) for protein...but need some more affordable food options...

3/1: met my food goal:

$2.33 - bag of pre-cut salad & banana

$1.08 - bean/cheese/rice burrito from del tco

$1.00 - box of wheat pasta for dinner (already had sauce)

-----------------------------------------

$4.41

I only had 1/2 the salad yesterday - going to finish it today for lunch with some more pasta mixed with chicken (already have a bag of frozen tenderloins)...couple fried eggs on toast and a cup of oatmeal for breakfast.

dinner - will make some mixed grains for starch, then some moong daal (indian lentils) for protein...but need some more affordable food options...

3/2:

bfast - eggs & toast (had @ home)

lunch - salad from the day before, plus when I stopped by a friend's house saturday night, they put together a tupperware with beef, potatoes, and rice...added to that to my lunch. Made more pasta for dinner (mixed with chicken tenderloins).

3/3:

bfast - eggs & toast for bfast (had @ home)

lunch - I bought another bag of salad & banana for $2.33...and brought a peanut butter/honey sandwich for carbs/protein from home

total food expenditure for days 1-3: $6.74

currently: out of bread, pasta, cheese, and honey...need to spend < $8.26 to stay under budget.

Groceries: Bought a loaf of bread (22 slices for $2.47 - $0.11/slice)...and a pack of kraft american cheese singles (24 slices for $2.98 - $0.12/slice)

Total food expenditure for days 1-3: $6.74 + 5.45 = $12.19

bfast - eggs & toast (had @ home)

lunch - salad from the day before, plus when I stopped by a friend's house saturday night, they put together a tupperware with beef, potatoes, and rice...added to that to my lunch. Made more pasta for dinner (mixed with chicken tenderloins).

3/3:

bfast - eggs & toast for bfast (had @ home)

lunch - I bought another bag of salad & banana for $2.33...and brought a peanut butter/honey sandwich for carbs/protein from home

total food expenditure for days 1-3: $6.74

currently: out of bread, pasta, cheese, and honey...need to spend < $8.26 to stay under budget.

Groceries: Bought a loaf of bread (22 slices for $2.47 - $0.11/slice)...and a pack of kraft american cheese singles (24 slices for $2.98 - $0.12/slice)

Total food expenditure for days 1-3: $6.74 + 5.45 = $12.19

Last edited:

- Joined

- May 29, 2012

- Messages

- 487

- Reaction score

- 97

how can I be more frugal? I'm going to read stop acting rich!

I think you're doing pretty good in terms of being frugal, there's not much room for you to improve. A few things that frugal millionaires do:

1. Shop at thrift stores - I do this and found awesome deals.

2. Get $15 haircut (tip included) - I also cut my own hair ($0).

3. Spend very little in terms of entertainment - I only go to the movies when I get free tickets.

4. They think long-term costs benefit - Ex: Eat healthy so they don't have to spend more on medical bills later.

5. They spend very little money accessorizing themselves (Seiko and Timex are the number 1 and number 2 watches worn by these people) - I wear a $20 Timex.

6. They re-use/refurbish things (furniture, shoes, clothes, teabags, etc...)

- Joined

- Dec 14, 2006

- Messages

- 1,671

- Reaction score

- 819

I am doing my company's ESPP to the maximum $22.5k/yr. We get 10% discount and only have to hold for 90 days, so I see it as a fairly low risk and easy way to make 11+% profit, providing that you buy in at a low price. Over the past few years, I've been making about $8k/yr profit, which would easily beat student loan interest.Has anyone paid the minimum on their loans and tried investing the money they would put into their loans into stocks? E.g. pay the minimum, invest in your company's stock (bad idea in most cases) but with Obamacare on the way, I would speculate the stock of pharmacys will be going up in the future (e.g. RAD from .20 cents to $6.50). On top of that, usually, you can buy company stocks at 10-15% discount (but you have to hold for a year.) So if your student loan interest is 5-7%, crossing your fingers that your company stock doesn't dip and even possibly increase by a few percent (or whatever stocks you choose to invest in), you could be making 2-7%+> in profit that you can contribute towards student loans later. I know this is risky and very speculative. What are your thoughts?

I'm already a very aggressive trader already with 90% of my portfolio with the stock called GFA. My hopefully get out of student loans quickly plan.

But without the ESPP discount, investing in individual stocks is too risky. What is GFA? Gafisa S.A., a Brazilian homebuilder? That would be crazy.

No, you only pay taxes on the profit, so you would have have to make about 8% x 0.85 = 6.8% after tax, to beat student loan interest.EDIT: Also, since you have to pay taxes on your capital gains (15% on long term gains) does that mean you have to effectively make over 22% just to break even?

Actually for an ESPP, the discount gets taxed at full income tax rates when you sell the stock, so that part would get taxed at 25-28%.

I am doing my company's ESPP to the maximum $22.5k/yr. We get 10% discount and only have to hold for 90 days, so I see it as a fairly low risk and easy way to make 11+% profit, providing that you buy in at a low price. Over the past few years, I've been making about $8k/yr profit, which would easily beat student loan interest.

But without the ESPP discount, investing in individual stocks is too risky. What is GFA? Gafisa S.A., a Brazilian homebuilder? That would be crazy.

No, you only pay taxes on the profit, so you would have have to make about 8% x 0.85 = 6.8% after tax, to beat student loan interest.

Actually for an ESPP, the discount gets taxed at full income tax rates when you sell the stock, so that part would get taxed at 25-28%.

Thank you for your input. I'm glad someone else thinks this way and i'm not entirely crazy for thinking about repaying my loans this way. I have actually done a lot of research on GFA and follow up on it everyday. I bought in before the big boys (Goldman (owned by Buffett), Blackrock and other major hedge fund companies started to get into it...). Lets just say if i'm right and I hold until 2016, good bye student loans. If not, then I will still be standing on my two feet. So it's a risk that I can live with. But I won't wore bore you guys with the details of this risky stock. I do plan on diversifying after graduation though. Thanks for the clarification on the tax details.

Therefore, in order to break even on an average rate of 7.1%, if I invested $10,000 annually I would have to make roughly $710 + 213 (30% tax on capital gains) = ~ $950. Therefore, by utilizing ESPP, as long as your company stock does not go down, you will break even.

Last edited:

rxgolfer - if you can do it, then go for it! like I said, I gave up on it...and no espp for me...

The more people I talk to about it, the more I want to do it. I've always been a risk taker (which is why I chose to go with a regional floating position) vs the conventional district float/staff positions. PS Vanguard is great! Opened up a IRA account with them as a freshmen in college. Own the total stock market fund (VTSMX) and the total international stock fund (VMMXX). My only regret is just only converting it into a roth IRA 3 days ago.

EDIT: My next step is evaluating the opportunity cost of both scenarios by creating an excel worksheet. Anyone have a template so I don't have to start from scratch? lol

Last edited:

- Joined

- Feb 22, 2007

- Messages

- 1,445

- Reaction score

- 382

Interesting…I have always found myself to be a pretty frugal person but there are definitely things I have done as a pharmacist that I would have never ever done as a poverty-stricken student. For instance:

1) Bought a Coach purse (at an outlet store though)

2) Usually go out to eat at least once a week (at nicer restaurants. No Chipotle)

3) Take at least one vacation per year, maybe upwards of $5000 per trip

On the other hand, I drive a 15 year old POS and live in a dinky little ranch house, so there's that.

1) Bought a Coach purse (at an outlet store though)

2) Usually go out to eat at least once a week (at nicer restaurants. No Chipotle)

3) Take at least one vacation per year, maybe upwards of $5000 per trip

On the other hand, I drive a 15 year old POS and live in a dinky little ranch house, so there's that.

@ rxgolf - no spread sheet...but you definitely have to have one!

@ sally: the last line is what I've noticed about "wealth"...most people "can" afford a lot of things - it just means they spend less on other things so they can free up more money to spend it on what they want. What "millionaire next door" talks about - are the people who spend more on everything: 3 leased cars, $10k/month mortgage, premium cable package @ $200/month...those people "look" rich, but in reality have less net worth because they spend so much of their income on their high consumption lifestyle

Day 4 of March:

bfast: 2 eggs and toast, 2 slices of cheese, mayo (@ home)

lunch: salad (purchased yday), banana (will buy @ work), chicken tenderloins pan fried with wheat bread/mayo/cheese

dinner: ???

I'm out of pasta - going to buy another box today...I have a 5lb Turkey in the freezer - I moved it down to the fridge today so that I can bake it tomorrow (google says defrost 1 day/4lbs...should be ready by tomorrow)...also going to take a shot at mashed potatoes. Will also buy 10-15lbs of chicken for $0.99/lb tomorrow, and between the 2 I should have enough meat for the month.

Grocery list from work today: potatoes, chili peppers, ginger, garlic, butter. Tomorrow: buy roti's (indian bread) from Indian market...

food goal Wednesday: Bake turkey, carve, freeze most of it. Try to make mashed potatoes as supplement. Make moong daal (indian lentils) and rice, give some of it to friends at church, freeze some.

food goal Thursday: Indian chicken?? Also - google cheap/healthy food recipe's...

Food should last Thu/Fri/Sat/Sun/Mon

@ sally: the last line is what I've noticed about "wealth"...most people "can" afford a lot of things - it just means they spend less on other things so they can free up more money to spend it on what they want. What "millionaire next door" talks about - are the people who spend more on everything: 3 leased cars, $10k/month mortgage, premium cable package @ $200/month...those people "look" rich, but in reality have less net worth because they spend so much of their income on their high consumption lifestyle

Day 4 of March:

bfast: 2 eggs and toast, 2 slices of cheese, mayo (@ home)

lunch: salad (purchased yday), banana (will buy @ work), chicken tenderloins pan fried with wheat bread/mayo/cheese

dinner: ???

I'm out of pasta - going to buy another box today...I have a 5lb Turkey in the freezer - I moved it down to the fridge today so that I can bake it tomorrow (google says defrost 1 day/4lbs...should be ready by tomorrow)...also going to take a shot at mashed potatoes. Will also buy 10-15lbs of chicken for $0.99/lb tomorrow, and between the 2 I should have enough meat for the month.

Grocery list from work today: potatoes, chili peppers, ginger, garlic, butter. Tomorrow: buy roti's (indian bread) from Indian market...

food goal Wednesday: Bake turkey, carve, freeze most of it. Try to make mashed potatoes as supplement. Make moong daal (indian lentils) and rice, give some of it to friends at church, freeze some.

food goal Thursday: Indian chicken?? Also - google cheap/healthy food recipe's...

Food should last Thu/Fri/Sat/Sun/Mon

Last edited:

- Joined

- Feb 24, 2009

- Messages

- 2,130

- Reaction score

- 208

You guys are lucky for your health ! I think our medical bills have been averaging around $1,000/month incl premiums.

Last edited:

- Joined

- Dec 19, 2004

- Messages

- 10,410

- Reaction score

- 4,038

totall forgot: today is national pancake day!

cool it on the pancakes, those will cost you more later if you overdo it.

more budget:

3/4:

$16.96 - gas in moto bike

$9.74 - metal strip for bracket in truck bed

$23.58 - nuts/bolts/washers/etc. for truck bed

3/6:

$3.23 - vanilla milkshake @ jack in the box =/

$15.06 - frozen chicken from Ralphs (15lbs)

$5.45 - cheese, loaf of bread

$20.67 - natural gas fuel to fill up truck

**good deed for the day: helped older friend pickup living room furniture

3/7

$13.52 - gas to fill up bike

$6.97 - can of crushed tomatoes, container of yogurt for making indian chicken

$35.74 - gas/recycling/trash bill

**good deed for the day: dude I only met once broke down on the freeway; picked him up with my new truck setup

3/8

$11.85 - air filter for dirtbike/supermoto project

$5.90 - replacement headlight switch for truck

$5.77 - chipotle =/

$2.92 - del taco =/

$22.26 - 2 stroke oil, transmission fluid for dirtbike/supermoto project

$12.94 - spark plug & brake fluid for dirtbike/supermoto project

3/9

$15 - replacement brake pads for dirtbike/supermoto project

Totals

Total food expenditure for 8 days: $39.17

Total gas expenditure for 8 days: $51.15 (would've been less if I didn't "help" the 2 friends above)

Total auto maintenance/repair expenditure: $5.90

Total recreational expenditure: $95.37

-------------------------------------------------------

Assessment: this is easy

-FOOD: despite eating out twice, I was under budget by $0.83 - gotta eat at home more though and cook some of that chicken...and this might be too little...

-GASOLINE: ride the bike more

-RECREATIONAL: it doesn't matter if it's drinking, or dinner with friends, or motorcycles - this made up almost half of my weekly expenditure. The only way NOT to spend that is find cheaper hobbies, or just stay at home/watch netflix...but I love dirtbikes/motorcycles...I'd do it anyways. Once this bike is done with the initial setup, I can likely enjoy it for $40/month...but that's it: NO MORE projects, recreational activities, trips etc.

**edited to remove facebook-esque material**

3/4:

$16.96 - gas in moto bike

$9.74 - metal strip for bracket in truck bed

$23.58 - nuts/bolts/washers/etc. for truck bed

3/6:

$3.23 - vanilla milkshake @ jack in the box =/

$15.06 - frozen chicken from Ralphs (15lbs)

$5.45 - cheese, loaf of bread

$20.67 - natural gas fuel to fill up truck

**good deed for the day: helped older friend pickup living room furniture

3/7

$13.52 - gas to fill up bike

$6.97 - can of crushed tomatoes, container of yogurt for making indian chicken

$35.74 - gas/recycling/trash bill

**good deed for the day: dude I only met once broke down on the freeway; picked him up with my new truck setup

3/8

$11.85 - air filter for dirtbike/supermoto project

$5.90 - replacement headlight switch for truck

$5.77 - chipotle =/

$2.92 - del taco =/

$22.26 - 2 stroke oil, transmission fluid for dirtbike/supermoto project

$12.94 - spark plug & brake fluid for dirtbike/supermoto project

3/9

$15 - replacement brake pads for dirtbike/supermoto project

Totals

Total food expenditure for 8 days: $39.17

Total gas expenditure for 8 days: $51.15 (would've been less if I didn't "help" the 2 friends above)

Total auto maintenance/repair expenditure: $5.90

Total recreational expenditure: $95.37

-------------------------------------------------------

Assessment: this is easy

-FOOD: despite eating out twice, I was under budget by $0.83 - gotta eat at home more though and cook some of that chicken...and this might be too little...

-GASOLINE: ride the bike more

-RECREATIONAL: it doesn't matter if it's drinking, or dinner with friends, or motorcycles - this made up almost half of my weekly expenditure. The only way NOT to spend that is find cheaper hobbies, or just stay at home/watch netflix...but I love dirtbikes/motorcycles...I'd do it anyways. Once this bike is done with the initial setup, I can likely enjoy it for $40/month...but that's it: NO MORE projects, recreational activities, trips etc.

**edited to remove facebook-esque material**

Last edited:

well, well, well....

March: I did NOT budget - I just spent whatever I wanted. Never checked my account...never set limits. Just went on impulse, bought a dirt bike for myself because it was a good deal, restored someone else's dirtbike as a surprise to him (on my dime because he lost his job), and loaned a family member $1000 so he doesn't have to pay high interest on a loan and is making monthly payments back to me.

Crazy part - I did not "feel" like I was spending a lot...

Earned: $5,224 (hours cut to 32-36/week and a day or 2 the scheduler didn't put me on, and I wasn't able to bill for vacation)

Spent: $5,440

Made ZERO extra payments towards my loans.

How did I spend more than I made?

$2,264 - Rent/gas/food/utilities/student loans: - food was a disgraceful $280 - gas was $236 since I would spend an entire tank driving to the desert for riding.

$800 - dirtbike I got for well under the market price (going to ride 3-6 months & flip it)

$1000 - loan to family member - do those even get repaid?? Not sure I can count on that...

$526 - money that went into restoring a mini supermoto for someone else (currently for sale - when sold, will cover all expenses of build)

~$850 - controllable expenses - clothes, tools, cash ATM withdrawals, church tithing, buying clearance kitchenware @ Target, new phone since old one got covered in brake fluid

MAY GOALS:

-Increase Food Budget to $200 (I keep spending $220-$270...I need to be practical about actual spending)

-Start couponing - follow guide @ krazycouponlady.com

-Add dirtbike riding to budget - let's try setting it up at $150? -also no more "restoring" any bikes - it's ALWAYS cheaper to buy a completed bike, then restore yourself

-LIMIT helping people to $25/month (includes making people food) - at least 2x/week I would make $15 of chicken curry/rice and just give it away to the hardworking humble-income friends from church. No more loans to family - I have my own loans to pay!

-just keep the damn dirtbike for now...whenever I sell one, I get an itch and buy another anyways...keep this one for now...just set a monthly budget - once that runs out, I stop riding.

-absolutely ZERO - clearance item shopping, ATM cash withdrawals, clothes, tools, electronics, etc.

-by April - pay off smallest student loan to lower monthly payments by $248

Hoping to earn ~$6,000 take home - let's budget ~$3,000 for rent/loan auto payment/dirtbike/food/gas/car expenses and make a $3,000 early payment this month!!

edit - starting today - chicken on sale again @ $0.99/lb - bought 20 pounds!

March: I did NOT budget - I just spent whatever I wanted. Never checked my account...never set limits. Just went on impulse, bought a dirt bike for myself because it was a good deal, restored someone else's dirtbike as a surprise to him (on my dime because he lost his job), and loaned a family member $1000 so he doesn't have to pay high interest on a loan and is making monthly payments back to me.

Crazy part - I did not "feel" like I was spending a lot...

Earned: $5,224 (hours cut to 32-36/week and a day or 2 the scheduler didn't put me on, and I wasn't able to bill for vacation)

Spent: $5,440

Made ZERO extra payments towards my loans.

How did I spend more than I made?

$2,264 - Rent/gas/food/utilities/student loans: - food was a disgraceful $280 - gas was $236 since I would spend an entire tank driving to the desert for riding.

$800 - dirtbike I got for well under the market price (going to ride 3-6 months & flip it)

$1000 - loan to family member - do those even get repaid?? Not sure I can count on that...

$526 - money that went into restoring a mini supermoto for someone else (currently for sale - when sold, will cover all expenses of build)

~$850 - controllable expenses - clothes, tools, cash ATM withdrawals, church tithing, buying clearance kitchenware @ Target, new phone since old one got covered in brake fluid

MAY GOALS:

-Increase Food Budget to $200 (I keep spending $220-$270...I need to be practical about actual spending)

-Start couponing - follow guide @ krazycouponlady.com

-Add dirtbike riding to budget - let's try setting it up at $150? -also no more "restoring" any bikes - it's ALWAYS cheaper to buy a completed bike, then restore yourself

-LIMIT helping people to $25/month (includes making people food) - at least 2x/week I would make $15 of chicken curry/rice and just give it away to the hardworking humble-income friends from church. No more loans to family - I have my own loans to pay!

-just keep the damn dirtbike for now...whenever I sell one, I get an itch and buy another anyways...keep this one for now...just set a monthly budget - once that runs out, I stop riding.

-absolutely ZERO - clearance item shopping, ATM cash withdrawals, clothes, tools, electronics, etc.

-by April - pay off smallest student loan to lower monthly payments by $248

Hoping to earn ~$6,000 take home - let's budget ~$3,000 for rent/loan auto payment/dirtbike/food/gas/car expenses and make a $3,000 early payment this month!!

edit - starting today - chicken on sale again @ $0.99/lb - bought 20 pounds!

Last edited:

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

$1000 - loan to family member - do those even get repaid?? Not sure I can count on that...

Any kind of personal loan will 3/4th of the time never get repaid. You can set up a legal contract to pay back but this tends to kill relationship with that person. You better off treating this as a gift and only give what you can afford, i.e., lesser than $1000. It will hurt a lot less financially and emotionally. You will be viewed as generous and you get to keep the relationship.

- Joined

- Feb 26, 2003

- Messages

- 8,860

- Reaction score

- 3,420

Earned: $5,224 (hours cut to 32-36/week and a day or 2 the scheduler didn't put me on, and I wasn't able to bill for vacation)

How does the scheduler determine how many hours do you get per week?

- Joined

- Feb 26, 2003

- Messages

- 8,860

- Reaction score

- 3,420

I doubt you are going get your loan back. I would just give it as a gift. Makes you look good and generous. He may remember it and one day, return the favor.

A family member of mine lost his job. I decided to help him out by paying for gas (so he can go to interviews), buying work out clothes (so he wouldnt get fat). I took him out so he doesn't feel depress. A few months later, I found out he was maxing out his credit card on this girl. She of course dumped him. He ended up owning 10 k on his credit card.

I didn't help him at all. I just made it worse. People who are in debt will always be in debt. It doesn't matter how much money they have. They don't have any financial sense.

A family member of mine lost his job. I decided to help him out by paying for gas (so he can go to interviews), buying work out clothes (so he wouldnt get fat). I took him out so he doesn't feel depress. A few months later, I found out he was maxing out his credit card on this girl. She of course dumped him. He ended up owning 10 k on his credit card.

I didn't help him at all. I just made it worse. People who are in debt will always be in debt. It doesn't matter how much money they have. They don't have any financial sense.

yup...it's a gift...

what I've noticed is that some people take help, are forever grateful, are humble for it, and try to pay you back any way they can. Other people are quick to take help, waste it, don't seem to care what you did, take advantage of your generosity, and have the audacity to ask for more, with no limits. Unfortunately these were some of my classmates in school...being close to failing a tough exam through a stressful semester shows you the true heart of people.

new people - I now "test" people before helping them with my time...and now have a very select few that I help without expectation of return.

what I've noticed is that some people take help, are forever grateful, are humble for it, and try to pay you back any way they can. Other people are quick to take help, waste it, don't seem to care what you did, take advantage of your generosity, and have the audacity to ask for more, with no limits. Unfortunately these were some of my classmates in school...being close to failing a tough exam through a stressful semester shows you the true heart of people.

new people - I now "test" people before helping them with my time...and now have a very select few that I help without expectation of return.

- Joined

- Mar 20, 2010

- Messages

- 226

- Reaction score

- 78

I just found this thread, but I really like following your progress Muse600. I'm graduating in a couple weeks and it's very motivating to help me create a budget and get rid of my loans! Thanks and keep posting!

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

Anyone have suggestions or know of any better ways to pay off student loans?

Here's my situation:

-6 month "oh no!" emergency fund already setup

-401k auto deducted from paycheck & maxed out

-RPh School Loans: $77,187 left over (started with ~$115,000, 20 months ago)

-motorcycle & truck paid off (& truck is cheap - old, runs on CNG, $2/gallon to drive, insurance $600/year)

-no medical needs/bills

-selfish no compromise wants: won't move from my apt (or retail job) in SoCal - because of friend nearby, won't live w' parents because they live in *freezing* central MA (no Rph jobs there anyways), and I love my $1,000 motorcycle.

Rent (includes water): $975 in SoCal - 1br/1ba, month-to-month

Cell phone: $34/month - 1200 mins, unlimited text/web

Home internet: $30/month

Electricity: ~$50/month - might go down, because I stopped using a 1,500W space heater & got a 75W electric blanket - yes SoCal @ night is in the 40's...apt gets into the 50's & I'm skinny.

Gas/Trash bill: ~$40/month

-----------------------------------------

$1,129/month - fixed

So my goal is:

My Monthly Takehome Pay (variable...but roughly ~$6,000)

-$1,129 fixed expenses

-$1,300student loan auto payment

-$100 (estimated average monthly car insurance/registration costs)

-$572/month (for food, gas, & hopefully everything else including car maintenance, clothes, interacting with other people etc.)

---------------------------------------------------------------------

Balance = goes towards my loans every 2-weeks when I get paid....so I should be able to do ~$2,800/month

Loans: two at 6.55%, one at 6.05% - start with the higher interest loans

I sold as much excess stuff from my apartment (car tools, motorcycle parts, cosmetic furniture), try to pick up extra shifts whenever possible (but it's rare...I heard we have a lot of floaters now), & 100% of my tax return & any little bonus I receive will go straight to greatlakes.

any further suggestions?

good thread !!

April Expenses Done:

Earned: $6,670

Spent: $3,910

------------------------

$2760 = early loan payment for this month

****Breakdown****

$1790 - Rent + Loan Autopayment

$127.03 - Utilities: 2 mo's of internet, gas/recycling/trash/electricity

$267.39 - Food ($32.12 "eating out", $66.67 eating @ work, $168.60 groceries)

$554 - Gas - I drove out to the desert SEVERAL times to go dirt bike riding...I like riding enough that I don't mind this expense

$276 - motorcycle upkeep/upgrade expenses - oil changes, parts on track bike, taxes/registration fees, other maintenance fluid/consumption items

$51.55 - track gate/entry fees

$133 - "other people" - took a church family to dinner and paid for everyone (~$35), went to a wedding (~$50), friend asked me if there was a replacement for flonase, so I bought him Nasacort

$302 - cash atm w' drawals, and stuff bought at retail stores that I didn't keep the receipt - not exactly sure what these are

$10.80 - new watch battery for my Fossil watch

$198 - car expenses - oil change, new air filter, d-rings for truck bed, ramp for bike, aura bass shakers

~$200 - home stuff, miscellaneous additional contributions to church ministries

Goal: Make $3,000 loan payment this month

I was $240 short...

How can I get there?

1.) LIMIT my monthly dirtbike/motorcycle stuff - that easily makes up $240...

2.) Set budget for car maintenance stuff

3.) Cut back on "other" people expenses

4.) Start coupon-cutting/getting organized with preparing food so I don't eat out as much - but I'm trying to build muscle & need to keep my intake up, so it's tough to be frugal on food

work...ride...lift...knock out loans

Earned: $6,670

Spent: $3,910

------------------------

$2760 = early loan payment for this month

****Breakdown****

$1790 - Rent + Loan Autopayment

$127.03 - Utilities: 2 mo's of internet, gas/recycling/trash/electricity

$267.39 - Food ($32.12 "eating out", $66.67 eating @ work, $168.60 groceries)

$554 - Gas - I drove out to the desert SEVERAL times to go dirt bike riding...I like riding enough that I don't mind this expense

$276 - motorcycle upkeep/upgrade expenses - oil changes, parts on track bike, taxes/registration fees, other maintenance fluid/consumption items

$51.55 - track gate/entry fees

$133 - "other people" - took a church family to dinner and paid for everyone (~$35), went to a wedding (~$50), friend asked me if there was a replacement for flonase, so I bought him Nasacort

$302 - cash atm w' drawals, and stuff bought at retail stores that I didn't keep the receipt - not exactly sure what these are

$10.80 - new watch battery for my Fossil watch

$198 - car expenses - oil change, new air filter, d-rings for truck bed, ramp for bike, aura bass shakers

~$200 - home stuff, miscellaneous additional contributions to church ministries

Goal: Make $3,000 loan payment this month

I was $240 short...

How can I get there?

1.) LIMIT my monthly dirtbike/motorcycle stuff - that easily makes up $240...

2.) Set budget for car maintenance stuff

3.) Cut back on "other" people expenses

4.) Start coupon-cutting/getting organized with preparing food so I don't eat out as much - but I'm trying to build muscle & need to keep my intake up, so it's tough to be frugal on food

work...ride...lift...knock out loans

Last edited:

- Joined

- Apr 29, 2014

- Messages

- 529

- Reaction score

- 233

Really interesting thread! Good for you for being so on top of your finances at a young age. I wish I had shown such wisdom when I was young and dumb.

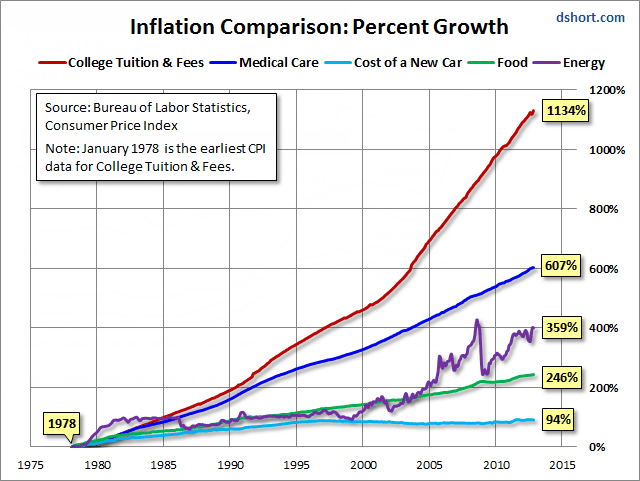

You know, this was one of the primary considerations that led me to choose to go to school overseas. How is it you can attend university in Germany or Spain for less than 5k a year in fees, but in the States you pay with your blood? It's inexcusable. I'm aware some will argue that it's due to higher income taxes, but that only answers part of the problem. Why has medical school tuition, for instance, risen so rapidly in comparison with inflation? Because the loans are being given out like candy. I think that's the only answer that makes any sense to me.

Enslaving the Next Generation

http://armstrongeconomics.com/2014/02/03/enslaving-the-next-generation/

You know, this was one of the primary considerations that led me to choose to go to school overseas. How is it you can attend university in Germany or Spain for less than 5k a year in fees, but in the States you pay with your blood? It's inexcusable. I'm aware some will argue that it's due to higher income taxes, but that only answers part of the problem. Why has medical school tuition, for instance, risen so rapidly in comparison with inflation? Because the loans are being given out like candy. I think that's the only answer that makes any sense to me.

- Joined

- Mar 12, 2014

- Messages

- 1,728

- Reaction score

- 563

Really interesting thread! Good for you for being so on top of your finances at a young age. I wish I had shown such wisdom when I was young and dumb.

You know, this was one of the primary considerations that led me to choose to go to school overseas. How is it you can attend university in Germany or Spain for less than 5k a year in fees, but in the States you pay with your blood? It's inexcusable. I'm aware some will argue that it's due to higher income taxes, but that only answers part of the problem. Why has medical school tuition, for instance, risen so rapidly in comparison with inflation? Because the loans are being given out like candy. I think that's the only answer that makes any sense to me.

yup, higher education in the States is business, a big business. They will raise tuition as long and as high as the students will be willing or able to pay. Most students are only afford to pay with federal loans that they are qualified for. There is no coincidence that the national avg tuition for undergrad, grad / health professional schools are about the same as the annual federal limit on Direct Stafford Loan + other federal loans combined for a student. Lower those limits and / or cut those federal loan programs for private colleges / universities, and I'd bet their tuition would drop like a rock.

Unfortunately, private universities are private enterprises. We have no hope that they will want to reduce their tuition unless they absolutely have to. They will continue to raise their tuition as we cannot lower limits or cut federal loan qualification for students going to private schools.

But federal and state government could provide incentives for those private schools to reduce / lower their ever-increasing tuition by expanding and supporting public colleges and universities to provide alternatives and more choices for students. So we need to get involved. Nominate and vote for the politicians who are supporting this ideas.

http://www.nytimes.com/2013/02/01/opinion/my-valuable-cheap-college-degree.html?_r=0

http://www.huffingtonpost.com/2012/...ges-universities-tuition-costs_n_1331180.html

http://www.forbes.com/sites/jamesma...-year-brick-and-mortar-degree-for-only-10000/

https://www.google.com/search?q=10K tuition&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US

Muse, I'm not going to lie, reading this thread made me sad for you. I thought it was terrible that someone could work so hard to get through pharmacy school only to live like they were making minimum wage. Then I saw that you managed to make an extra $2700 payment on your student loans this month and realized you are on to something. I wish I had the willpower to pull something like this off.

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

April Expenses Done:

Earned: $6,670

Spent: $3,910

------------------------

$2760 = early loan payment for this month

****Breakdown****

$1790 - Rent + Loan Autopayment

$127.03 - Utilities: 2 mo's of internet, gas/recycling/trash/electricity

$267.39 - Food ($32.12 "eating out", $66.67 eating @ work, $168.60 groceries)

$554 - Gas - I drove out to the desert SEVERAL times to go dirt bike riding...I like riding enough that I don't mind this expense

$276 - motorcycle upkeep/upgrade expenses - oil changes, parts on track bike, taxes/registration fees, other maintenance fluid/consumption items

$51.55 - track gate/entry fees

$133 - "other people" - took a church family to dinner and paid for everyone (~$35), went to a wedding (~$50), friend asked me if there was a replacement for flonase, so I bought him Nasacort

$302 - cash atm w' drawals, and stuff bought at retail stores that I didn't keep the receipt - not exactly sure what these are

$10.80 - new watch battery for my Fossil watch

$198 - car expenses - oil change, new air filter, d-rings for truck bed, ramp for bike, aura bass shakers

~$200 - home stuff, miscellaneous additional contributions to church ministries

Goal: Make $3,000 loan payment this month

I was $240 short...

How can I get there?

1.) LIMIT my monthly dirtbike/motorcycle stuff - that easily makes up $240...

2.) Set budget for car maintenance stuff

3.) Cut back on "other" people expenses

4.) Start coupon-cutting/getting organized with preparing food so I don't eat out as much - but I'm trying to build muscle & need to keep my intake up, so it's tough to be frugal on food

work...ride...lift...knock out loans

I hope you have a mint.com account.

tried mint...quicken...excel...the online breakdown with bofa...

I'm a bit oldschool and actually like the excel method...takes me about 25 mins/month to do it

thanks dude...although I do admit to being an oddball...I do live relatively frugally, but it's because I choose to. Anyone making ~$6,600/month can live comfortably with a $120k student loan...you don't have to live like a pauper...and most of my pharmacy grad friends certainly don't. But to be debt free in 18 months vs. holding it another 8 years is my motivation.

but in all my forum exploration, I never found any tricks for student loans. Just live below your means and pay the excess towards loans...the tricky part is just the willpower and effort to live below your means.

I'm a bit oldschool and actually like the excel method...takes me about 25 mins/month to do it

Muse, I'm not going to lie, reading this thread made me sad for you. I thought it was terrible that someone could work so hard to get through pharmacy school only to live like they were making minimum wage. Then I saw that you managed to make an extra $2700 payment on your student loans this month and realized you are on to something. I wish I had the willpower to pull something like this off.

thanks dude...although I do admit to being an oddball...I do live relatively frugally, but it's because I choose to. Anyone making ~$6,600/month can live comfortably with a $120k student loan...you don't have to live like a pauper...and most of my pharmacy grad friends certainly don't. But to be debt free in 18 months vs. holding it another 8 years is my motivation.

but in all my forum exploration, I never found any tricks for student loans. Just live below your means and pay the excess towards loans...the tricky part is just the willpower and effort to live below your means.

Last edited:

- Joined

- Nov 30, 2009

- Messages

- 213

- Reaction score

- 46

This thread should be stickied in the pre pharm forum so these kids can see how lavishly some of you pharmacists are living with all that debt. You only live once guys. Spending your 20s and 30's eating ramen and not getting car washes to save a nickel seems a little insane, but to each their own I guess.

Similar threads

- Replies

- 6

- Views

- 2K