- Joined

- Sep 16, 2008

- Messages

- 3,009

- Reaction score

- 2,495

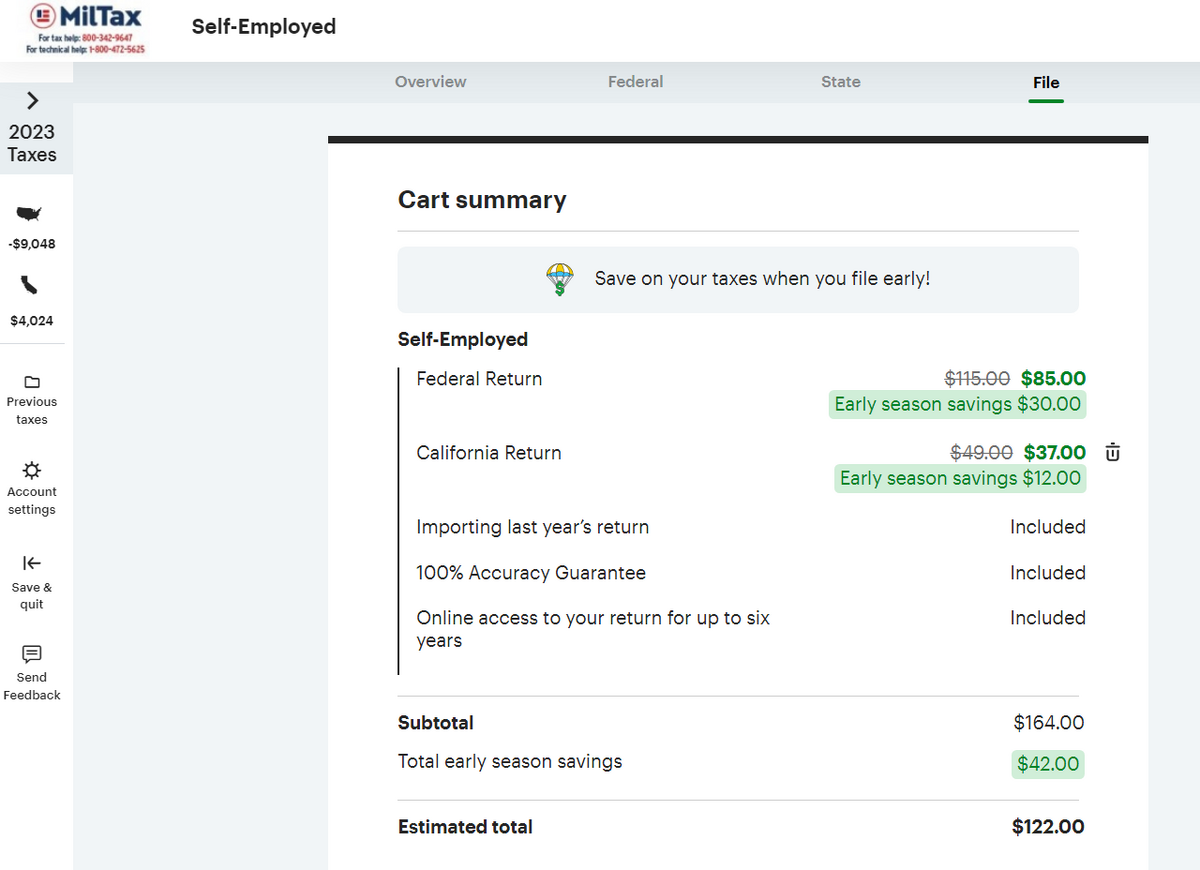

Anybody else using the the free (via Mil Tax Access MilTax Preparation and e-Filing | Military OneSource ), but then at the end, when you're trying to actually file, getting charged by HNR block? see screenshot

Is this because I'm using the 'Self Employment' mode? (for reported self employment incoming, requiring a Schedule C). Is that mode not included in the 'free' version for military?

Is this because I'm using the 'Self Employment' mode? (for reported self employment incoming, requiring a Schedule C). Is that mode not included in the 'free' version for military?