- Joined

- Nov 3, 2015

- Messages

- 1,354

- Reaction score

- 1,101

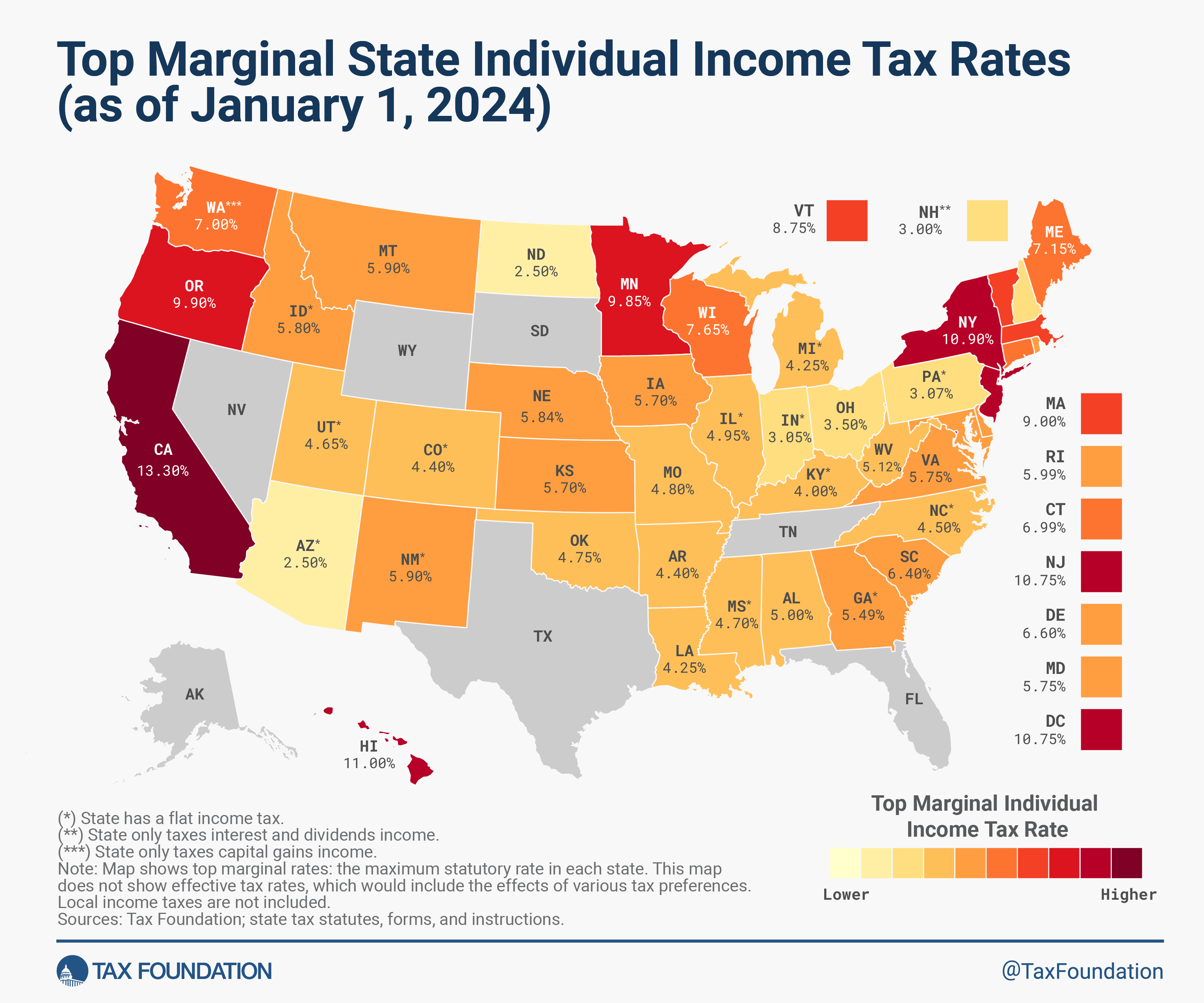

A few examples below for married couples net income after federal,state and local taxes. in a midwest state

400k --> after tax 277k

500k--> after tax 335k

600k--> after tax 390k

Does the idea that even if we bust our tail and generate an extra 100k, at these income levels, your going to see roughly half of it go to uncle sam. Does this bother or kill the desire to do this for many of you unless there was some unexpected need for it? For me its an eye opener that it becomes this way as people approach these levels.

400k --> after tax 277k

500k--> after tax 335k

600k--> after tax 390k

Does the idea that even if we bust our tail and generate an extra 100k, at these income levels, your going to see roughly half of it go to uncle sam. Does this bother or kill the desire to do this for many of you unless there was some unexpected need for it? For me its an eye opener that it becomes this way as people approach these levels.