I don't see the connection between increasing tuition and increase in the number of dental schools. Won't the applicant perception of the profession decrease knowing that it will be more saturated than it is at the moment? Especially now that mid-level providers are gaining territory? And won't it also decrease since corporations are making working conditions devoid of autonomy with low salaries?

I think that the demand for dental education will decrease at least noticeably primarily because of these factors and will eventually cause private schools to compete with public school tuition rates. This happened in the 70s as shown: (Full article:

http://news.vin.com/VINNews.aspx?articleId=27460)

Additionally, analogous to the dental profession is law. Plenty of articles (e.g.

http://www.nytimes.com/2011/01/09/business/09law.html?pagewanted=all,

http://www.nytimes.com/2013/01/31/e...fall-as-costs-rise-and-jobs-are-cut.html?_r=1) elucidate their situation, "Law school applications are headed for a 30-year low, reflecting increased concern over soaring tuition, crushing student debt and diminishing prospects of lucrative employment upon graduation." Applications for dental school is clearly not at a low at the moment, but my claim is that it will be in a foreseeable future due to the exact same reasons as pointed out in the quote.

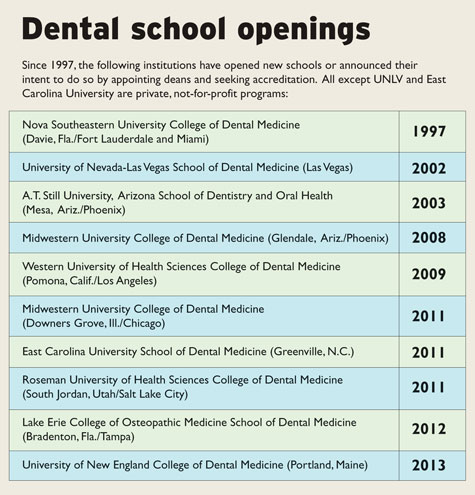

There is a connection between increasing tuition and increasing number of dental schools. Tuition on average increased 5-10% annually the past 15 years, there were 9 more schools for the same period - 5 in the last 5 years. This increased the number of dentists entering the profession too by 10-20% since the turn of the century. Many schools have increased their class sizes and added international dentist seats to their programs to keep up with their cost, Boston U and Tufts are examples. Private schools like Midwestern University in AZ opened few years ago, charges close to $500k (including living) to most of their students to get a diploma, and almost doubled their class size to about 200 couple of years ago - and yet, they still have a wait list after the class is filled each year. This is not an uncommon practice in new programs, and the trend will continue to happen to existing and future programs.

Mid-level practice idea is not going to keep up with these new dental programs, because the dentist conveyor belt is producing more dentists into the market than ever before, which makes the mid-level practice graduates restricted to certain area of the country, i.e. Minnesota.

Yes, corporate dentistry benefits from these highly debt conscious new dentists by opening more chain offices for them, but that's not on any new perspective dental students agenda. Most applicants see dentistry through the senior dentists they know - who own their own practice and living a fairly good life. Probably the dentist they had to shadow for 20-40 hours to apply to dental school, but not at corporate dental chain, or the chops shops that have become a common first stop for new graduates. That's the #1 reason why they apply to dental schools, and they never take into account the changing landscape from graduating from dental school to owning your own practice. The biggest benefactor from this irony are dental schools, which continue to raise their tuition every year until a generation of regretful dentists warn future applicants to not consider dentistry as a career. Only then we could see a change in demand and cost of tuition. In the meantime, dental schools will capitalize on the current dynamics.

Now... The situation with Law Schools. There are too many law schools in this country, and most are not considered your typical programs - when you compare it to dentistry. There are evening program law schools, some are online these days, and so on. But when it comes to your ideal law schools, particularly top 30-50 programs, the tuition is rising like dental schools. Yes the overall number of applicants are down because of the many options of obtaining a law degree, but there is a big waitlist on the traditional path, specially at prestigious schools. In dentistry, the public doesn't really care where you attended for your training, but in law - it's probably the number 1 thing people lookup before they consider you as a professional - see the movie "My Cousin Vinny" to understand this concept. Also, the more prestigious a law school is, the more your resume looks good, the higher chances you will find a job, and the more you have to pay at that school for the opportunity.

Here is an example why many law schools are very similar to dental school, in terms of tuition.

http://www.lawschooltransparency.com/reform/projects/Non-Discounted-Cost/