The scary switch that happens to investors over age 60

It gets worse with each passing year.

Susie Poppick |

@SusiePoppick

Sunday, 29 May 2016 | 11:00 AM ETCNBC.com

That linear decline seems to happen regardless of your sex, wealth and even your education and experience with the stock market, said study co-author and Texas Tech University professor Michael Finke.

Finke, along with Texas Tech professor Sandra Huston and University of Missouri finance professor John Howe, looked at literacy scores of more than 3,870 adults aged 60 and older. Topics in the

assessment included investing, borrowing, insurance and basic financial knowledge.

"The changes in ability are similar to what happens with driving," Finke said. "It happens gradually, in a way we don't necessarily perceive one year to the next, and that makes us vulnerable."

Even though literacy scores dropped with age, when the study subjects were asked to rate their own knowledge of each topic in the test, general self-confidence did not decrease at all with seniority. And when it came to insurance, subjects actually assessed their knowledge

morepositively as they got older — despite the fact that their abilities were declining.

Americans say this is their biggest financialregret

One reason older adults may be overconfident about insurance in particular, Finke said, is that seniors are more likely to have experience with or own life insurance: They are more likely, then, to overestimate their understanding of it.

Importantly, the gap between confidence and real ability just keeps widening with age, no matter the financial topic, Finke said.

"We need to acknowledge at the beginning of retirement that this is normal," he said. "It is a natural part of aging and we all experience changes in our ability to process information as we get older."

Indeed, in a second part of the study, the researchers found a correlation between cognitive decline and worsening financial literacy.

Don't let these 3 Social Security myths mess up your benefits

Specifically, they were able to predict aging adults' financial scores by looking at how they performed on assessments of two measures of intelligence: fluid and crystallized.

Fluid intelligence is the ability to quickly and efficiently process a stimulus, a capacity that tends to peak for most people in their mid-20s, said Finke. Tasks that might measure this skill include rapid arithmetic, he said.

Crystallized intelligence, on the other hand, depends on accessing memory and knowledge, and is at fullest strength for most around their mid-50s, he said. Thinking of synonyms for words and other vocabulary tasks might measure this type of intelligence, Finke said. Unfortunately, declines in both types of intelligence tended to be predictive of a slide in financial literacy.

A crucial insight from the research is that planning for both the financial and cognitive aspects of retirement must start far ahead of time.

The decline of pensions and rise of the 401(k) plans means more and more people are directly responsible for decision-making that will affect their quality of life in old age, Finke said.

"In a DIY world, consequences are greater than ever," he said. "It's very important to identify someone you trust early on who can take over decisions as a fiduciary, whether that's an adult child or a professional."

The best places to 'grow old' aren't always ones that rank high for retirement

Kevin Horan | Getty Images

Those planning for retirement, then, may want to look at the process as twofold: Working adults will need to both save enough and also form a succession plan for financial decision-making.

And if the latter sounds tricky, the former might be even harder.

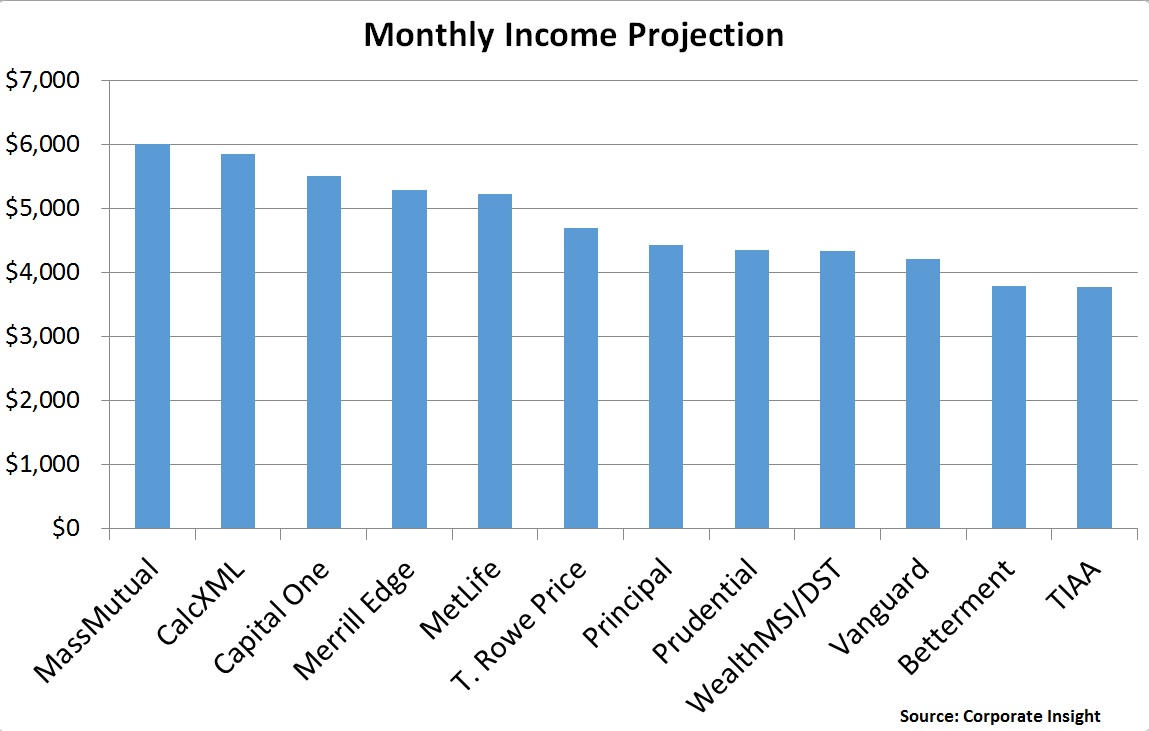

A new Bankrate

study finds that older Americans are falling far short of replacing the minimum 70 percent of pre-retirement income that advisors recommend. Out of seniors in all 50 states plus Washington, D.C., only those in Hawaii, Alaska and South Carolina have saved enough to hit that mark.

On the bottom of the list? Massachusetts, where retirees are able to replace only 48 percent of their previous income.

There's a little good news, though. No matter where you live or how old you are, there are still moves you can make to boost your retirement income — whether as an

individual or a

couple.

Simply being aware of the challenges you face is a big part of the battle.