- Joined

- Jul 5, 2018

- Messages

- 23

- Reaction score

- 16

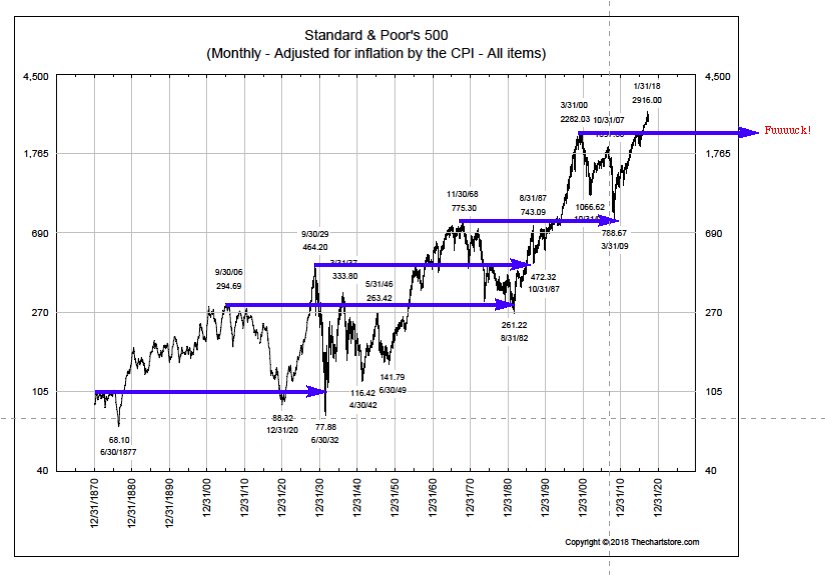

Holy, wait whole decades to get back to par, Batman!

i'm fairly certain your misleading graph ignores the effects of reinvested dividends which is massive over time (like 2% per year)

But typically during those bear stretches the principal investment is being chewed up by inflation. The dividend reinvestment may only mitigate the true losses.

Unfortunately, the tax man only cares about nominal gains. So that blunts the dividend tailwind.

I was thinking the same thing when I saw it but was too lazy to look up a corrected version. Thanks for confirming.i'm fairly certain your misleading graph ignores the effects of reinvested dividends which is massive over time (like 2% per year)