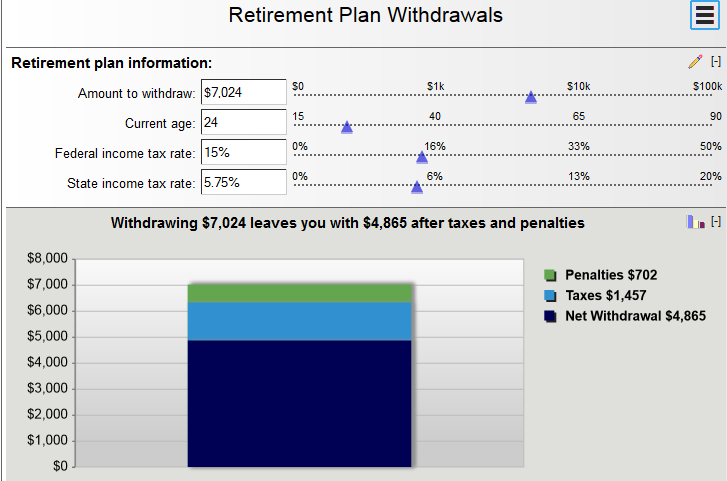

Currently have $7024.38 in my 403b account (401k equivalent, just for non-profit orgs).

According to https://www.dinkytown.net/java/RetirementWithdrawal.html withdrawing the full amount would result in having around $4865.

Fed income tax rate = 15% bracket

State income tax = 5.75%

- As a newly accepted student, I am trying to plan for my deposit ($2000), moving expenses, and emergency funds/cash-on-hand. There is also the potential that I may need to make a second $2k deposit.

- I plan on using FAFSA for tuition and the full COA.

- I have NOT filed my taxes yet and am unsure if I will receive a tax refund. I will be filing soon which may add to my emergency fund/cash to pay deposits. If I receive a tax refund, it will be used towards deposits and/or moving expenses. However, I am preparing in case I do not receive a tax refund or may even need to owe taxes. Last year, I received a tax refund.

- I currently have around $500 saved. My 1st deposit is due Feb. 28th. I plan on using a credit card for the transaction and will pay it off before the due date. The 2nd deposit may be due March 30th, if I am accepted to the second school.

Question 1: Would withdrawing be a smart and/or feasible option in terms of paying my deposits and having immediate funds for moving/emergency? My thoughts tell me it's not smart, but feasible as I have no other real savings/savings accounts.

Question 2: Should I stop my monthly contributions? Stopping would net me an additional ~$1541 pre-tax from next paycheck at the end of Feb to end of June. I would stop working at the end of June. July would be a "free" month to move as classes start end of July to beginning of Aug.

Question/statement 3: I can borrow funds from family members and current girlfriend, but am unsure if I would be able to pay them back. I have a tight budget and am able to save, but the amount saved may not be enough as I only work until the end of June. After receiving FAFSA money for the full cost of attendance for the fall semester and tuition has been taken out/paid for, could I use the leftover money to pay the family members back? I believe FAFSA gives you a direct deposit to your checking account.

Statement 4: I am open to the idea of taking out a private loan, but am hesitant to do so. I have no private loans, but do have federal loans ($35k) from undergrad. I have a credit score above 700 hovering around 730, have a clean and up-to-date credit report, and am confident I can receive a private loan if needed. I am hesitant in that I may not be able to pay it back immediately.

Thank you for your time and insight!

--

Edits:

1. Employer does match.

2. Private loan would be for $4000 for deposit and expenses prior to starting school this upcoming fall. Obviously better to forgo the interest from the bank and borrow from family, but I was wondering if this is my absolute last resort option.

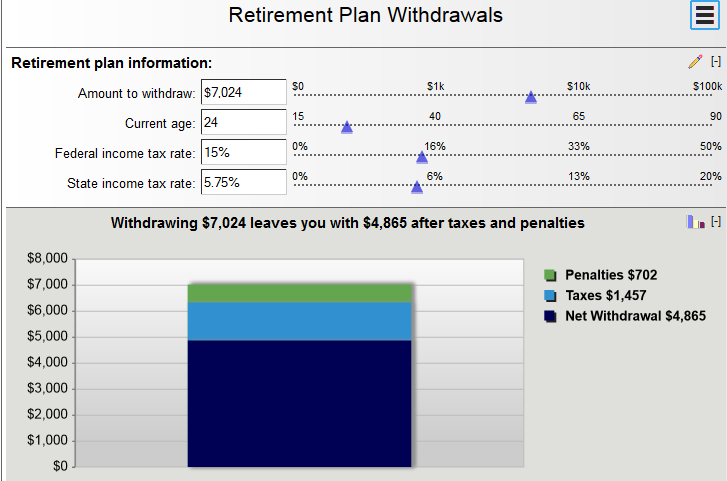

According to https://www.dinkytown.net/java/RetirementWithdrawal.html withdrawing the full amount would result in having around $4865.

Fed income tax rate = 15% bracket

State income tax = 5.75%

- As a newly accepted student, I am trying to plan for my deposit ($2000), moving expenses, and emergency funds/cash-on-hand. There is also the potential that I may need to make a second $2k deposit.

- I plan on using FAFSA for tuition and the full COA.

- I have NOT filed my taxes yet and am unsure if I will receive a tax refund. I will be filing soon which may add to my emergency fund/cash to pay deposits. If I receive a tax refund, it will be used towards deposits and/or moving expenses. However, I am preparing in case I do not receive a tax refund or may even need to owe taxes. Last year, I received a tax refund.

- I currently have around $500 saved. My 1st deposit is due Feb. 28th. I plan on using a credit card for the transaction and will pay it off before the due date. The 2nd deposit may be due March 30th, if I am accepted to the second school.

Question 1: Would withdrawing be a smart and/or feasible option in terms of paying my deposits and having immediate funds for moving/emergency? My thoughts tell me it's not smart, but feasible as I have no other real savings/savings accounts.

Question 2: Should I stop my monthly contributions? Stopping would net me an additional ~$1541 pre-tax from next paycheck at the end of Feb to end of June. I would stop working at the end of June. July would be a "free" month to move as classes start end of July to beginning of Aug.

Question/statement 3: I can borrow funds from family members and current girlfriend, but am unsure if I would be able to pay them back. I have a tight budget and am able to save, but the amount saved may not be enough as I only work until the end of June. After receiving FAFSA money for the full cost of attendance for the fall semester and tuition has been taken out/paid for, could I use the leftover money to pay the family members back? I believe FAFSA gives you a direct deposit to your checking account.

Statement 4: I am open to the idea of taking out a private loan, but am hesitant to do so. I have no private loans, but do have federal loans ($35k) from undergrad. I have a credit score above 700 hovering around 730, have a clean and up-to-date credit report, and am confident I can receive a private loan if needed. I am hesitant in that I may not be able to pay it back immediately.

Thank you for your time and insight!

--

Edits:

1. Employer does match.

2. Private loan would be for $4000 for deposit and expenses prior to starting school this upcoming fall. Obviously better to forgo the interest from the bank and borrow from family, but I was wondering if this is my absolute last resort option.

Last edited: