- Joined

- Dec 23, 2012

- Messages

- 240

- Reaction score

- 208

Hello all,

I am beginning medical school in the fall and I am coming in with already a massive undergraduate student debt. Having grown up poor, I really had terrible financial literacy. I just wanted to get a college degree and I didn't care how much it would cost. Only after graduating college and working did I gain some sense of how to deal with finances (although, I am certainly still learning).

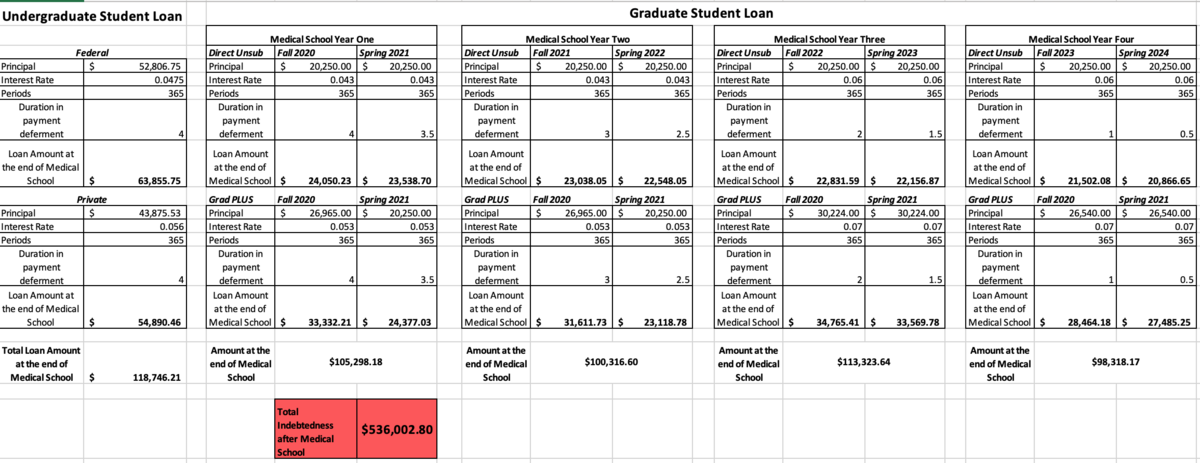

I created an excel sheet calculating how much debt I will be in after medical school. If my calculations are correct, factoring interest compounding daily, I would end up at around $540,000!! I make several assumptions. First that the low interest rate for 2020-2021 (4.3%/5.3% (direct unsub/grad plus) will remain for next school year as well, but will go back to 6%/7% the last two years. My second assumption, is that cost of attendance for my school will remain the same and I will need to pull the maximum amount of loan that I am offered.

Is this normal and are there others out there that will be or are currently in similar debt? Are there any books you recommend or resources I can read to better prepare myself how to handle this much debt?

Sorry for the long post.

I am beginning medical school in the fall and I am coming in with already a massive undergraduate student debt. Having grown up poor, I really had terrible financial literacy. I just wanted to get a college degree and I didn't care how much it would cost. Only after graduating college and working did I gain some sense of how to deal with finances (although, I am certainly still learning).

I created an excel sheet calculating how much debt I will be in after medical school. If my calculations are correct, factoring interest compounding daily, I would end up at around $540,000!! I make several assumptions. First that the low interest rate for 2020-2021 (4.3%/5.3% (direct unsub/grad plus) will remain for next school year as well, but will go back to 6%/7% the last two years. My second assumption, is that cost of attendance for my school will remain the same and I will need to pull the maximum amount of loan that I am offered.

Is this normal and are there others out there that will be or are currently in similar debt? Are there any books you recommend or resources I can read to better prepare myself how to handle this much debt?

Sorry for the long post.