- Joined

- Apr 22, 2013

- Messages

- 6

- Reaction score

- 1

Hey guys! So I'm going to graduate from medical school and am going to start residency in July!

As title suggests, I am looking to buy a house during residency, and was wondering if this is a good idea.

Here's my situation:

-I don't have student loan debt

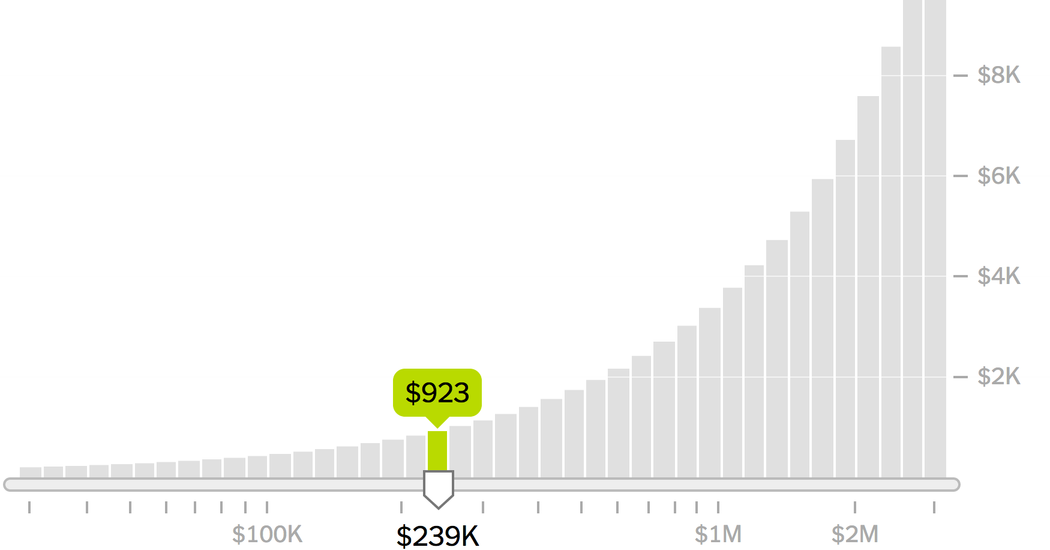

-I am in an area where average home cost is around 250k-300k (in Arizona)

-I plan to use a physician loan mortgage, probably going to put 5%-10% down depending on price and rate, for a 30y mortgage

-I am staying here for 3 years of residency, and very likely another 3 years somewhere in town for my fellowship training.

So here's my question, do you think this is a good idea? should I aim for a condo or a house? Open to any suggestions! TIA!

As title suggests, I am looking to buy a house during residency, and was wondering if this is a good idea.

Here's my situation:

-I don't have student loan debt

-I am in an area where average home cost is around 250k-300k (in Arizona)

-I plan to use a physician loan mortgage, probably going to put 5%-10% down depending on price and rate, for a 30y mortgage

-I am staying here for 3 years of residency, and very likely another 3 years somewhere in town for my fellowship training.

So here's my question, do you think this is a good idea? should I aim for a condo or a house? Open to any suggestions! TIA!