@begood95 @Frogger27 Let's have some fun.

First of all, I don't think

@Frogger27 is from the Baby Boomer Generation. And by Baby Boomer Generation, I presume that's the generation that supposedly screwed up the economy and forced the poor premedical Millenials into waiting tables during their gap year. Blaming a supposed age cohort for the subprime mortgage crisis of 2009 is pretty absurd. Absurd in the sense that if you blame the Baby Boomers, then who do you blame for the dot-com crash of 2001? In fact, who do you blame for the current student loan bubble that is occurring with education inflation? Do you blame your debt on your alma mater, Wall Street, or the students who feed the fires of the machine complex in order to get get ahead of the curve and land themselves a

decent job? You know, the one they tell you, "I hope it's six figures, but I don't care if I only make around high five figures like starting $65,000 and then maybe around $80,000."

When Michael Burry left his work as a Stanford Hospital neurology resident in order to start his own hedge fund, he had a knack for seeing things other people couldn't see when it came to market trends. It made him and his clientele a lot of great returns. When he saw the volatility of the mortgage market, he came up with an arrangement to set up credit default swaps (CDS) against mortgage backed securities (MBS) because he recognized that the banks were treating loans as actual credit (subprime mortgage). By mixing it with other crappy bottom tier investments they "de-risked" the investment via

diversification, thereby garnering tripe A ratings from credit rating agencies who were afraid that the banks would go to their competitors to receive a more favorable rating. Michael Burry essentially deduced this and executed a plan that would punish the banks when they were exposed for not possessing the actual capital they claimed to possess within their investments. These investments are known as toxic assets.

Michael Burry was 46, do you consider him to be at fault for screwing up the economy or the future of Millenials? Do we still blame an age cohort for the: Wells Fargo phony account scandal, the Libor scandal, the HSBC money laundering scandal, JP Morgan's London Whale, Detroit's Bankruptcy or the Enron scandal? How about the culture within these workplaces such as from the book, "Why I left Goldman Sachs" where bankers refer to their clientele as

muppets when they dupe them into bad investments or the movie, "The Wolf of Wall Street" where penny stocks were sold to

shmucks who thought they were investing in the next Microsoft when they were actually investing into the pocket of the brokers who were making margins they would never receive from any other type of stock.

Entitlement is the idea that you can actually type out a response that blames an entire generation for your crappy job at a Denny's, McDonald's, or What-Have-You-Inc when you have a degree in biochemistry, molecular genetics, biomedical engineering, or whatever super cool awesome degree you thought would get you a

maybe-5ok-job out of college. Meanwhile your friends in business are watching Broadway plays and living the life in a penthouse condo in Manhattan bragging about working a job in mutual funds for Blackrock or Vanguard. People who are older weren't more mature when they were your age. They were brash and naive, many of them are just as ignorant about how the world turns or where their money goes when they deposit it into the bank. It's just as likely that they also blamed everyone else for their own predicament. It's just that when you blame 100 people for your crappy life, but you get older and nothing changes, then you begin to realize that you're the only constant and the only variable at fault for not finding the solution to why you're living in a literal **** hole.

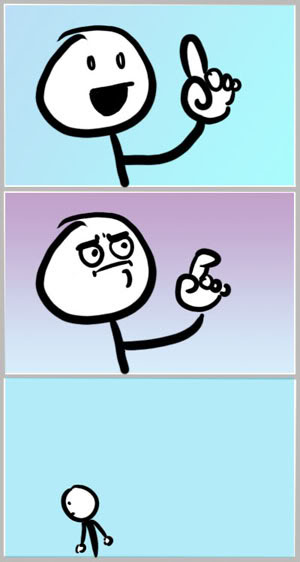

Second,