- Joined

- Jun 2, 2012

- Messages

- 13

- Reaction score

- 0

Its your favorite topic, again! Money!

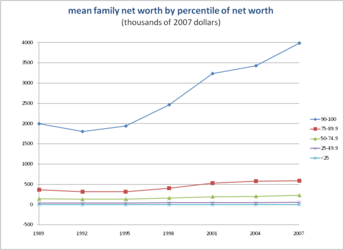

1) How common is it for physicians to have assets (not income) >1 million? (Fairly common, right)

2) Where can I find a tax table or other table which will break down households by assets (again I am neither talking about sources of revenue nor income), into the 1% and so on?

Where would those with assets of >1 million fall?

Apart from this, I understand that Obama claims that those earning more than 250K are in the upper middle class. Sorry, I dont have a source.

3) According to this article in the Washington Times, (http://communities.washingtontimes.com/neighborhood/making-change/2009/nov/17/can-you-name-us-socio-economic-levels/) there are 12 socioeconomic classes in the U.S. Those with assets >1 million are not rich, but they constitute a millionaire middle class who by spending habits may not have accepted their wealth. Sure, I agree.

It would be nice to know where this data is widely available. Thanks.

Discuss.

1) How common is it for physicians to have assets (not income) >1 million? (Fairly common, right)

2) Where can I find a tax table or other table which will break down households by assets (again I am neither talking about sources of revenue nor income), into the 1% and so on?

Where would those with assets of >1 million fall?

Apart from this, I understand that Obama claims that those earning more than 250K are in the upper middle class. Sorry, I dont have a source.

3) According to this article in the Washington Times, (http://communities.washingtontimes.com/neighborhood/making-change/2009/nov/17/can-you-name-us-socio-economic-levels/) there are 12 socioeconomic classes in the U.S. Those with assets >1 million are not rich, but they constitute a millionaire middle class who by spending habits may not have accepted their wealth. Sure, I agree.

It would be nice to know where this data is widely available. Thanks.

Discuss.