- Joined

- Sep 7, 2014

- Messages

- 3,204

- Reaction score

- 5,889

I do the same but usually 2-3 months out, try to give xrt by 12 weeks out from surgeryAside...

I've adopted this strategy and took it from a wise breast rad onc attending in training.

If patient initially declines XRT and wants to do an AI I schedule them a follow up with me or nurse navigator at 1 month s/p AI. If they're miserable or having bothersome side effects, I then push harder on XRT...because VERY likely (as noted above) there's not way in hell they're completing 5 years.

Anything to avoid horrible xrt

Anything to avoid horrible xrt

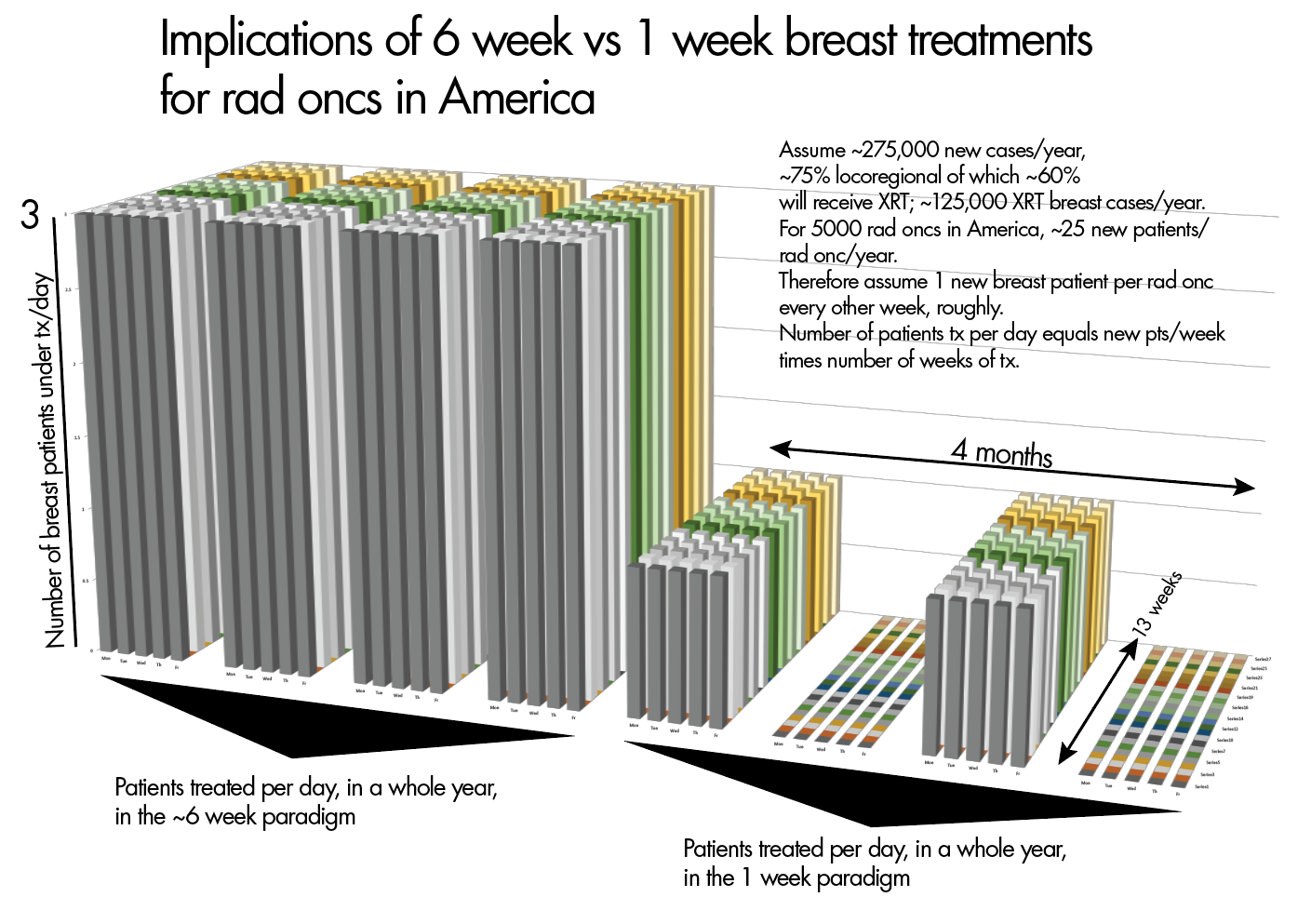

It's slow day Friday which means time for a graph.Yup.

But the calculus has changed. In the era of the CALGB trial it was 6 weeks.

Now it could be just 5 treatments with fancy treatment with nearly zero toxicity.

Maybe 15-16 fx is that sweet spotMain issue with breast RT in the old days was 2D planning and lack of field in field, resulting in significant hotspots, which lead to significant burn.

While there is a slight long-term cosmetic advantage to moderate hypofrac (15-16 fx) that is not maintained on the 'good' 5-fraction data (underpowered, but numerically higher rates of adverse issues 5-fraction both in 28.5/5 in FAST and 26/5 in FAST-FORWARD when compared to 15-16 fx).

Maybe 15-16 fx is that sweet spot

I was told that NRG is developing this concept - for all the flak academic rad oncs get on this forum, appreciate them for this concept.Can someone please run an over age 70 stage I three arm trial of 5 fraction APBI versus AI versus AI+APBI? Is someone working on this?

I'm thinking no survival difference. QoL and cost better with APBI alone. NO need for bone strengthening meds and misery of hot flashes and joint aches.

If it were suddenly known that a lucrative drug’s utilization were going to fall by 50 plus percent, that company’s market capitilzation would take a big hit. Aside from the drop in radiation oncology popularity for med students (which hasn’t been as negatively proportional to the drop in XRT utilizations we’re talking about TBH), haven’t seen a similar drop in the “rad onc market cap.” We know in rad onc that you can’t cheat physics. Will rad onc be able to cheat economics?Indeed, what we are about to witness in breast is huge. Look at what the CHHiP trial in the UK has lead to

Around 16k patients in the UK receive primary RT for prostate cancer per year.

16k x 37 fractions --> 592.000 fractions (assuming 37 x 2 Gy) per year

16k x 20 fractions --> 320.000 fractions (assumung 20 x 3 Gy - the "winner" regime in CHHiP) per year

That's 272.000 fractions less per year.

Assuming 255 days per year when RT is delivered (365 - weekends - 5 days for holidays) --> 1066 fractions per day less.

Let's assume 30 patients per LINAC per day, that would mean 35 less LINACs needed (including staff) for the UK.

The closest thing one can come to "shorting" rad onc would be to short Varian Elekta and accuray stock?If it were suddenly known that a lucrative drug’s utilization were going to fall by 50 plus percent, that company’s market capitilzation would take a big hit. Aside from the drop in radiation oncology popularity for med students (which hasn’t been as negatively proportional to the drop in XRT utilizations we’re talking about TBH), haven’t seen a similar drop in the “rad onc market cap.” We know in rad onc that you can’t cheat physics. Will rad onc be able to cheat economics?

Varian stock price would be one indicator among many. (Note to VAR: fund a COVID study.) However the linacs are very underutilized worldwide. A big decrease in US utilization may be offset by increased linac purchases in other developing countries. (So when I say rad onc market cap I’m being a little creative/cutesy; thinking about residency programs and their sizes, rad onc salaries, rad onc unemployment rates etc.)The closest thing one can come to "shorting" rad onc would be to short Varian Elekta and accuray stock?

Elekta and accuray stock look God awful the last several years, reinforcing that Varian is a de facto monopoly in the businessVarian stock price would be one indicator among many. (Note to VAR: fund a COVID study.) However the linacs are very underutilized worldwide. A big decrease in US utilization may be offset by increased linac purchases in other developing countries. (So when I say rad onc market cap I’m being a little creative/cutesy; thinking about residency programs and their sizes, rad onc salaries, rad onc unemployment rates etc.)

Well there is one such drug right now...If it were suddenly known that a lucrative drug’s utilization were going to fall by 50 plus percent, that company’s market capitilzation would take a big hit. Aside from the drop in radiation oncology popularity for med students (which hasn’t been as negatively proportional to the drop in XRT utilizations we’re talking about TBH), haven’t seen a similar drop in the “rad onc market cap.” We know in rad onc that you can’t cheat physics. Will rad onc be able to cheat economics?

I thought Accuray was broke?Elekta and accuray stock look God awful the last several years, reinforcing that Varian is a de facto monopoly in the business

Probably on the way there....i think they bought tomotherapy several years ago and haven't been able to mainstream the use of CK even with expanding it to do standard imrt treatmentI thought Accuray was broke?

Oh yeah, forgot about them, surprised they made it this far. Thinking they'll be delisted first