What can I do with a PsyD degree that I can't with a MA?? Is it worth going into a substantial amount of debt for one over the other?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PsyD vs MA

- Thread starter EKS9

- Start date

- Joined

- Feb 15, 2009

- Messages

- 19,119

- Reaction score

- 26,526

There's always the PhD option with zero debt. But, as for doctoral vs masters, if licensed, it opens up the door for certain assessment training and opportunities. Presumably, if a reputable PsyD, it would also train you in research to an adequate degree, so research and teaching opportunities would be better. Though, teaching opportunities are becoming more and more like earning minimum wage.

There's always the PhD option with zero debt. But, as for doctoral vs masters, if licensed, it opens up the door for certain assessment training and opportunities. Presumably, if a reputable PsyD, it would also train you in research to an adequate degree, so research and teaching opportunities would be better. Though, teaching opportunities are becoming more and more like earning minimum wage.

I've been accepted into a PsyD program, but lately I'm questioning if going into that much debt will be worth it in the long run. I like to have my options open when considering future career paths since I have so many interests within the field, which is a benefit of the PsyD. I want to be intellectually challenged. Maybe work clinically for a while and then go into some sort of teaching job. Who knows...

But I'd have to take out loans for cost of living as well, in addition to cost of schooling. To put it blatantly, I'm hella poor. My family can't help and I know that if I do take out these kinds of massive loans, I'll be working to pay them off for a really long time.

- Joined

- Feb 15, 2009

- Messages

- 19,119

- Reaction score

- 26,526

Everyone has to do what is right for them, but I don't recommend taking out loans for a psych degree more than 50k. Looking at median salaries, and crunching numbers of loan repayments, interest, etc, it just doesn't look like a great return on investment. And that's even before our field takes a hit on reimbursements next year.

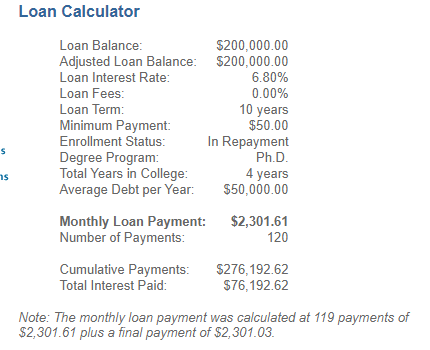

As with anything, whether it be the cost of education, or accepting a job, I'd strongly urge spending a day to really crunch some numbers on what this all would look like. Debt, likely salary, monthly loan payments, other projected living expenses, etc. It helps to see the numbers and what they would look like at different debt levels. Sometimes it's doable, other times it's crushing.

As with anything, whether it be the cost of education, or accepting a job, I'd strongly urge spending a day to really crunch some numbers on what this all would look like. Debt, likely salary, monthly loan payments, other projected living expenses, etc. It helps to see the numbers and what they would look like at different debt levels. Sometimes it's doable, other times it's crushing.

Everyone has to do what is right for them, but I don't recommend taking out loans for a psych degree more than 50k. Looking at median salaries, and crunching numbers of loan repayments, interest, etc, it just doesn't look like a great return on investment. And that's even before our field takes a hit on reimbursements next year.

As with anything, whether it be the cost of education, or accepting a job, I'd strongly urge spending a day to really crunch some numbers on what this all would look like. Debt, likely salary, monthly loan payments, other projected living expenses, etc. It helps to see the numbers and what they would look like at different debt levels. Sometimes it's doable, other times it's crushing.

Thanks so much for your replies. I really appreciate it. I'll definitely have to take your advice and sit down and dig into the numbers a bit more to see if what I want is even doable.

- Joined

- May 27, 2015

- Messages

- 295

- Reaction score

- 510

If you search for loan calculators, then you can get an idea of what monthly payments would look like on a 10- or 25-year repayment schedule. Even on a loan of $50,000, the monthly payments will set you back in terms of quality of life and milestones (e.g., home ownership).But I'd have to take out loans for cost of living as well, in addition to cost of schooling. To put it blatantly, I'm hella poor. My family can't help and I know that if I do take out these kinds of massive loans, I'll be working to pay them off for a really long time.

This thread about financial considerations of attending an unfunded program is worth reading, as well.

- Joined

- Feb 15, 2009

- Messages

- 19,119

- Reaction score

- 26,526

Thanks so much for your replies. I really appreciate it. I'll definitely have to take your advice and sit down and dig into the numbers a bit more to see if what I want is even doable.

Of course, people are coming into this whole thing at different levels of their lives with different levels of support. Very few people really look at the numbers though, before going through with things, and unfortunately are left holding the bag and delaying things after it's all said and done. I've seen a lot of people put off big life decisions (having children, home ownership, being able to go private practice) due to feeling weighed down by large loan payments. And, while there are loan repayment programs, they are not guaranteed. Just look at PSLF and all of the problems people are having with that.

- Joined

- Jul 15, 2014

- Messages

- 2,480

- Reaction score

- 3,421

Also consider that you'll only be making something like 32-35k right out of graduate school if you go the M.A. route. Once you're licensed as an M.A., it can go up from there but salaries top out around the bottom of what psychologists make.

thanks for the thread and advice, I will definitely check that outIf you search for loan calculators, then you can get an idea of what monthly payments would look like on a 10- or 25-year repayment schedule. Even on a loan of $50,000, the monthly payments will set you back in terms of quality of life and milestones (e.g., home ownership).

This thread about financial considerations of attending an unfunded program is worth reading, as well.

- Joined

- Apr 13, 2011

- Messages

- 469

- Reaction score

- 549

I just did the math on a 10-year term loan for the average PsyD graduate debt ($200k). Yikes. 2300/mo =$27,600/year for 10 years. That's more than 25% of the average PsyD annual salary. Interestingly, that puts the annual salary of the PsyD paying off their loan at about the average salary of an LMHC (~$50k). If the choice is between the two, it might make the most sense both in terms of training and finances to go with a PsyD. Of course, it also requires a tolerance for risk -- if something goes wrong and you default on the loans that's a bigger problem for the in-debted PsyD than it would be for the LMHC who (theoretically) just has to reduce spending. Others thoughts?

EDIT: The correct national mean for LMHC annual salary is $50k, which is significantly lower than a PsyD even after accounting for loan repayment.

EDIT: The correct national mean for LMHC annual salary is $50k, which is significantly lower than a PsyD even after accounting for loan repayment.

Last edited:

- Joined

- Mar 1, 2014

- Messages

- 905

- Reaction score

- 1,584

if something goes wrong and you default on the loans that's a bigger problem for the in-debted PsyD than it would be for the LMHC who (theoretically) just has to reduce spending. Others thoughts?

This thread reminds me of two of my colleagues from internship and postdoc. Both had huge loans. Both were absolutely open about the fact they had no intent on paying it back. Justified it by saying they were "providing a needed service in a tumultuous time" or some BS like that. Last I checked they were doing ok, owning homes, families, good jobs, etc., so I'm assuming they're doing IBR. I remember one of them even worked out the tax bill he would have after the 20 or 25 years of payments (if PSLF didn't work), and he said he just planned on filing for bankruptcy to have it wiped clean, and it wouldn't matter by that point "Because ill have my house and retirement and ill be fine." I'll never forget their brazen openness about it, and legit seemed like real vanity/narcissism/entitlement. Anyway...agree with everyone above lol.

Last edited:

- Joined

- Jul 15, 2014

- Messages

- 2,480

- Reaction score

- 3,421

about the average salary of an LMHC (~$75k).

Substance Abuse, Behavioral Disorder, and Mental Health Counselors : Occupational Outlook Handbook: : U.S. Bureau of Labor Statistics

You're off by about 25-30k. From a debt to income perspective, both are terrible options though the LMHC will incur less overall debt. The low salary makes it difficult to pay your bills, do adult milestones, and pay back your debt all at the same time. LPCs tend to do better in rural communities than in the city IME, but you cap out around the average early. I faced the choice the OP is thinking about a number of years ago and told myself that I'm either doing a Ph.D. program or managing a Starbucks.

Last edited:

- Joined

- Apr 13, 2011

- Messages

- 469

- Reaction score

- 549

You're right. I did a quick google and didn't notice that it had corrected for my locality. The mean is 75k where I am, but 50k nationally. Thanks for the correction. I'll edit my post to not mislead others...Substance Abuse, Behavioral Disorder, and Mental Health Counselors : Occupational Outlook Handbook: : U.S. Bureau of Labor Statistics

You're off by about 25-30k. From a debt to income perspective, both are terrible options though the LMHC will incur less overall debt. The low salary makes it difficult to pay your bills, do adult milestones, and pay back your debt all at the same time. LPCs tend to do better in rural communities than in the city IME, but you cap out around the average early. I faced the choice the OP is thinking about a number of years ago and told myself that I'm either doing a Ph.D. program or managing a Starbucks.

Dang, thanks for calculating this lol. Very helpful.I just did the math on a 10-year term loan for the average PsyD graduate debt ($200k). Yikes. 2300/mo =$27,600/year for 10 years. That's more than 25% of the average PsyD annual salary. Interestingly, that puts the annual salary of the PsyD paying off their loan at about the average salary of an LMHC (~$50k). If the choice is between the two, it might make the most sense both in terms of training and finances to go with a PsyD. Of course, it also requires a tolerance for risk -- if something goes wrong and you default on the loans that's a bigger problem for the in-debted PsyD than it would be for the LMHC who (theoretically) just has to reduce spending. Others thoughts?

EDIT: The correct national mean for LMHC annual salary is $50k, which is significantly lower than a PsyD even after accounting for loan repayment.

View attachment 311032

Similar threads

- Replies

- 10

- Views

- 2K