^ Having worked in retails in an affluent neighborhood, I would be sad for mankind if we are the greatest thing since slice bread.

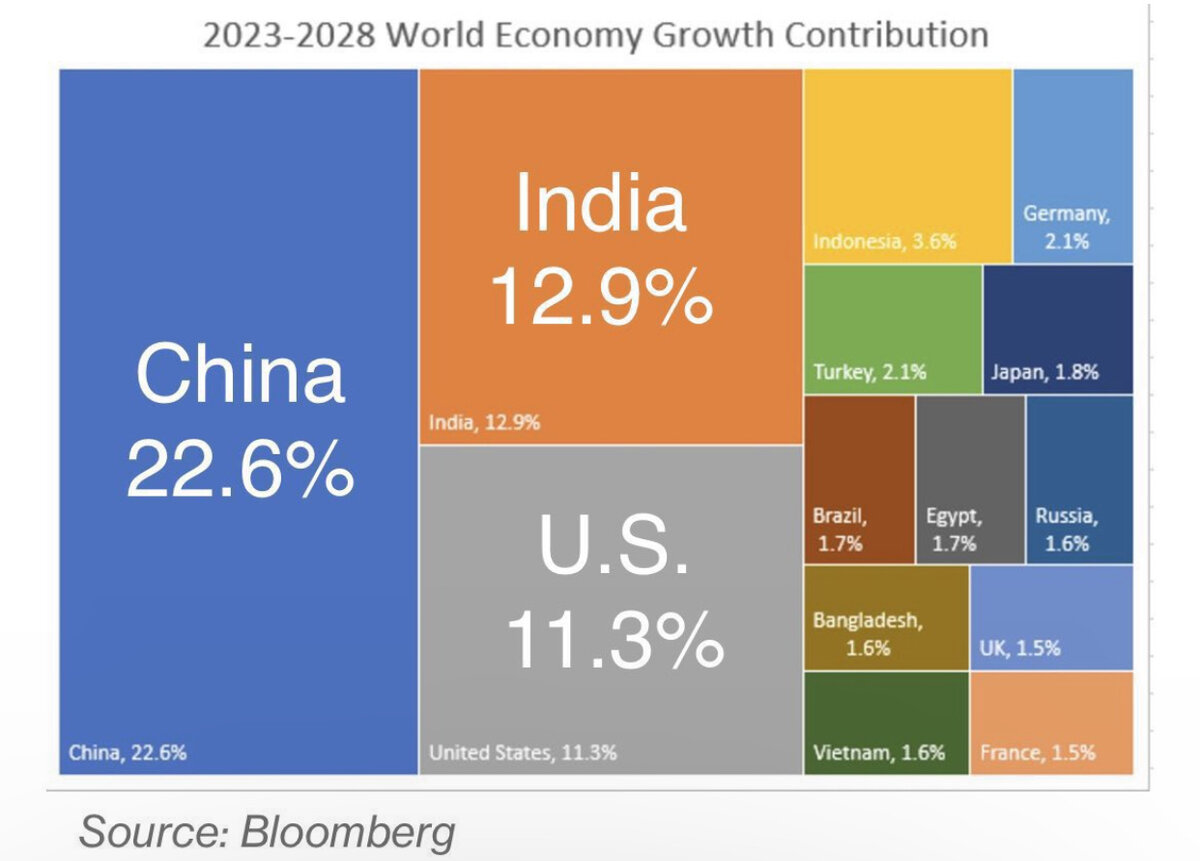

According to the IMF, just four countries will be responsible for 50% of global growth….three of them will be in Asia. These countries will surely protect their industries from US companies.

US companies had it good for the last 80 years. Europe and Asia got destroyed during WW2. There was virtually no competition. Everybody wanted to immigrate to the US. US companies could do whatever they wanted, even causing the housing crash in 2008 without one CEO going to prison. Now the money printing machine has finally ran out of ink. With massive debt, high interest rates, stagnated economy at home and fierce competition abroad, where are these companies going to find growth?

You really think so? Not according to the data. The number of educated foreign students has not only dropped significantly but the number of them going back home after their education has also spiked.

You can’t depend on growth from foreign talents forever. It is just unnatural and unrealistic.

Now US companies have real competition on their hands. They will win some but they won’t dominate like before.

According to the IMF, just four countries will be responsible for 50% of global growth….three of them will be in Asia. These countries will surely protect their industries from US companies.

US companies had it good for the last 80 years. Europe and Asia got destroyed during WW2. There was virtually no competition. Everybody wanted to immigrate to the US. US companies could do whatever they wanted, even causing the housing crash in 2008 without one CEO going to prison. Now the money printing machine has finally ran out of ink. With massive debt, high interest rates, stagnated economy at home and fierce competition abroad, where are these companies going to find growth?

I reckon American dominance will continue to decline, but we still will remain the land of innovation attracting the brightest minds from everywhere for foreseeable future..

You really think so? Not according to the data. The number of educated foreign students has not only dropped significantly but the number of them going back home after their education has also spiked.

You can’t depend on growth from foreign talents forever. It is just unnatural and unrealistic.

Now US companies have real competition on their hands. They will win some but they won’t dominate like before.

?

?