- Joined

- Dec 10, 2013

- Messages

- 474

- Reaction score

- 355

I've been a little frustrated about the lack of info that exists on how much debt med students will really have when they finish residency. I've seen articles stating that the average medical student debt is ~$189,000. That just isn't true for most of us.

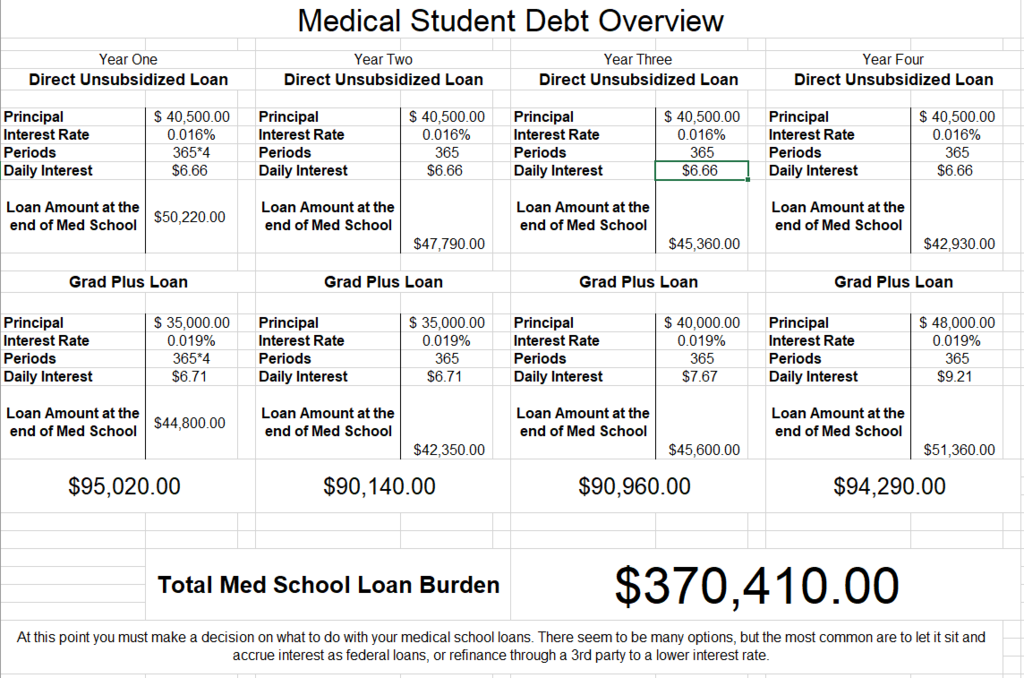

If we take out $75,500 the first year, which isn't a whole lot (50k tuition, 4k insurance, 2k fees, 19k living expenses, etc.) it will turn into $95,020 by the end of medical school. If we take out the same our second year it will become $90,140 by the end of medical school. By our third I assume we will need to borrow more to pay for travel expenses, increases in tuition, etc. So say we borrow $80,500 our third year, it will become $90,960. If we borrowed even more our fourth year (say $88,500)to cover residency applications, interviews, and travel it would turn into $94,290 by the end of med school. Total that would come out to be $370,410. The simple daily interest (which is what the feds use) on that amount is ~$70 a day! That's right, at the end of medical school you will be "earning" $70 bucks a day on your loans. A resident simply can't afford to pay that amount of interest, therefore the debt will continue to climb during residency.

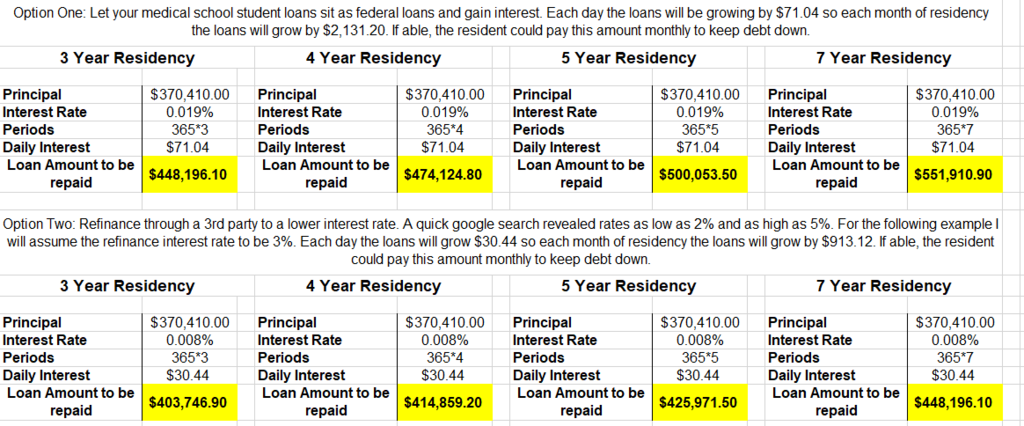

One way to ease the buildup of that interest during residency is to refinance the med school loans. There are pros and cons to this as well. Federal loans qualify for certain forgiveness programs and other benefits. However, by refinancing to a 3% interest rate one could save $45k during a 3 yr residency just on interest.

So lets assume this hypothetical DO student finishes residency in family practice with $403,746.90 in debt. Medscape lists average salary of FP as $209,000. That would give you a monthly income of $17,500. Doesn't sound so bad..... But, after state/federal income taxes that monthly pay would be reduced to ~$12,000 give or take a few grand depending on your state/circumstances. Of that 12k you live off 6k a month, which is not a bad life, but it is by no means luxurious. That leaves you 6k a month to use to pay off your loans. At that rate your loans would be paid off in just over 6 yrs.

Finally, after undergrad, med school, residency, and 5-10 yrs of loan repayment you could start contributing to retirement, kid's college funds (if they aren't already in college), a mortgage, etc. That means 21 yrs after starting undergrad you could begin saving for your future. That would put most of us into our 40s.

Obviously there is huge variability in this hypothetical scenario, but for many of us it isn't too far off the mark.

I'm happy I'm seeing this now and understanding it so I'm not disappointed with my life in the future. I'm stoked to go to med school and be a doctor, but I realize when I finish residency I will not instantly be a loaded, super rich doc.

I think it is important as a pre-med to at least consider the financial side of things and keep expectations realistic. Hopefully this post will help illustrate the financial obstacles we as medical students have to face.

If we take out $75,500 the first year, which isn't a whole lot (50k tuition, 4k insurance, 2k fees, 19k living expenses, etc.) it will turn into $95,020 by the end of medical school. If we take out the same our second year it will become $90,140 by the end of medical school. By our third I assume we will need to borrow more to pay for travel expenses, increases in tuition, etc. So say we borrow $80,500 our third year, it will become $90,960. If we borrowed even more our fourth year (say $88,500)to cover residency applications, interviews, and travel it would turn into $94,290 by the end of med school. Total that would come out to be $370,410. The simple daily interest (which is what the feds use) on that amount is ~$70 a day! That's right, at the end of medical school you will be "earning" $70 bucks a day on your loans. A resident simply can't afford to pay that amount of interest, therefore the debt will continue to climb during residency.

One way to ease the buildup of that interest during residency is to refinance the med school loans. There are pros and cons to this as well. Federal loans qualify for certain forgiveness programs and other benefits. However, by refinancing to a 3% interest rate one could save $45k during a 3 yr residency just on interest.

So lets assume this hypothetical DO student finishes residency in family practice with $403,746.90 in debt. Medscape lists average salary of FP as $209,000. That would give you a monthly income of $17,500. Doesn't sound so bad..... But, after state/federal income taxes that monthly pay would be reduced to ~$12,000 give or take a few grand depending on your state/circumstances. Of that 12k you live off 6k a month, which is not a bad life, but it is by no means luxurious. That leaves you 6k a month to use to pay off your loans. At that rate your loans would be paid off in just over 6 yrs.

Finally, after undergrad, med school, residency, and 5-10 yrs of loan repayment you could start contributing to retirement, kid's college funds (if they aren't already in college), a mortgage, etc. That means 21 yrs after starting undergrad you could begin saving for your future. That would put most of us into our 40s.

Obviously there is huge variability in this hypothetical scenario, but for many of us it isn't too far off the mark.

I'm happy I'm seeing this now and understanding it so I'm not disappointed with my life in the future. I'm stoked to go to med school and be a doctor, but I realize when I finish residency I will not instantly be a loaded, super rich doc.

I think it is important as a pre-med to at least consider the financial side of things and keep expectations realistic. Hopefully this post will help illustrate the financial obstacles we as medical students have to face.