- Joined

- Jul 27, 2011

- Messages

- 2,257

- Reaction score

- 2,923

I hope this post ages well over time. Do your own due diligence. I'm NOT a financial advisor. Just a dude that likes to play with money.

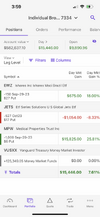

I've probably received a dozen or so messages from different people regarding options and/or real estate. In the spirit of education, here's a trade that I think is significantly better than any syndication out there. So anyone considering investing in a syndication, should consider this trade as well. I personally hold 725 of the following contracts and expect to get ~ 40k from that.

Ticker: MPW

What is it? Medical real estate REIT that owns about 400+ hospitals/freestanding ERs/rehab facilities.

Current price: $7.5/share

Current Dividend yield: $1.16/yr (expected to drop soon which is a reason why the stock has been hammered). Dividend announcement going to happen soon that may create some wild volatility especially if there's an unexpectedly large drop in dividend.

Why in this world did it drop 70% from it's peak last year:

The Bear case:

1) REITs as a whole have not done well due to increase in interest rates.

2) 2 largest tenants (Steward and prospect) have had large losses during covid leading to deferred rent and MPW helping them as tenants. Prospect for example had rent deferred this year and a part of rent was forgiven in return for equity into their managed care business. Receiving equity instead of cash rent investors didn't like.

3) Covid disrupted hospital financials for operators which are MPW tenants - MPW tenants have incurred huge losses during covid and are now finally recovering as volumes have recovered especially in outpatient money maker procedures.

4) Short attack. Historically high short selling at 20%. Which basically means an extra 120 million shares (20% of all shares which is 600 million) have been sold by people who never owned the stock to begin with causing significantly high selling pressure and price drop.

5) Increasing question about inability to cover dividend payment and anticipation of a cut due to rent deferrals ($0.29 per share per quarter - $1.16/yr aka >15%).

The Bull case:

1) Hospital financials are improving. Volumes are back. Staffing shortages are improving. Travel nurse utilization is improving.

2) VALUE. It's already dropped 70% from peak (You know...buy low sell high. Buy when everyone else is fearful kind of thing). MPW holds 19.2 billion of real estate and real estate related assets and 10.8B of debt. So they have a book value of ~ 8.4B. Currently the stock price puts the market cap at 4.5B. That's basically 53 cents on the dollar of assets. Granted if you look at the balance sheet, out of 19.2B, 2.4B is equity in real estate related firms and NOT directly real estate properties/assets. Then if you assume all those equity investments of MPW go to 0; then it's still an enterprise with a book value of 16.8B. Subtract debt and you have 6B. Current price is trading at 75 cents on the dollar.

3) Hard to predict the future, but we're heading towards terminal/plateau of interest rate hikes based on current fed guidelines (Expected to have 1 more rate hike in September). Next year if the rates back off, the entire REIT industry will benefit.

4) Mission critical Assets. You need hospitals.

5) Experienced sponsor that has been through 2008 as well as multiple tenant bankruptcies in the past and have always been able to squeeze their investment back.

If owning a company that's trading on pennies on the dollar due to massive price drop and holds 400+ hospital building hard assets is interesting to you then here's a safer way to make a play

The trade:

Sell cash covered puts - $6 strike January 2024 expiration. (see attachment)

Premium you receive = 56 dollars per contract based on todays closing prices

Absolute return in 5 months if price stays above $6 = 56/(600-56) = 10.3%

Annualized return = 24%

So...your outcomes:

1) MPW stays above $6 - You made 10.3% in 5 months. Great. 24% Annualized return. Rinse and repeat, sell more contracts for future dates.

2) MPW drops below $6 - Great you can buy MPW for $6/share (8.4B assets for market cap of 3.6B, 43 cents on the dollar), start collecting dividends (If they stay at $1.16/yr then that's a 19% dividend, but I think we're in for a cut), and start selling covered calls. Between covered calls and dividend, probably an easy 20+ percent return until eventually a long term recovery happens for the reit industry and the hospital operators.

Disclaimers:

1) I'm not a financial advisor. Just a regular dude.

2) You'll experience massive volatility as this REIT somehow is becoming a meme stock with such large short percentage.

3) Do your own due diligence.

4) I have sold 725 of the above contracts with naked puts (leveraged) with an average premium of $56.24 per contract that I've received. But instead of requiring the full cash which is $600 ($6 strike x 100 shares) - 56.24 = 543.76 per contract, I only require $250 - premium (56.24) = 193.76; giving me a cash on cash return 56.24/193.76 = 29% in 5 months.

5) This post may not age well at all as I cannot predict the future and this stock could go to $1 or penny stock value.

6) The exact numbers may be off just a tiny amount since I'm going on memory rather than looking up everything as I write this post

For anyone considering physical real estate or real estate syndications into private companies. In my humble opinion, as of today, this may be a better play.

Buy low sell high. Buy when everyone else is fearful. Sometimes to make money you have to hold a falling knife.

Good luck to all.

I've probably received a dozen or so messages from different people regarding options and/or real estate. In the spirit of education, here's a trade that I think is significantly better than any syndication out there. So anyone considering investing in a syndication, should consider this trade as well. I personally hold 725 of the following contracts and expect to get ~ 40k from that.

Ticker: MPW

What is it? Medical real estate REIT that owns about 400+ hospitals/freestanding ERs/rehab facilities.

Current price: $7.5/share

Current Dividend yield: $1.16/yr (expected to drop soon which is a reason why the stock has been hammered). Dividend announcement going to happen soon that may create some wild volatility especially if there's an unexpectedly large drop in dividend.

Why in this world did it drop 70% from it's peak last year:

The Bear case:

1) REITs as a whole have not done well due to increase in interest rates.

2) 2 largest tenants (Steward and prospect) have had large losses during covid leading to deferred rent and MPW helping them as tenants. Prospect for example had rent deferred this year and a part of rent was forgiven in return for equity into their managed care business. Receiving equity instead of cash rent investors didn't like.

3) Covid disrupted hospital financials for operators which are MPW tenants - MPW tenants have incurred huge losses during covid and are now finally recovering as volumes have recovered especially in outpatient money maker procedures.

4) Short attack. Historically high short selling at 20%. Which basically means an extra 120 million shares (20% of all shares which is 600 million) have been sold by people who never owned the stock to begin with causing significantly high selling pressure and price drop.

5) Increasing question about inability to cover dividend payment and anticipation of a cut due to rent deferrals ($0.29 per share per quarter - $1.16/yr aka >15%).

The Bull case:

1) Hospital financials are improving. Volumes are back. Staffing shortages are improving. Travel nurse utilization is improving.

2) VALUE. It's already dropped 70% from peak (You know...buy low sell high. Buy when everyone else is fearful kind of thing). MPW holds 19.2 billion of real estate and real estate related assets and 10.8B of debt. So they have a book value of ~ 8.4B. Currently the stock price puts the market cap at 4.5B. That's basically 53 cents on the dollar of assets. Granted if you look at the balance sheet, out of 19.2B, 2.4B is equity in real estate related firms and NOT directly real estate properties/assets. Then if you assume all those equity investments of MPW go to 0; then it's still an enterprise with a book value of 16.8B. Subtract debt and you have 6B. Current price is trading at 75 cents on the dollar.

3) Hard to predict the future, but we're heading towards terminal/plateau of interest rate hikes based on current fed guidelines (Expected to have 1 more rate hike in September). Next year if the rates back off, the entire REIT industry will benefit.

4) Mission critical Assets. You need hospitals.

5) Experienced sponsor that has been through 2008 as well as multiple tenant bankruptcies in the past and have always been able to squeeze their investment back.

If owning a company that's trading on pennies on the dollar due to massive price drop and holds 400+ hospital building hard assets is interesting to you then here's a safer way to make a play

The trade:

Sell cash covered puts - $6 strike January 2024 expiration. (see attachment)

Premium you receive = 56 dollars per contract based on todays closing prices

Absolute return in 5 months if price stays above $6 = 56/(600-56) = 10.3%

Annualized return = 24%

So...your outcomes:

1) MPW stays above $6 - You made 10.3% in 5 months. Great. 24% Annualized return. Rinse and repeat, sell more contracts for future dates.

2) MPW drops below $6 - Great you can buy MPW for $6/share (8.4B assets for market cap of 3.6B, 43 cents on the dollar), start collecting dividends (If they stay at $1.16/yr then that's a 19% dividend, but I think we're in for a cut), and start selling covered calls. Between covered calls and dividend, probably an easy 20+ percent return until eventually a long term recovery happens for the reit industry and the hospital operators.

Disclaimers:

1) I'm not a financial advisor. Just a regular dude.

2) You'll experience massive volatility as this REIT somehow is becoming a meme stock with such large short percentage.

3) Do your own due diligence.

4) I have sold 725 of the above contracts with naked puts (leveraged) with an average premium of $56.24 per contract that I've received. But instead of requiring the full cash which is $600 ($6 strike x 100 shares) - 56.24 = 543.76 per contract, I only require $250 - premium (56.24) = 193.76; giving me a cash on cash return 56.24/193.76 = 29% in 5 months.

5) This post may not age well at all as I cannot predict the future and this stock could go to $1 or penny stock value.

6) The exact numbers may be off just a tiny amount since I'm going on memory rather than looking up everything as I write this post

For anyone considering physical real estate or real estate syndications into private companies. In my humble opinion, as of today, this may be a better play.

Buy low sell high. Buy when everyone else is fearful. Sometimes to make money you have to hold a falling knife.

Good luck to all.