- Joined

- Jul 16, 2003

- Messages

- 6,030

- Reaction score

- 3,811

http://www.wsj.com/articles/pacira-subpoenaed-by-department-of-justice-1429199797

Oh... ohhh.... someone is in trouble....

Oh... ohhh.... someone is in trouble....

LOL!This drug is a total pain in my ass!

This drug is a total pain in my ass!

Your right about the lack of understanding about clinical data. And more importantly, it needs to be good data. Not some bullsh*t put out by the maker.Exparel is a great drug and PCRX in the low 70's is a good entry point. I've told the Reps. that the company needs to invest in more studies showing efficacy, safety and cost-effectiveness of Exparel over standard local anesthetics. I'm a fan of the drug EXPAREL but indifferent on PCRX because of poor management and lack of understanding about the importance of clinical data to support the product.

60+% percent gain in 3 months. Not too shabby considering what the market has done over the last 3 months.

Exparel is a great drug and PCRX in the low 70's is a good entry point.

PCRX is a speculative stock but Exparel is a great drug. So, if you believe in the product like I do a good entry point is the low 70s. The problem is management hasn't done a good job in getting Exparel approved for Nerve blocks; there is no excuse not to spend money on clinical studies showing efficacy and safety compared to the current standard.

PCRX is a speculative stock but Exparel is a great drug. So, if you believe in the product like I do a good entry point is the low 70s. The problem is management hasn't done a good job in getting Exparel approved for Nerve blocks; there is no excuse not to spend money on clinical studies showing efficacy and safety compared to the current standard.

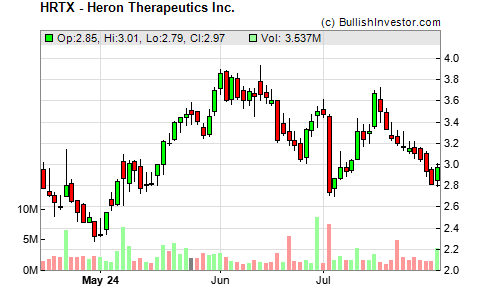

You should show that graph out 10 years ago. HTRX was $120+ a share in 2005. They've lost money 9 of the last 10 years, however. How are they still in existence? Probably by printing more shares. In 2005 when they were $120+ a share, they had 300,000 shares outstanding. Now at $14 a share they have 29 million shares outstanding. They keep losing money and diluting their shares as fast as possible. Not exactly the kind of company you'd want to bet on with an investment.

Just wondering - what happened to Pacira for their stock to tank like this in the last few months? Also for the people that were bullish on it, are you still feeling same and buying more at this time?

Exparel is heading exactly where Depodur the other Pacira sad liposomal product has ended... History!

Thanks for the insight Blade. Still trying to find an entry point to health care stocks and not sure where to go. I'm in Canada and Exparel isn't on anyone's radar here at the moment.