Anyone understand how this would work with someone who's on the Navy HSCP program? The four years while in school count as active-duty time? If one were to start making payments on the loans while in school on the HSCP would the 10 years be up after a 6 year commitment in the Military? Thanks.

Well, first of all, the details of the program itself is uncertain for now. The dept of ed still in the process of making some kind of application that would "lock you in" for the program, for tracking and other purposes. After all, it'd totally suck if the govt decides to exclude all military personnel in healthcare profession, or worse yet repeal the whole program altogether in your 9th year. They can, and will do that if they find, say, coupling the multi yr retention bonuses and the forgiveness program, would be considered double dipping and should not be allowed. A similar reasoning could be found where you cannot take advantage of the HPLRP and multi yr-retention bonuses simultaneously (agreement p3). Unless there is a formal contract with the government of the eligibility, anything is possible in between.

However, as the program reads, it is simple and clear. A federal loan is a federal loan; the government does not distinguish when and for what purpose you obtained your loan. Anything else would defeat the whole purpose of the program, that is, the program is not designed to discriminate against those with higher degrees over lesser degrees. If so, a dentist can get their loans forgiven while a USPS delivery guy can't? That would be a classic 5th amendment violation (yes, I learned that in law school).

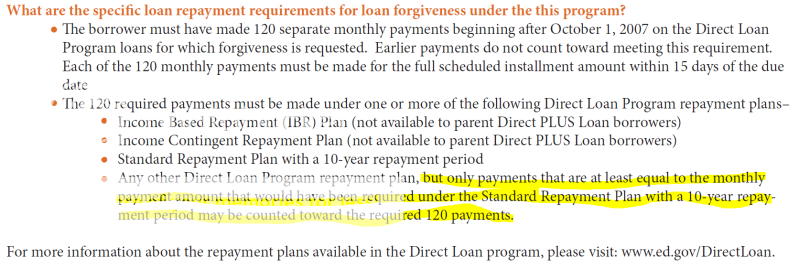

The program requires you to be working full-time in some type of public service area (it could even be an NGO). Yes, Army is one of them, but the term "full-time" is defined as working 30 hours of more a week. From what I understand those who are in HSCP are in fact serving active duty, but I am not sure it'd fit the definition of "full-time," although we spend way more than 30 hours studying every week. I would think that it would be considered full time, by the virtue of the active status itself.

The program also requires you to make payments under a qualified loan consolidation program, which there is only one now. You should be able to consolidate all your loans and start making payments and it'd do just fine. However, the catch is that any subsequent loans that are not part of the original consolidated loans will not be covered under the program, even if you re-consolidate later. That portion would require another 10 years of repayment. After some calculations, I found that one can truly take advantage of this program if your income is substantially low (say $40k a year) or your outstanding loan amount is great (say $200k). If you have less than say $100k, you would pay most of it within the 10 year period, and you might find yourself in a situation where the amount you'd be making in the private sector would be greater than the benefit of staying in the public sector (if you are considering leaving). I was in shock for a moment when I found out that if you make $30k for 10 years and have $200k outstanding fed loans, you could pay only $70k and get away with it. That's over $350k tax-free income! Yes, the amount forgiven under PSLP is TAX-FREE. (NB if you couldn't pay off your loans in 25 years under income contingency or based payment plan, that amount would be DISCHARGED and may be TAXABLE) It's almost too good to be true...

👍👍👍