- Joined

- Jun 10, 2008

- Messages

- 112

- Reaction score

- 0

Last edited:

My money that I saved over the years is in a mutual fund that has consistently earns around 10% per year. My loan money is in a high interest savings account (5%) and comes down each month into my checking to pay my rent.

The article:4. Withdrawals used to help pay for first-time home purchase

Despite a lifetime limit of $10,000, this exemption can make it much easier for an IRA owner to buy a house.

5. Higher education costs

College can be expensive. Thankfully, certain higher education costs for you, your spouse, children or grandchildren can be withdrawn penalty-free. You may still owe federal income tax, however. For more information, read the Internal Revenue Service article, Notice 97-60 Using IRA Withdrawals To Pay Higher Education Expenses.

A Caveat

There is one catch to these qualifying exemptions; the holder of an IRA is subject to a five year waiting period (measured in tax, not calendar, years). An investor could not, for example, deposit $3,000 in their IRA this year and withdrawal it next year penalty-free even if it would otherwise qualify as an exemption.

Excellent advice, Pressmom! In addition, I'd say go ahead and start a Roth IRA while you're at it. For everyone who doesn't make a ton of money, you can often start them for as little as $25 a month (less than a dollar a day) and work your way up. Starting young is super helpful and it's all about that compound interest. I finally got around to starting mine last month and it's so neat to see it grow in just a month. Much faster than a little savings account, even though my investment options were pretty tame.

I'll also second the savings account thing for the loans. My loan check goes into my savings account, so that way, I can make a little bit off it and it's not quite as easy to spend it if it just went straight into checking. But you can move it into checking with a click or two of a mouse, so it's pretty easy to get to and more liquid than a mutual fund for short term stuff.

If anyone has access to USAA (you should if you or your parents were in the military), they have very, very good plans out there for investing and retirement and lots of FREE financial planning advice and tools, not to mention excellent insurance rates and banking options.

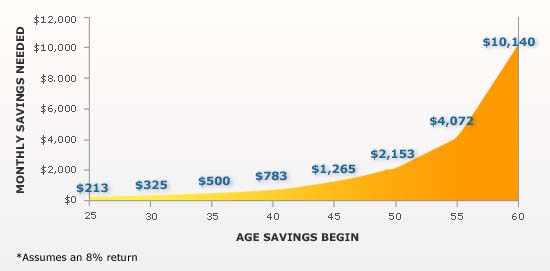

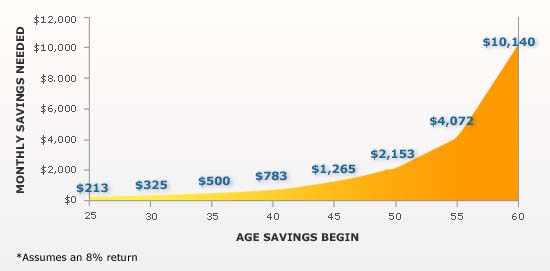

Oh yeah, thought this was cool. Say you want $750,000 for when you retire at age 65. This chart shows you how much a month you need to save each month with a decent IRA, 401K, mutual fund, etc retirement investment based on when you start. So if you chip in $200ish a month when you're 25, that's a lot easier than 10K a month when you're just about to retire in a few years! Pretty cool.

The costs aren't prohibitive if you go to your state school.

Sure, if you assume everyone lives in Georigia or some other cheap state.