- Joined

- Apr 22, 2007

- Messages

- 22,789

- Reaction score

- 9,857

Second-longest bull market ever aging gracefully, but investors wonder how long it will last

Second-longest bull market ever aging gracefully, but investors wonder how long it will last

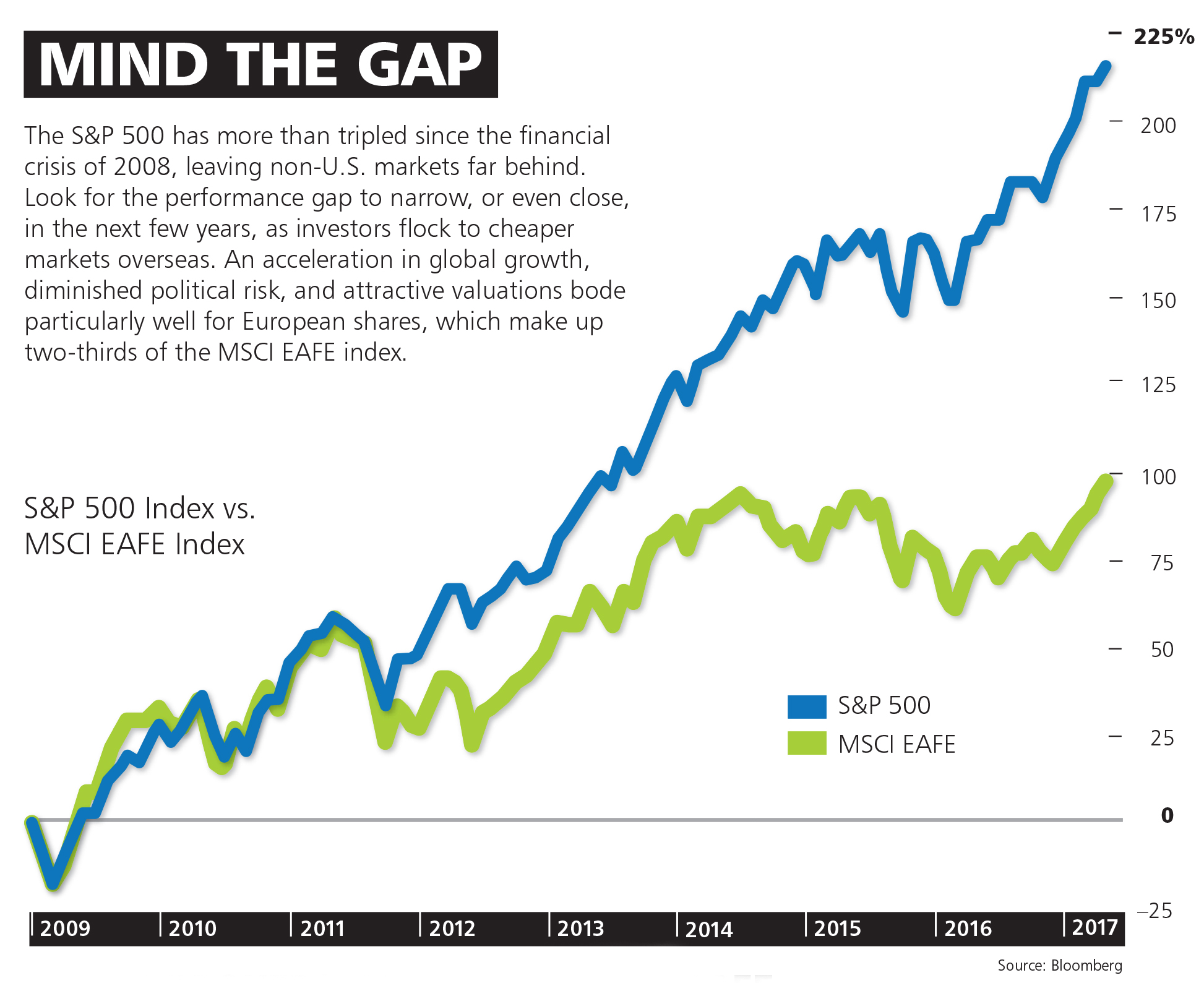

- Since the prior bear market ended in March 2009, this advance in equities is now the second-oldest on record without at least a 20 percent drop in the S&P 500.

- The current trailing 10-year annual return for the index is only 7.6 percent. At previous major bull market peaks, this 10-year annual pace has routinely been above 15 percent.

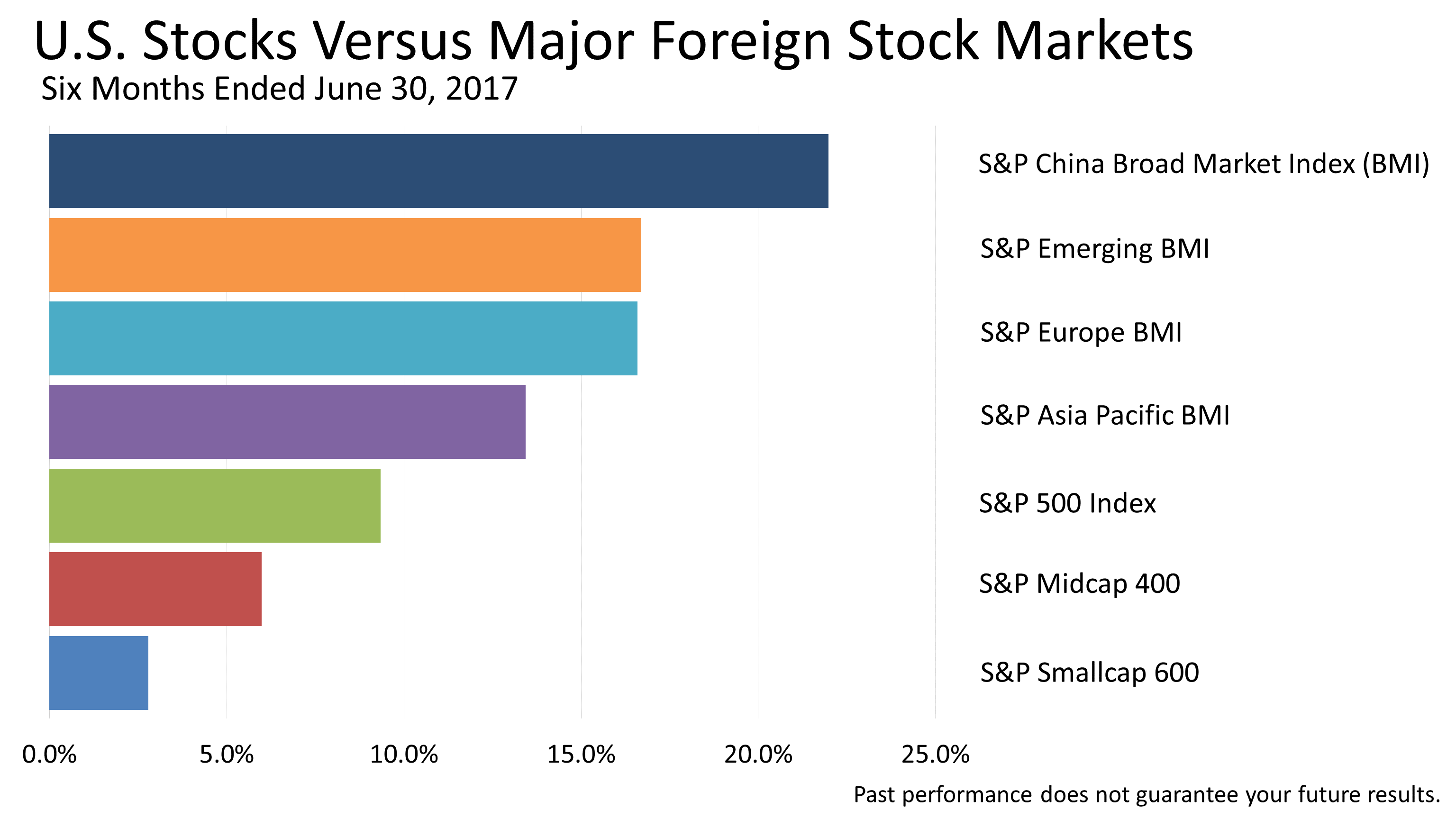

- There aren't many worrisome stresses in the capital markets at the moment. All asset classes appear similarly stretched in valuation – yet rationally valued in relation to one another.

Second-longest bull market ever aging gracefully, but investors wonder how long it will last