- Joined

- Apr 22, 2007

- Messages

- 22,789

- Reaction score

- 9,858

In conclusion, though we have shown issues associated with both the active and passive approach, all told we do not believe investing passively in emerging markets is the ideal option. Active management, which comes in various forms, not only better maneuvers through these markets' associated risks, but it takes advantage of shifting market dynamics and individual opportunities that a quantitative, market cap weighted index approach is likely to overlook. It is also important to emphasize that the most successful emerging market allocations will be those made by investors who are comfortable and accepting of a long-term investment period.

Up For Debate Yet Again: Active Vs. Passive But This Time It's The Emerging Markets | Seeking Alpha

Results are not mixed at all. Read the rest of the article. The data is decidedly against active management in that article, even in EM.Looks like the results are mixed; If i had access to DFA funds then my mix would be 50/50 (passive/active) in my retirement accounts. BUt, since I don't have access to DFA funds I choose ACTIVE management for International equity, emerging markets and emerging market bonds.

The following is a summary of the results:

- In the large-growth category, relative to the MSCI index benchmark, all six of the actively managed large growth funds outperformed. The average outperformance was by 1.5%.

- In the large-blend category, both active funds outperformed the comparable Vanguard fund by an average of 1.4% and the comparable DFA fund by an average of 1.1%.

- In the large-value category, both active funds underperformed the comparable DFA fund by an average of 1.0%.

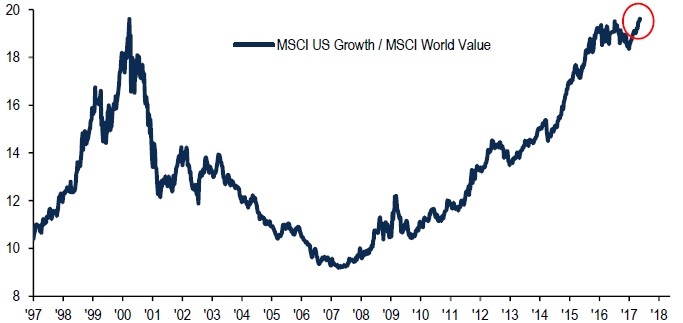

Vanguard Value Index Fund (VTV), relative to its growth counterpart, the Vanguard Growth Index Fund (VUG), in the past 10 years:

.

.So... how is everyone playing this one? Tech has had a good year. Hit hard today. Picked up some Nasdaq 100 today. Should have sold Crus last Friday. Almost did. Helluv a runnup from 5 in 2008 to 64 (still a chip guy with my play funds to some extent). NXPI is is getting bought out by qualcomm.

Looks like a lot of people might be running to bonds. I played that card when they were hit hard at the end of last year. Sitting strong on NUV and NZF.

Probably still a bargain if rates don't run up too fast. Anyways... What are you guys doing?

This has been a very solid thread. 👍

A 1-2% drop doesn't impact anything I do any more than a 1-2% jump up does. Well I guess after a drop I take a peek at my watch list to see if anything is approaching a price I'd buy it at. But mostly just ho hum go about your business and make plans for the weekend.

Anyone thought of shorting Mednax? There is only a finite amount of practices to eat up and several competitors in a cutthroat market. They won't be able to sustain growth for too much longer.

But, do you know when that will happen? Next year? 2019? Good luck with the short if you don't have any idea on the timing. Instead, wait for the earnings to start missing forecasts, maybe 2 quarters in a row, before initiating any type of short.

Don't forget Mednax could buy any of the following to juice their earnings then fire the unneeded, worthless, lazy management on their acquisition:

1. USAP (they will sell out soon)

2. AMG's AMC in Nashville

3. Team Health

If all else fails they "merge" with another AMC. You could get seriously squeezed hard on that short position.

From what I see, they have missed earnings 4 quarters in a row. For reasons I don't want to discuss on here that I know, I don't see them merging with a chunk of the AMCs.

I think growth stalls substantially. Fruitful markets have been pillaged. Even more fruitful markets bare tough competition that will require hire multiples. It is going to be tough. Let's revisit in a year. Will be fun.

I'm staying out right now but going to keep an ear to the ground.

Anyone thought of shorting Mednax? There is only a finite amount of practices to eat up and several competitors in a cutthroat market. They won't be able to sustain growth for too much longer.

The anesthesia business is a relatively small portion of Mednax as an overall company. Whatever you think about their current and future anesthesia business should not majorly impact your overall assessment of the corporation. I personally am not invested in them (outside of whatever is in any mutual funds) and have not thoroughly researched their business enough to make a declaration one way or the other.

It's still coming. I believe I said I don't know exactly when, and you can't know exactly when, but it's pretty inevitable. Bond market tells all. 6-12 month lag time possible to see the results in equities. I did think the election/inauguration provided the right conditions to see the crash come, but it didn't. Technicals are still there. I still believe DJI going here by the end of the year...

View attachment 217655

On a side note, DJI up ~4.6% since my post. Silver up 6.5% 😉

Matty

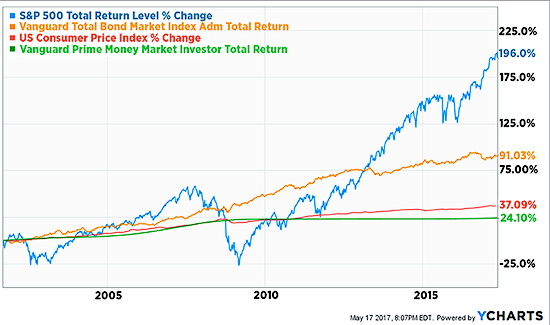

I've become a Boglehead of sorts. Having read a plethora of good books lately (albeit most geared to the boglehead and Benjamin Graham crowd), I am assured that my "strategy" is sound. No, I can not predict the future. No I will not attempt to time the market. No I will not sit on large sums of cash trying to time the market. I will stay mostly vested (aside from money market for nearer term disposable income). I will invest frequently and dollar cost average to the best of my ability without hoarding cash and then DCA'ing over, like a year (decided against that cuz most will not be vested in such a scenario). I will always refer back to the crises of old and have reference books detailing the "culture" surrounding prior booms and busts.

Still working on asset allocation and am light in Bonds but have Cash Balance/Defined Benefits sitting in CD's (can't lose money or become disqualified), so that's sort of my "fixed income" category. As I build, I'll put some in REITs in tax advantaged accounts. I'll keep expense ratios low (Vanguard for me, for now). I will ride it out and build wealth via high savings rates and EXPECTING corrections. I will look at those as a blessing to then "buy low".

I'm not sure what I'll do if I sense a true mania/bubble. Probably, it will be a sector specific thing (Tulips, Housing, Tech etc.) and will then "rebalance" out of the manic sector. That one will be more difficult I think.

Great thread. And all of my above posting, I need to caveat that I don't know jack..... None of us do. And I've become convinced that accepting that is critical to success. That is not the same, however, as having financial knowledge and developing a sense of things. It's just important to know that it's nearly impossible to accurately predict the future, AND get the timing right. Then again, maybe I'm wrong. I'll pretend I'm right on this one though as evidence suggests such.

We could see another 10-15% gain in the market before any pullback occurs. Earnings for the S and P were pretty good this quarter. I do agree that valuations are starting to appear stretched but timing the market is extremely hard to do.

Timing may be difficult, but it is so much better to be cautious early, then too late.We could see another 10-15% gain in the market before any pullback occurs. Earnings for the S and P were pretty good this quarter. I do agree that valuations are starting to appear stretched but timing the market is extremely hard to do.

I think we are starting (since last year) to go through a long deflation. I would not buy real estate now.

The best-performing 4% of listed stocks accounted for the entire lifetime dollar wealth creation of the U.S. stock market since 1926.

I'm adding here, just as FYI and curious if this looks familiar (I think Jan 2016 is that big red bar that sort of touches a "trough" in the jaggedy green one (how long that lasted or why it happened ? ?)

Timing may be difficult, but it is so much better to be cautious early, then too late.

Why a toxic mix of low volatility, passive strategies, and high levels of leverage is reason for…

To successfully apply the meaning of the red trough and the jaggedy green thing to your market timing, you'll need a chicken, a charcoal grill, and a heavy blunt object.

Bludgeon the chicken to death and cook it. After you've feasted upon it, put its thigh bones back on the grill until the coals go out. Examine the bones. (Be careful, they will still be hot.) Count the number of cracks. If there is an odd number, buy. If even, sell.

Some people will tell you this is nonsense, that you need to cast the chicken's entrails upon the ground first, but they're just nuts who think they can find hidden meanings by looking at the pattern of some squiggly lines.

To successfully apply the meaning of the red trough and the jaggedy green thing to your market timing, you'll need a chicken, a charcoal grill, and a heavy blunt object.

Bludgeon the chicken to death and cook it. After you've feasted upon it, put its thigh bones back on the grill until the coals go out. Examine the bones. (Be careful, they will still be hot.) Count the number of cracks. If there is an odd number, buy. If even, sell.

Some people will tell you this is nonsense, that you need to cast the chicken's entrails upon the ground first, but they're just nuts who think they can find hidden meanings by looking at the pattern of some squiggly lines.

Do you know if they explained what "the entire lifetime dollar wealth creation of the U.S. stock market" means... ? Is that market cap? ...obviously market cap has to be relative ... Sometimes I think laypeople talking about the stock market and economics is about as bad as non-medical people discussing even mildly difficult medical science.. if that makes sense

I'm going to go retire to "my farm" (and try to find new antibiotics in my barn using rainforest soil samples)

since the New England B&B is obviously too complicated

insert trailer to Pacific Height here ... wasn't 1990 wonderful ?

I think you've given away investment secrets.. so, we only need to find that tropical paradise and consult the expertise of a few of the local gentlemen... (as portrayed so memorably in this 1977 classic from the novel by Peter Benchley (if real LIFE were so easy) )

guys, that's enough pot for tonight. Why don't we just set the bong down, and go to bed. There now - that's better.

Staying fully vested? What do you mean?I understand your premise. But, consider that most gains, as in for the entire year or following any bull market, occur historically, in surprisingly short time intervals. If you miss those (via sitting on the sidelines), you will be buying high. Staying fully vested, diversified, and rebalancing every year or two seems like the best advise I've read, and seen.

Staying fully vested? What do you mean?

Rebalancing is exactly right. Like I said, better to be cautious early.

And your point and short time frame for gains, it's always much shorter for losses.

With another thread asking for investment advice, it's a good time to check in on this. Still waiting for that 25-40% drop in "a few months" and silver up 26 as predicted. I guess I'll keep waiting. It's just bound to happen. 😉It's still coming. Just wait a few months for it.

25-40% drop.

Book it.

Buy some silver.

[/QUOTE]One of the most interesting things in financial literature is that people that make vague bear -predictions almost never get called out on it after the fact. - Mman

View attachment 211930

I could be wrong, but there, now I'm not vague at least. We can look back on this post in a year and see if I'm right