Fair enough. It might be revealing to see a bit of a breakdown as to what is contained in each category. The fact that 27% of physicians are working <40 hrs is probably inflated by the number of women who enter medicine and then stop cut down their practices to <30 hrs/wk. Those women generally make <$100k (I recall seeing a figure around $60-70k). I would also wonder who that 41-50 hrs (28%) is.

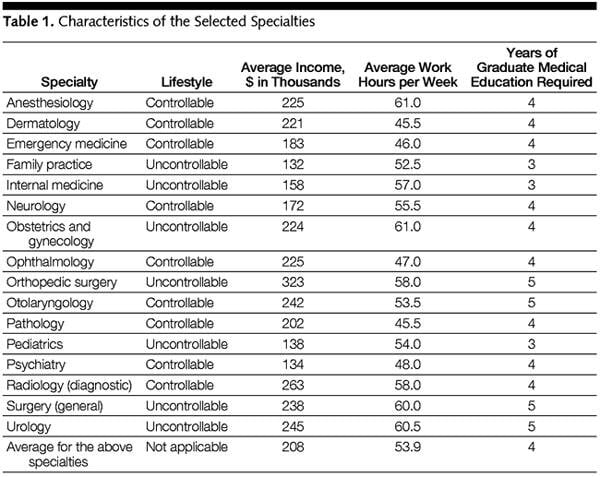

My previous statement of 60 hrs being typical was a bit high, but the following list of specialties shows that one would expect the average physician to work >50 hrs:

That's a pretty suspicious graph. I don't believe that radiologists work close to 60 hours a week. In fact, there's no way that there working hours are on par with general surgeons.

This is from the bls site:

In 2008, 43 percent of all physicians and surgeons worked 50 or more hours a week.